RECESSION RISK JUST GOT PULLED FORWARD

The Fed has two jobs: stable prices and stable employment. Both are going in the wrong direction.

Closer To A Tipping Point

Let’s talk about that Friday August 1st non-farm payrolls (NFP) report that spiked volatility & equity selling on negative revisions. The 2Y yield immediately priced in a Fed rate cut by falling 25bp. Sept FOMC rate cut odds spiked to 88%, and there are some whispering Fed will cut by 1% by end of year!

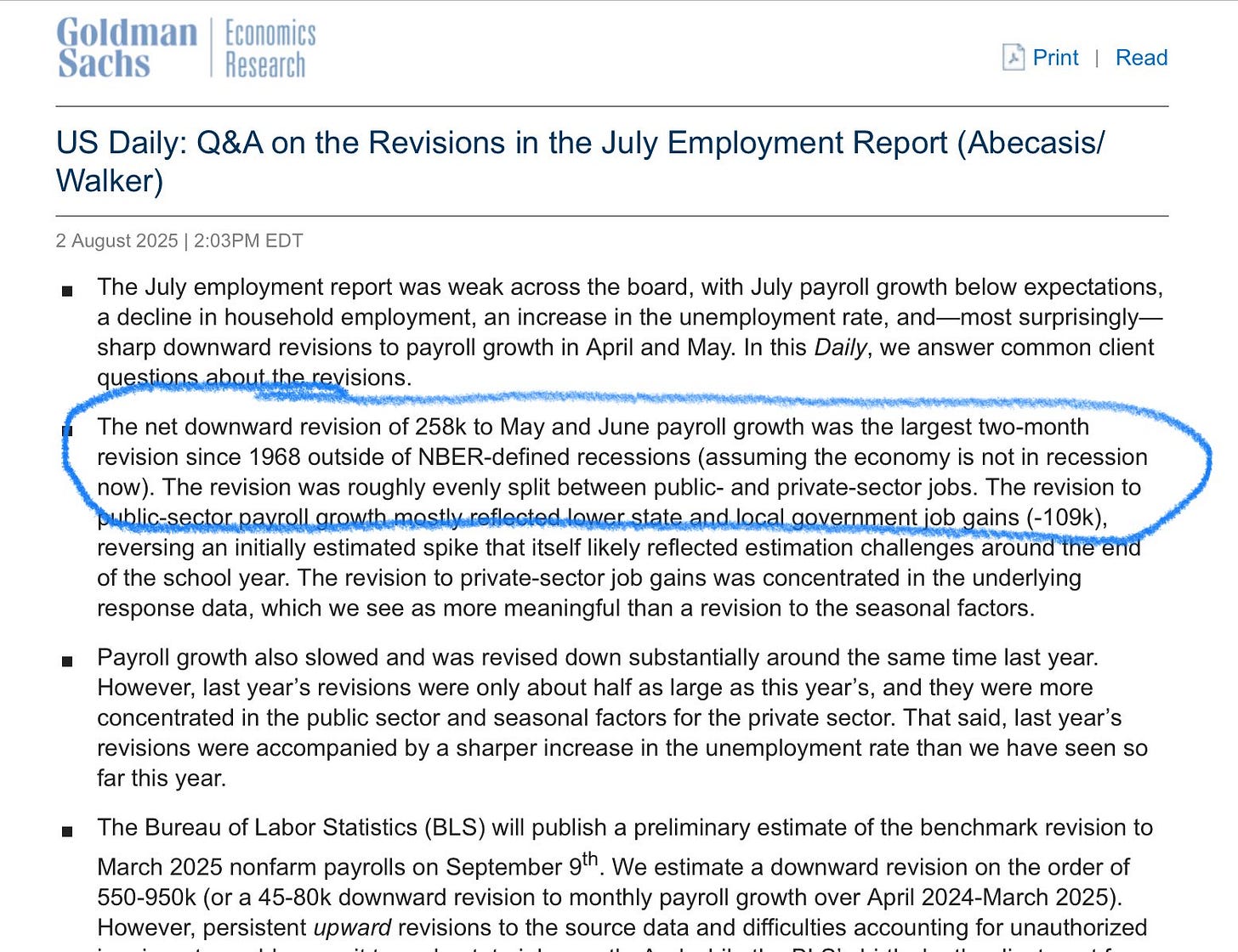

On this same fateful day that May & June job growth was revised lower by 258K, Trump fired the Director of BLS. If the market didn’t trust the data before, it really doesn’t trust it now.

