RECESSION INTO ALL TIME HIGHS

Dip Before The Melt-Up

AI Deals Fuel Sky-High Valuations Against AI Boom Warnings

Recession Into All Time Highs

And What About MAIN STREET?

Part 2 Thursday: FED CUTTING INTO RISING YIELDS INTO RECESSION

Dip Before The Melt-Up

I have been warning in anticipation of getting to $6666 SPX:

PROTECT when you can not when you have to!

This just in -

Nomura's McElligott sees massive deleveraging flow risk as leveraged ETF AUM is in the 100%tile, and estimated rebalancing needs for a 1% spot move is sitting at a record of $7 bln.

THIS is exactly what I warned about when I wrote about a rising risk of a QUANT QUAKE just one week ago for September 30th, ahead of likely government shutdown:

If that wasn’t warning enough, then might I introduce…

Take that with a grain of Fleur de Sel, but even little ‘ol me already posted that a meltup into $7000 then $8200 by year-end would set up a meltdown scenario.

And that call was JULY 7th - with best reasons to be tactically long:

AI Deals Fuel Sky-High Valuations Against AI Boom Warnings

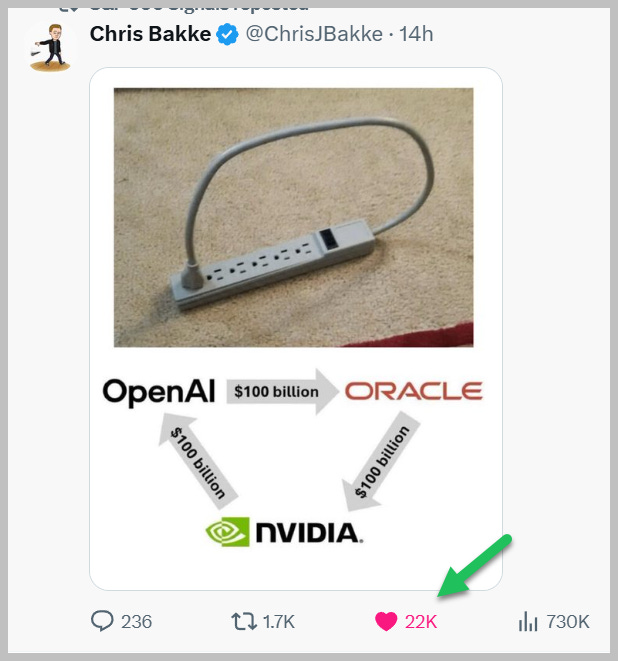

I also noted of late how mainstream FinTwit and Wall Street analysts are starting to tire of the Nvidia/OpenAI/Coreweave/Oracle et al ROUND-TRIPPING:

*OPENAI TO BUY $100B OF CHIPS FROM NVIDIA

*NVIDIA INTENDS TO INVEST UP TO $100B IN OPENAI

Rich Privorotsky, Goldman's head of Delta One

"... definitely not old enough to have been around trading during the tech bubble and let’s level set, multiples are now where near that point in time. That said, vendor financing was a feature of that era and when when the telecom equipment makers (Cisco, Lucent, Nortel, etc.) extended loans, equity investments, or credit guarantees to their customers who then used the cash/credit to buy back the equipment…well suffice it to say, it did not end well for anyone."

And some are even warning it is unsustainable. Lol

With many more saying they have no idea how to monetize. Yup.

Put all that together and I can see a case of RECESSION INTO ALL TIME HIGHS