Rising Yields Equal Risk Off

We’ve had mega-cap tech concentration risk – started on “January Effect” post October 2022 global central bank liquidity infusion – but it picked up in earnest and size since March Fed/Treasury bank bailout/backstop. But soon with AAPL and AMZN reporting this week, we will have all megacap tech earnings ‘out of the way’ for the market to decide if the risk-reward is to the upside.

I think this thesis will be challenged. Here are the 6 reasons with corresponding charts below to illustrate why it makes sense to PROTECT NOW.

1. We can see in June and July Hedge Funds aggressively covered shorts in global equities. Notably, the trailing 2-month pace of short covering is the largest in 6+ years (since 2016) and the 3rd largest short covering event of the last decade.

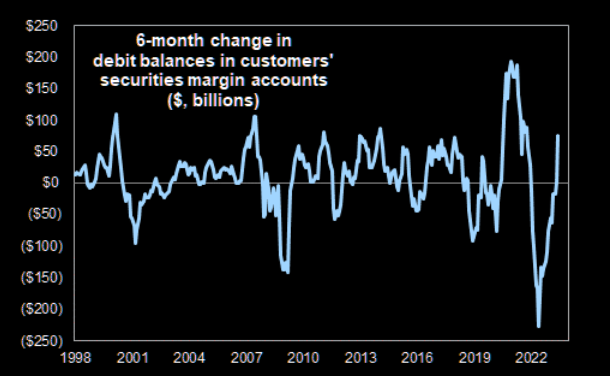

2. Add to that, we have had the largest 6 month increase in leverage on record (according to Goldman), with a clear case of FOMO-the-MOMO chase in full view as concentration risk in megacap tech forced a NASDAQ “SPECIAL REBALANCE” to ‘down-weight’ AAPL, MSFT, GOOGL etc.

3. Not only do we have short-covering and leveraged HF chasing at a time that seasonally of VIX lows meets August chop as the worst month of the year when it comes to money flows, we have both Positioning and Sentiment in the 99 percentile for asset managers.

4. Earnings season update: should we worry? With stocks beating consensus expectations underperforming by a greater amount than almost any time (i.e removing Covid) during the past 18 years. (Scott Rubner, GS). Future earnings growth is pricing in rate cuts and an earnings trough. I see more disappointment as yields continue higher and my GAAPSPX chart (below) is not done going down at the same time wage inflation is not done going up! In a nutshell, with SPY is trading for 20x forward earnings, even as estimates decline, THE MARKET IS PRICED FOR PERFECTION.

5. My call has been that the Hedge Fund Factor Rotation theme in July, following my June 1st "Stalking Value Rotation" theme, almost always precedes volatility.

And in case you are curious how I know: It's not my first rodeo.

https://twitter.com/SamanthaLaDuc/status/1269318203966205958?s=20

6. BOJ YCC Tweak will bring carry trade unwind risk. The US-Japan 10Y SPREAD and USDJPY track extremely well, so a rising USDJPY helps illustrate how US 10Y are rising.

Macro headwinds are picking up speed:

1. The BOJ carry trade unwind.

2. Yesterday, US Treasury issuance was much higher than expected, which can at the least threatens a disorderly long end yield spike. This is all Treasury ‘bond stuffing’ and it’s very negative for bond holders.

3. Plus, the lag effects of Fed’s 525bp hikes needing 12-18 months to kick in…

WE ARE THERE.

“Bond bulls must defend here.” Translation: Fed buys more debt and pushes the 10 year yield lower And/Or… The relative strength of the dollar falls.

What's the Trade?

First, how are options priced? Well...

Nomura: 3M vol is way “oversold” at 11.5 with 1m realized in the 6th %ile over the last 3 years.

Longer dated SPX puts haven't been this cheap in a very long time.

BofA: "Since our data began in 2008, it has never cost less to protect against an S&P drawdown in the next 12 months."

My SPX ROADMAP has been updated time and time again, higher, with each Fed intervention, USD swap or Central Bank coordinated liquidity (or yen intervention), but now, it appears a strong case that rising yields will be the trigger for RISK OFF which could bring the SPX down to potentially $4000 next few months.

In fact, the SPY positioning has a lot to say about that (see last BONUS CHART!)Long Story Short, I'm wrong if above; otherwise:

SPX SHORT < 4660

QQQ SHORT < 390

COMPQX SHORT < 14600

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!