RISK ASSETS CROWDING OUT RISK PREMIUM

The Yellen Playbook, Revisited

Liquidity over Inflation. Again, for now. Case in point, just after midnight Sunday, we got this headline from Bloomberg:

Japanese Bonds Surge on Bets That Government May Tweak Issuance

We are talking a survery not policy by BOJ! But it was enough to spark speculation that MOF might reduce issuance of super-long bonds which pushed yields on Japanese AND US bonds down, sparking a gap up in indices that got bought.

Joseph Wang @FedGuy12 posted:

“Japan sparking a bond rally on news it's tweaking the composition of their issuance so there will fewer longer dated issuance. This is similar to what Yellen did in 2023 to help stabilize longer dated yields.”

In fact, the Yellen playbook ran from Oct ‘22 Policy Intervention to Nov 1st ’23 Policy Intervention, all the way through 2024, and into the Transfer of Treasury to Bessent in Jan 2025 - who has continued the playbook I might add.

The irony is that the 30Y US yield had tagged 5.15% last Thursday May 22nd before retreating to 4.94% today - the very gap from THE November 1st, 2023 “Powell Pivot & Yellen Yahtzee” I have referenced so often as THE trigger for the bullish “1995 OR 1999” vibe - which continued for all of 2024! We have now made several assaults on this 30Y 5% level this year (Jan, Apr & May) before all attempts saw actual or implied intervention. Like now.

And not just with Japan whispering. Bessent was out late last week promising SLR relief for banks and tools to keep equities & bonds bid:

“Our focus is to grow the economy faster than the debt, that’s how we will stabilize debt-to-GDP.”

This is another reason why I posted the above liquidity levers detailing all the ways Bessent can make it rain LIQUIDITY. And one way is to issue a bunch more shorter-duration bills over notes/bonds July 30th at next QRA, which the market is very likely front-running now.

BUT, if the 30Y gets/stays above 5.08 by end of June, yields are likely moving decisively higher.

Financialization of Treasury Demand

In addition to the above bond support that entered the market - helping that June quarterly bull risk reversal I posted last week…

Not only were global bond markets supported, Trump walked back the 50% EU tariff threat Friday.

“Trump announces EU tariffs market down ~50bps, Trump withdraws EU tariffs market up ~150bps. Not sure for how long can this perpetum mobile work.”

That quote is from Marco Kolanovic, and I had to google the “perpetum mobile” to best understand his intent. It works!

"Perpetuum mobile" …

In physics, it refers to a machine that could continue to move indefinitely without external energy input, which is considered impossible due to the laws of thermodynamics.

My point is that not only did we gap up on Trump walking back EU tariffs…

And BOJ whispering, spiking the USDJPY and bonds…

And Bessent adding bond support & liquidity, or promises thereof spiking equities and bonds…

All while the rotation of gold softens and VIX falls, further supporting the advance…

But we also have large speculative chases in the Crypto/Bitcoin treasury companies that is pushing the envelop in the financialization of unsavory balance sheets.

Two excellent reads on the subject:

and

Matt Levine nails the raging Bitcoin/crypto treasury company rags-to-overnight-riches trade:

“A few hundred million dollars’ worth of crypto, plus a wisp of a public company, is worth billions of dollars now.” Sell Your Crypto on the Stock Exchange

