Run-over is the new Roll-over!!

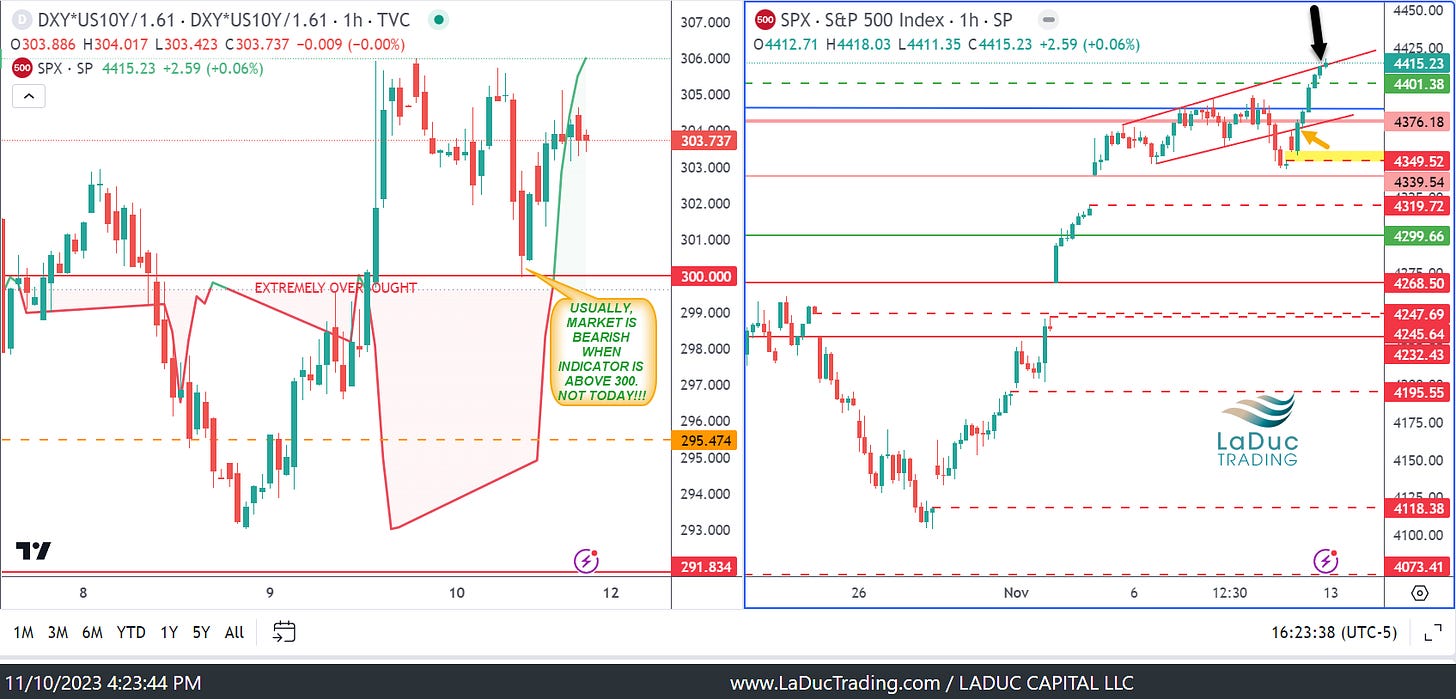

No part of my short thesis into end-of-week worked. We neither gapped down nor got rejected at the underside of the hourly channel (see chart).

Instead of selling off as I expected post UMich data at 10AM ET, mad buying commenced as soon as closed my trading room SPX traveled all the way back to the top of that channel - all the while my USD/10Y indicator stayed firmly above 300!! I can't even tell you how few times this hasn't worked as a directional tell, inversely. Well, today was one where they were positively correlated - a rare event.

Inflation Expectations are Rising

"Immaculate Disinflation" was not reflected in the hot U of Mich report today:

1-Year Inflation: 4.4% (est 4.0%; prev 4.2%) -

5-10 Year Inflation: 3.2% (est 3.0%; prev 3.0%)

A follower remembered how a hot print like that in July 2022 caused a -3% SPY day.

Craig pointed out it was June 2022 when Fed could still hike 75bps and economy was still strong.

Now, the prospects of hiking into a recession are dismissed for chances of a Santa rally.

We continue to throw caution onto the idea that inflation expectations are well-anchored. With softer growth readings, we are moving into the stagflationary camp at an accelerating pace. Expectations for rate cuts to address the growth concern are misreading the Fed's reaction function. We need to see way more risk off first to get the Fed anywhere close to providing stimulus.

But first Santa and Seasonality

Here is the Macro-To-Micro Power Hour that Craig and I did after the close Thursday - as we review the major macro, technical and money flows for year-end.

On USD and YEN

And speaking of recession risk next year and how the USD might fare, I did a detailed write up under #macro-to-micro-support that presents my views on how the USD Has Likely Peaked, how USD Weakness Threatens Bond Bounce, and how Bank Of Japan Pivot Is Bearish US Dollar.

On Swiss National Bank Selling

The latest Q# 13-F was released on SNB, and it shows a strong trend in selling US equities - especially mega cap tech - since they stopped raising rates end of 2022. It's also curious how they have received USD repo swaps in September, which are typically relegated to periods of severe financial distress. Both trends bear watching.

Forever Thankful - Happy Veterans Day!!

We owe each and every person who serves in the Armed Forces a tremendous debt of gratitude – one that we’ll never truly be able to understand or repay unless we have served ourselves.

THANK YOU for your service!!

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!