So let’s review the data we have to better assess these five questions:

WHY THE LABOR MARKET IS NOT AS STRONG AS WE THOUGHT

HOW REVISIONS ARE A FEATURE OF NFP REPORTS NOT EXCEPTION

WHY CLAIMS THAT BLS IS POLITICAL MISSES THE POINT THEIR DATA JUST LAGS

WHY CLAIMS THAT FED IS POLITICAL MISSES THE POINT THEY RELY ON LAGGING BLS DATA

HOW BLS REVISIONS SHOW LABOR MARKET IS WEAKENING

Do Job Revisions Matter?

Last week we learned that the the Q2 US labor market report was much weaker than expected AND rate cut odds spiked higher as a result.

“Fridays Jobs report, with its large negative revisions and disappointing headline number, has forced the market to assume the US labor market is at stall speed and the Fed will have to cut rates to keep it from potentially crashing” DataTrek

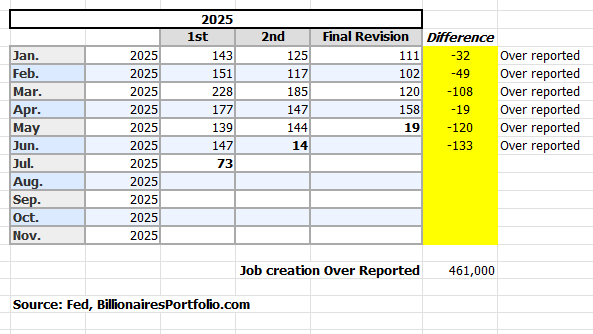

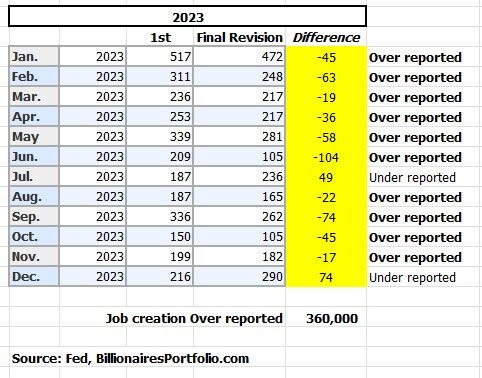

Here’s how it breaks down: 2025 Revisions YTD were 461K OVER-Reported…

Market Reaction:

The August 1st NFP July payroll expectation was missed AND the prior two months of payrolls data had to be revised downward, resulting in the realization to markets that prior job growth was WRONG - by a lot!

The FOMC meeting just two days prior with Powell pushing back on Trump to hold rates steady is now being unwound with September rate cut odds increasing to 88%.

Goldman Sachs is claiming that the recent 2 month job revisions were the largest outside recessionary times since … 1968… and they expect more large revisions next month.

The Worry:

“Monthly job growth that hovers around zero for a few months in a row is a classic early recession indicator.” DataTrek

Cracks In Employment

Before the Aug 1st NFP report came out, Waller was warning in a Bloomberg interview:

“Looking across the soft and hard data, I get a picture of a labor market on the edge,”

From the same article:

A monthly employment for June, published on July 3, showed a sharp slowdown in private-sector job growth and a deceleration in wage growth, even as the unemployment rate ticked lower. The task of analyzing the labor market has been complicated in recent months by Trump’s rapid crackdown on immigration, which has coincided with an outsize decline in the foreign-born labor force.

Parker Ross dug in Friday with a detailed X thread to show how the labor market is not as solid as many assume:

