Rise in Repo Rates Matters to Liquidity & Collateral Values - In Everything

Rise in Repo Rates (That Sticks) Can Trigger -> QE (Fed Buys Assets) -> Crack-Up (Equities) -> Gold & Commodities Spike -> Dollar & Bitcoin Crash -> Game-Over

I promised earlier this week I would take some time to assemble my thoughts and post on this recent repo worry and if we should.

Then Dallas Fed President Lorie Logan was interviewed post FOMC meeting, and she said (if she was a voting member; she becomes one next year) she would dissent to further rate cuts in December unless the labor market or inflation notably cooled:

“I did not see a need to cut rates this week.”

“And I’d find it difficult to cut rates again in December unless there is clear evidence that inflation will fall faster than expected or that the labor market will cool more rapidly.”

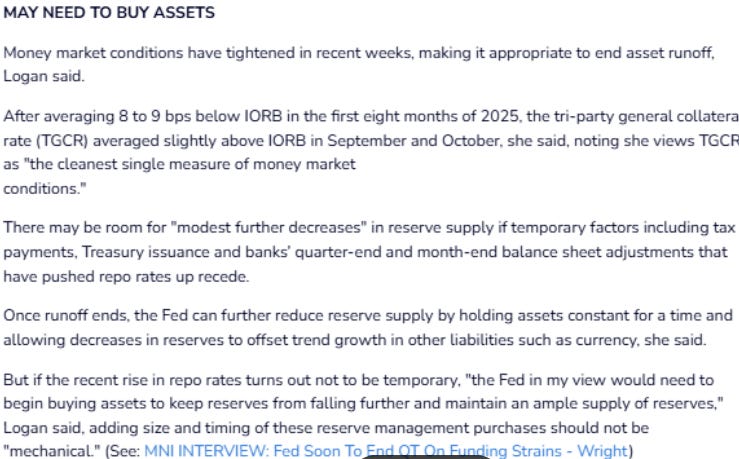

The rest of the speech covered the balance sheet (she supported the stopping of QT given the drift higher in funding market rates) and reiterated her case to move away from Fed Funds as the target rate.

But then this made me really pay attention:

I went to find the context; here it is:

Well, that’s just surprising. And I need to explain why!

This macro-focused client post is very important, so I no matter your level of sophistication in markets, I hope you read it all the way to the end.

Quick Primer On Repo & Reverse Repo

How Much Liquidity?

Liquidity, Meet Collateral Values

What Did She Say?!

First Major Problem: Collateral Values Are Shite Now

Repo Collateral in Repo Markets

Repo Collateral in US-Rest Of World Balance of Trade

Second Major Problem: Too Much Leverage

Leveraged Collateral Shortage, Meet Fed Buying Assets

Phase III of this Monetary Illusion & Money Bubble