Price Discovery Is Not Allowed

Neither Is Government Data on CPI and Employment

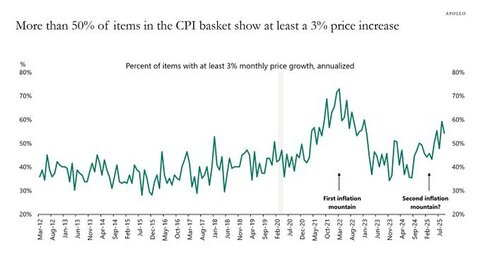

Thursday is CPI morning (usually) and you would think market is front-running a weaker-than-expected print - despite sustained, compounding inflation - and with 55% of the (remaining) CPI components above 3%, as shown by Apollo.

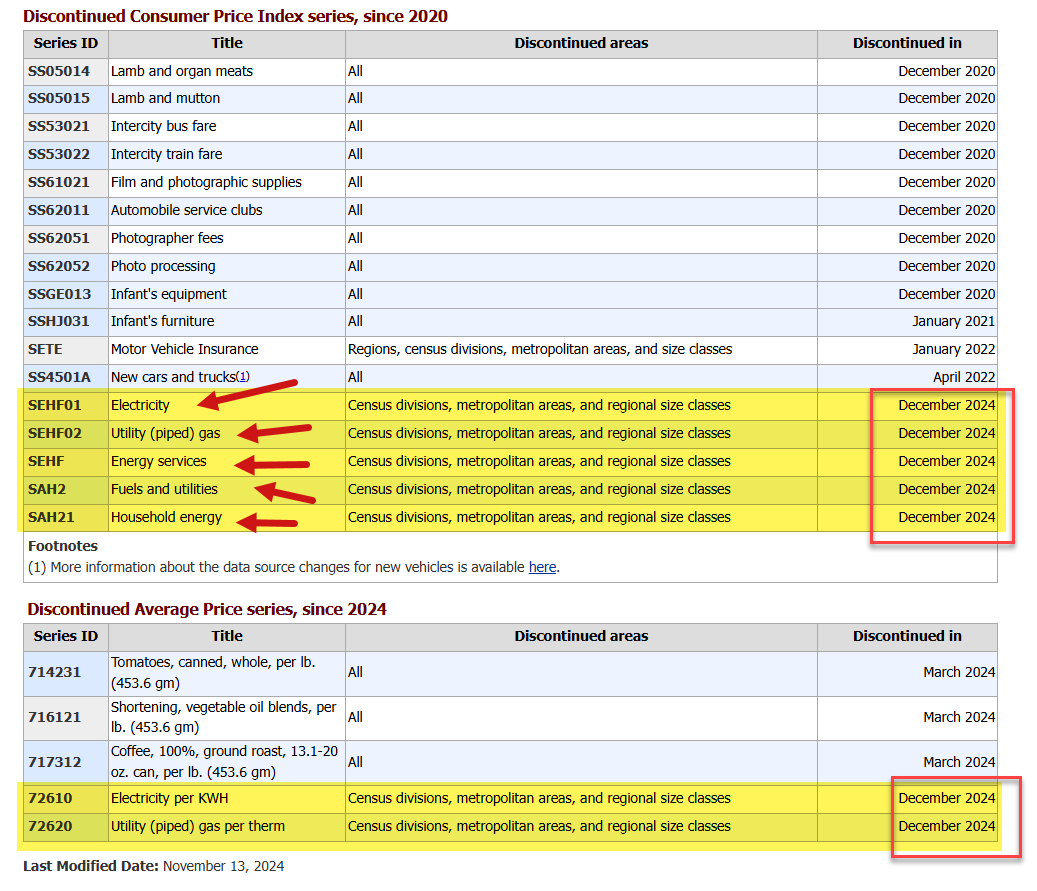

I emphasize “remaining” componenets because the CPI basket has been dramatically pared back to remove those inflationary components like meats, train fares, new cars/trucks/motorcycles, coffee, long-term care insurance, motor vehicle insurance, ELECTRICITY, piped nat gas, energy services... so as to reprice inflation expectations lower. Some under Biden and we voted them out for the gaslighting.

Now look what has been removed under Trump:

Know the game. Know we are being gamed.

The Known Unknowns

Market was also front-running a vote to reopen the government - even if nothing was accomplished and it only pushes out the need to vote on the Continuing Resolution bill in 80 days. So we get to do this all over again at year-end.

What the market is ignoring is the fact that Massie got his votes for the Epstein files petition:

In spite of a last ditch effort by the President to foil the motion, and @SpeakerJohnson’s propaganda, the discharge petition I have been leading just succeeded! In December, the entire House of Representatives will vote on releasing the Epstein files.

And already the news cycle is leading with the story everyone already knew but no one does anything about:

Just in: Jeffrey Epstein said that Donald Trump ‘spent hours at my house’ with a woman later identified as a victim of sex trafficking, according to emails that raise fresh questions about the relationship between the late paedophile and the US president. - FT

But here’s the kicker we didn’t know about:

WH Press Sec. Leavitt: October CPI and jobs data likely never to be released.

The market acting like this is OK is why it’s really NOT OK!!

My entire thesis of RECESSION RISK PULLED FORWARD is based on the weakening of the labor market, so we need to see the labor figures!!

This is also not OK:

The share of subprime borrowers at least 60 days past due on their auto loans rose to 6.65% in October, the highest in data going back to 1994, according to Fitch Ratings.

BTW 15y car loans won’t fix this; they will only make it worse!

US Government Doubling Down On Mortgage Risk

So many of the recently suggested/floated policy changes - from the 50Y mortgage loans to dropping credit score requirements to reinvigorate “affordability” - are only inviting back systemic risk.

Fannie Mae set to drop its 620 credit score minimum. Mortgage giant will instead use its own analysis of risk factors.

Lots of folks like this idea for obvious reasons: access. But what may be missed in this policy proposal to reinvigorate subprime-rated mortgage debt is the role TAXPAYERS will now take should the economy go sideways and housing take a hit.