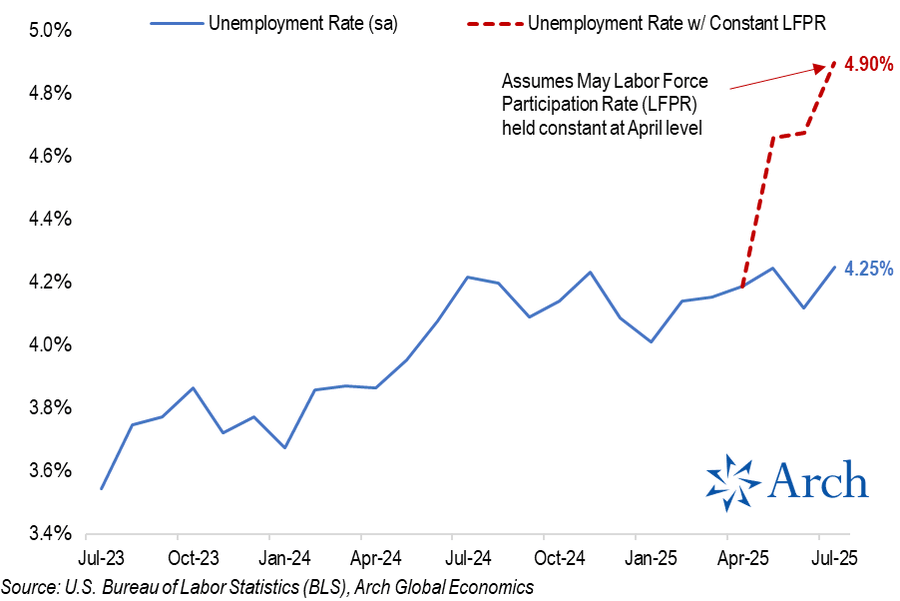

“If not for collapsing labor force participation since April, unemployment would've climbed to 4.9% today instead of 4.25%.”

“That "not in the labor force" segment of the unemployed surged in July as new entrants not finding jobs put 15bps of upward pressure on the headline unemployment rate.”

“It's not just new entrants not being able to find jobs and ending up in the unemployed cohort, workers are increasingly resorting to part-time work as full-time employment has trended lower.”

”Job growth has cooled to an average of just 35k over the past 3 months from nearly 130k just back in April and ~230k at the beginning of the year.”

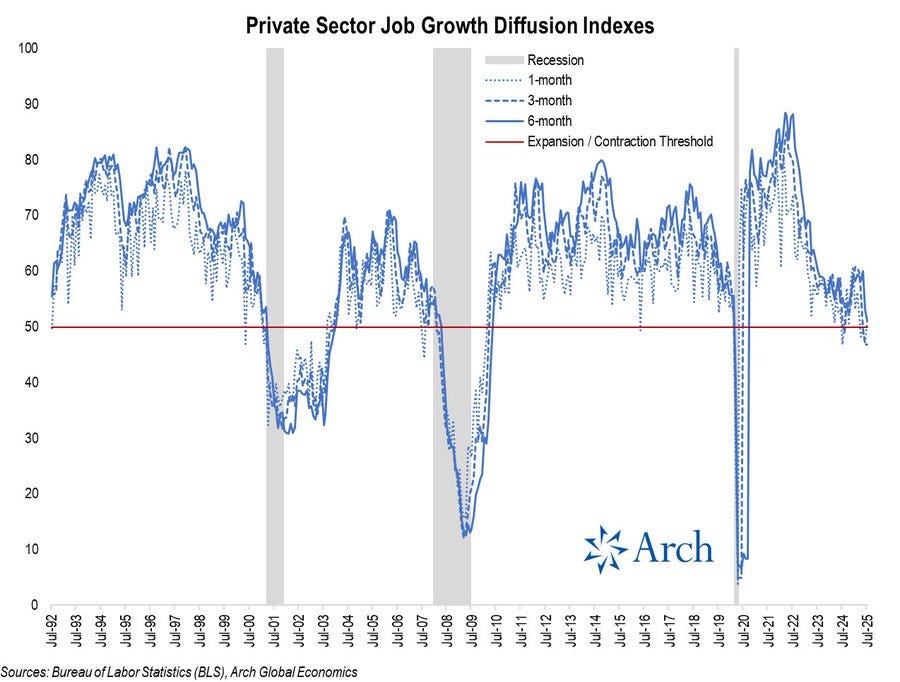

“the private job growth diffusion index, which reflects the breadth of job gains across industries. The 3m index dropped below the 50 expansion / contraction threshold back in May and remained at 46.8 in July, down from 60.8 back in Jan '25.

“Within private sector employment, manufacturing has been even uglier... The diffusion indexes for manufacturing have been in contraction territory since early 2023 despite a brief spike earlier this year that subsequently collapsed.”

