Risk Off Continues

My star Intermarket analysis chart of Weighted Dollar / Yield Ratio Chart is above 300 - which is all I need for for my continued SWING SHORT thesis to work.

Today, it did nothing but rise back above 325, which is market bearish.

I said early in my live trading room that if SPX falls -.65%, it can double that. Yup, that worked. Now at -1.40% on the day.

QQQ just needed to break/stay below 355. It did. It's down 2.5% on way to my swing short PT of $348.50.

VIX held 18.70 like a champ (posted level Monday).

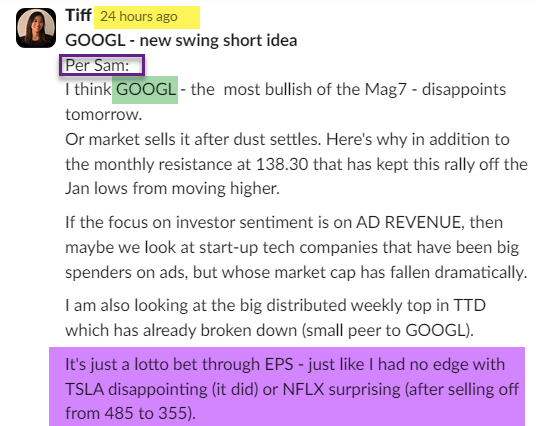

What also worked was the GOOGL short rec'd yday as "earnings lotto" in #swing-ideas as I think it will continue lower.

Also in the trading room, I suggested the MSFT fade at exactly $345.71 wkly resistance.

META swing short rec'd Oct 13th has worked well into earnings. I like keeping half through EPS tonight. Given my thesis for GOOGL and the slowing cloud spend, I like the play for META weakness.

AMZN swing short rec'd Sept 19th has worked well into earnings. Ditto with above: keeping 30% through EPS Thursday night. Even if retail beats, I doubt AWS will.

Oil was fading before the headline risk caused a support bounce of WTIC $83. Staying short from last week: XLE swing short as well as USDCAD long. Both working.

Nat Gas shockingly didn't sell off hard but so far looks like a shallow pullback before a spike higher.

Gold is still digesting. I do not trust bitcoin here.

USDJPY is about to make a big move. JGBs are still moving higher: "If 80 then 100" still in play.

Dollar (DXY) is bullish so broader market is not - as long as it stays above 105.77$ weekly.

TNX - gyrating around 4.9% is the level to watch. The longer it stays here, the more bullish. But as I said RISK OFF > 4.7% has proven spot on.

TLT - Still bearish on Monthly, Weekly, Daily...

$82.50 still the minor support with 80.50 to 81.23$ as the stronger 2009 support.

Swings that continue to perform well short:

XHB - could see a bounce at 68$ daily and IWM may bounce at $63 area, but both continue to work past two months, as do EWG, NVDA, and XLE shorts all working well.

REMINDER: Craig and I are doing a Macro-To-Micro Power Hour TODAY at 4PM.

Join Us!

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!