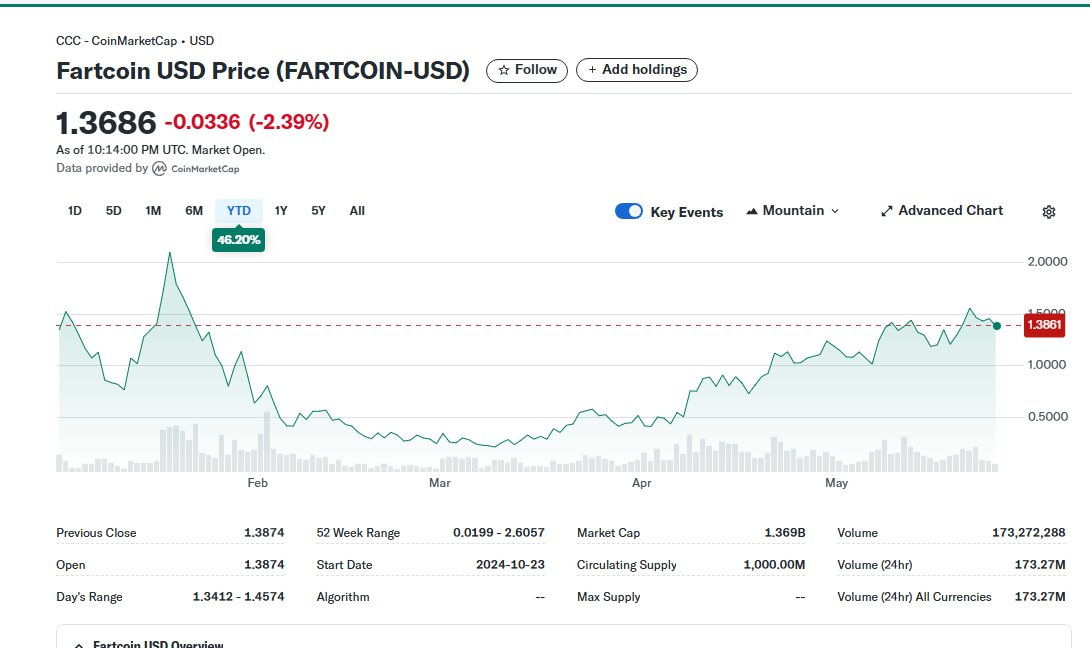

Basically, Crypto/Bitcoin treasury companies are the spec asset du jour. All the cool kids are doing shareholder dilution in exchange for fast trading gains! Even though it offers no productive use of the money - other than to the US treasury market as yet another ponzi to create demand.

Ironically, Bessent promised early they would not do any policy intervention this year. Remember that?! But as soon as the bond and credit markets froze in early April, they have done nothing but intervene and promise ever more intervention! He is really embracing the Yellen Playbook with promises of liquidity this summer on top of tricks for financialization of treasury demand - anything to fund these irresponsible omnibus bills!!

Risk Assets Crowding Out Risk Premium - For Now

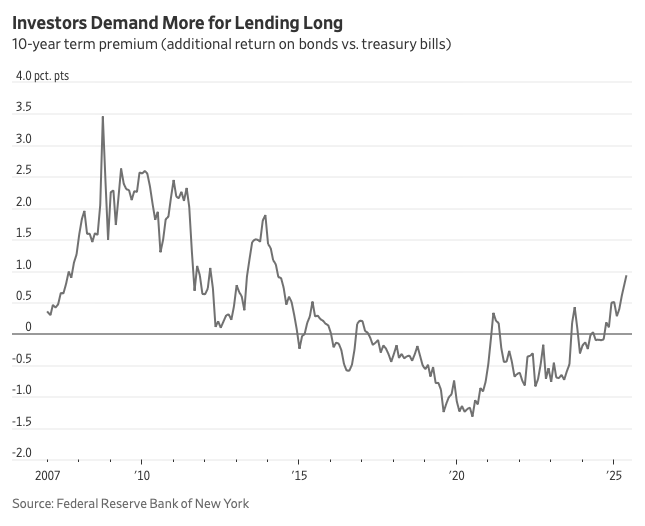

Equities rising with Treasuries with Term Premium with Gold is not a theme you see often.

Greg Ip writes about why investors demand more for lending long in his WSJ column:

“Rising 10-30 year yields without changed Fed expectations tells you this is about deficits and eroding reserve status of $. The term premium (the statistical junkyard for stuff we can't explain) has shot up to 90 bp, from negative.”

FedGuy again,

“Tsy yields are on track to rise until they are so painful that the public ultimately opts for a period of austerity. Deficit spending has lost its magic.”

BIS General Manager Carstens weighed in last week on the unsafe US fiscal debt situation.

“Days of ultra-low rates over, fiscal authorities have narrow window to put their house in order before public trust in their commitments starts to fray”

And as Geoffrey explains to our EDGE clients how…:

“The US market is in advanced stage of decomposition.”

But first, let’s Make Fartcoin Great Again.

Reminder: As market focuses on chasing Bitcoin/Crypto/Stablecoins and equities higher - as “inflation absorbers” - it is a detraction from the productive use of money & real investment in people/projects/things. It also reduces long-term growth at a time when the surge in Treasury supply swamps demand.

Long story short, we aren’t as rich as we think. And the Yellen Playbook won’t keep yields from rising on long-end as deficit spending spirals higher and MONEY GOES HOME.

Excellent as always, Samantha.👍

SB just said we will never default on our debt. You don't say things like that. and let's give China some credit, Bernanke shoved a load of sterilized 30Y on them, as reserves, then Trump promised ONCE before to take it back. They were remarkably calm, but they hate weakness, and my guess is in resolve they will accept ONLY dollars in payment and remit them directly to their sellers and take off all (or most) capital controls. The ball then is in our court, to ban foreign investment. Trump tariffs steel then allows Japan to buy X? Stock up 30% on the news, is that inflationary? So Central LA RE could become Palo Alto.