“With the diffusion index for the broader private sector having flipped into contraction territory, it's not likely that service sector wage growth will remain resilient for much longer.”

Translation: The cracks in the “solid” employment thesis are getting larger.

Is Fed Trapped?

Gordon Johnson shared some charts and stats that highlight further doubt about the strength of the general labor market amidst a contraction in manufacturing and services activity and employment:

ISM Manufacturing Employment Index: At 43.4, we are at the lowest level in 10 years, excl pandemic.

ISM Services Employment Index: At 46.4, we are at 3rd lowest level in 10 years, excl pandemic.

ISM Prices Paid are also a concern - rising into near 70 on the latest print today - which makes it difficult not only for consumers but also for a Fed thinking about cutting rates that could further fuel higher prices.

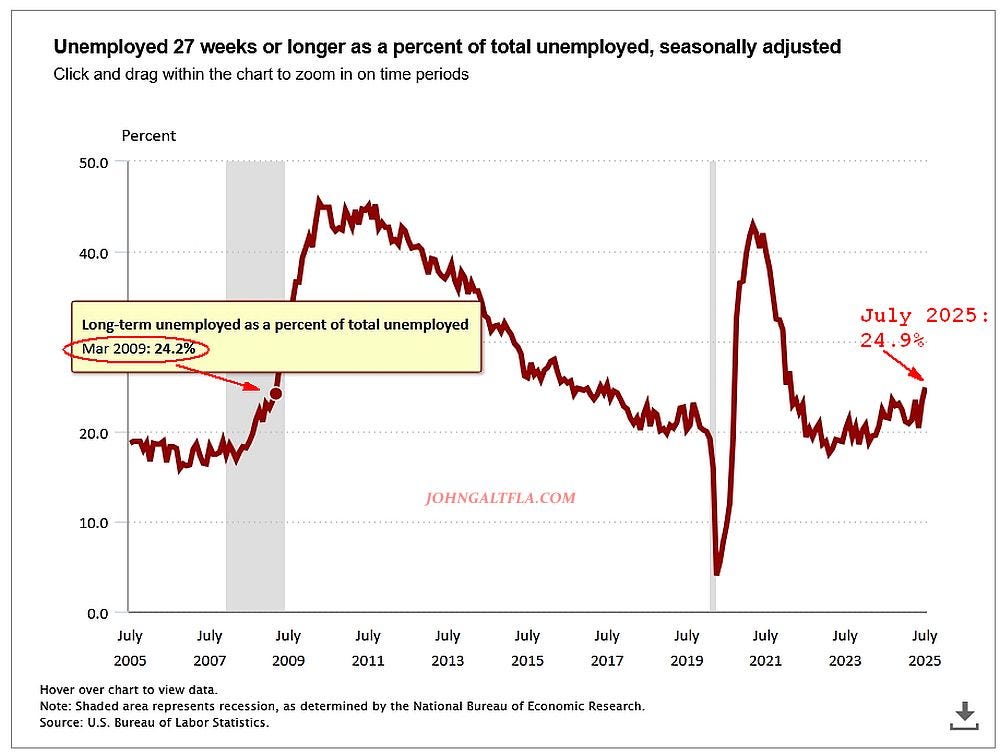

“John Galt” also posted a good chart that bears watching:

Unemployed 27 weeks or longer as percent of total unemployed, seasonally adjusted, now equals March 2009 levels, right after a major economic crash and before a massive regime change of Fed QE.

In a nutshell, the Fed has two jobs: stable prices and stable employment. Both are going in the wrong direction.

BLS As Lagging Indicator For Fed Policy - Ensures Fed is Always Behind The Curve

Misreading the health of the economy using BLS data is common, as the revisions are lagging, making the releases less reliable. That is a feature of the BLS design, not a politically motivated agenda - even if it looks that way.

Have a look at 2021:

Lots of UNDER-reported jobs in 2021- all while inflation was running HOT and Fed was not yet hiking. Why? Job growth is not recorded real-time; it lags - from revisions in the field from slow-to-respond business that need to be applied to prior months. That’s just how the system works because they are not estimated (like CPI). This is actual data that is recorded - after it is collected which is most often after the month closes.

And think about 2020. The monetary AND fiscal stimulus was a massive liquidity explosion to both the economy AND markets, so as money supply expanded, so too did jobs into 2021.

In 2021, when the Fed said “inflation is transitory” as justification for continuing with their ultra-loose, zero-bound rate regime on top of QE, Biden was able to push through his Build Back Better bill - which fueled inflation even more! All the while, BLS was UNDER-reporting job growth by 1.9 million for 2021. Is it any wonder, CPI hit 9.1% middle of 2022?!

Now, look at 2023. BLS did the opposite and OVER-reported job growth by 417K jobs by the time Fed paused their rate hiking on Nov 1st, 2023.

They held that line of Fed pause all the way from Nov 1st 2023 to September 18, 2024.

Now, let’s revisit one year ago - on the August 2024 NFP print for July: BLS made a (one-time!) massive 818K revision to payroll numbers and soon after in Sept (18th) 2024, the Fed did a surprise 50bp rate cut!

Many cited the double Sept rate cut as politically-motivated to juice the markets to help get Harris elected, but more likely it is just the Fed being the Fed: almost always REACTIVE not proactive to lagging BLS data, and as such, BEHIND THE CURVE - like now - except inflation is not falling; it’s about to rise again WHILE jobs fall.

Given the Fed has two directives - stable prices & stable employment - and both are going in the wrong direction… that puts Fed in a tight spot.

Critical Recession Buffer Removed

Employment matters to economic growth given 70% of GDP is based on consumer spending. And the US labor market is not as strong as market thought. Given revisions are a feature of payroll reports, claims that the BLS is political misses the point that their data just lags. And claims that the Fed is political likely misses the point the Fed relies on lagging BLS data. And the BLS revisions data clearly show the labor market is weakening.

Now, here’s the wrinkle.

If the Fed bases monetary policy on lagging BLS data, that paints the wrong picture on the health of the US economy, because that is how the BLS collects data, will Trump firing the Director of BLS change anything?

Can we even believe the data that will now be presented by this agency moving forward?

Does any of it matter now that Trump is about to put in place a loyalist Fed chair as soon as Powell leaves or is demoted?

And how do bond holders feel about this clear fiscal dominance move - over both the Fed and BLS agencies?

These are pretty important questions to answer as we move forward, but so too are the insights offered up by Claudia Sahm recently highlighting in June - before Friday’s payroll revisions - how the labor market weakness removes the buffer the economy previously had from recession risk getting pulled forward:

“The labor market being solid or “in balance” now, as opposed to very strong, leaves employment more vulnerable to a decline in demand from tariffs, reduced immigration, and federal government downsizing.

… “The notable strength of the labor market in 2022-23 served as a critical buffer against a recession. It helped offset the drag on growth from higher inflation and higher interest rates, providing time for pandemic-related disruptions to unwind.:

Remember, her warning is from June - highlighting the lack of buffer should demand turn lower. She just updated her warning today:

“Currently, the data suggest that reduced labor supply is likely the key driver though reduced demand is playing a role and the risk of cyclical weakening in the labor market have risen.”

Conclusion

As clients know, I have been very remiss to predict recession the past few years as one of my key indicators of 267K jobless claims has yet to get/trend above. I have however been on record since June of 2024 that I expect it will hit by end of year 2025 - accompanied by rising yields and falling oil.

Given the job market has slowed sharply year-to-date, and with it signs of a slowing economy and consumer spending - as our very own Geoffrey has detailed in his research for clients - it feels closer to a market at risk of pulling recession risk forward then one that is able to buffer the storm of 2022-2023.

And given both 2022-2023 offered up repeated policy interventions in the form of fiscal, monetary and treasury accommodations, it would require further QE to buffer a labor-induced economic storm into 2026. The problem is this time, QE will not only stoke liquidity to run the market hot, but also inflation. And this time, given conditions of fiscal dominance as backdrop, don’t be surprised if yields don’t fall but rise with prices. And this time, as Fed cuts into job contraction, expect businesses find it much more difficult to pass on costs against falling consumer spending.

So labor weakness matters. Even more than AI capex. But not as much as inflation.

Why not just count the Number of real workers, hours or taxes

instead of guessing, and why does the FED keep using these USEless numbers...?

great article...

Interesting chart depicting 2008/2009. History doesn't repeat...but it rhymes.