PEACE: The Trump Trade Revisited

When I predicted Trump would win, I posted my thesis on trades & specifically the impact of PEACE on US dollar, yields & oil. Time to revisit! AND how it intersects with yen carry trade & USD smile!

»CLUB/EDGE client post February 6th, 2025

I started on this bent early:

January 15, 2024: What to Expect If Trump Wins the 2024 Election

This specific post a year ago focused on policies that had potential to be inflationary: higher labor costs from deportations/changed immigration policies; higher inflation from tariffs & tax costs; and, higher cost of debt ... "as treasury holders DEMAND to be compensated for “the fall of money”. Because USD will lose value and with it inflation will soar."

This was way before Musk, RFK Jr, Tulsi & DOGE!

I also wrote about the risk of higher cost of ENERGY from oil policies before I turned strongly bearish oil in April. I am still strongly bearish oil - unless in case of war.

All of the above was also before the master plan of Trump, Bessent and Musk entered the arena in November and promised LOWER dollar, yields & oil.

Most notable difference from last Jan to this one? My analysis a year ago was before D.O.G.E. and the fiscal restructuring that is underway to cut out excess government spending and corruption by embedded politicians and special interests.

This Is A Game Changer

I'm not going to pretend to know what the fallout will be from all the revelations being discovered and disclosed from these government agency financial audits by Musk/DOGE, but we do know that it means a much smaller government than we've had - which is what Trump said he would do if elected.

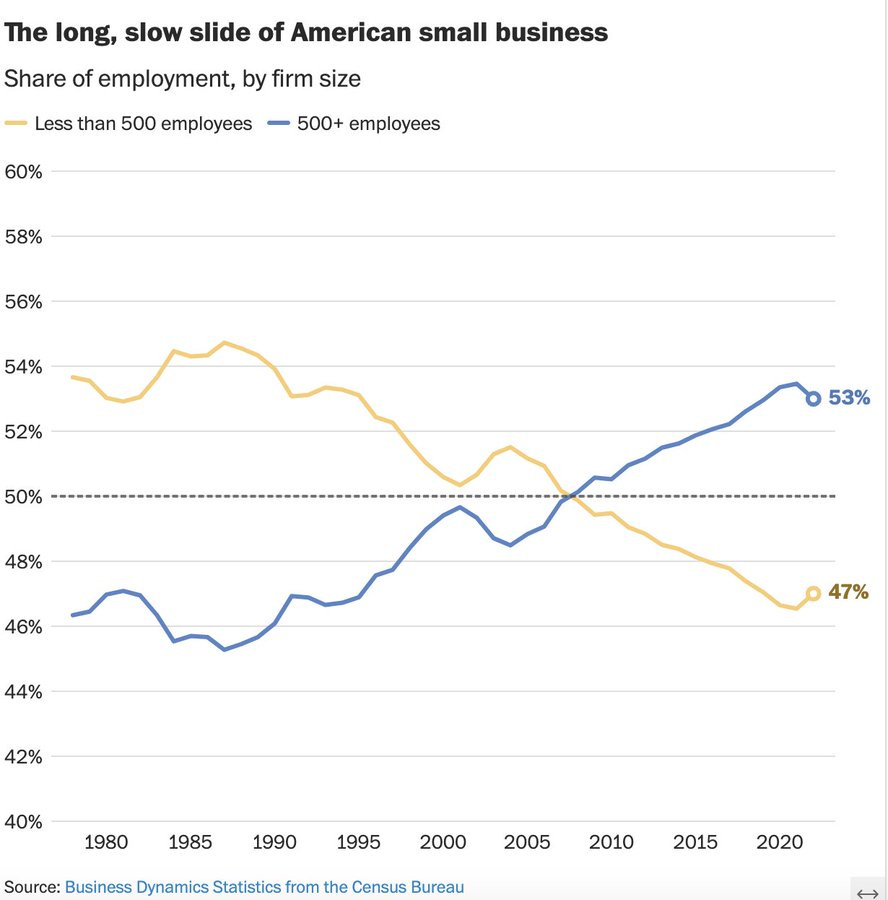

The likely result: more white-collar job losses for which the private sector needs to make up the slack. It also means reduction of foreign-born immigration and deportations that result in more blue-collar jobs for which many American-born citizens are not willing or able to fill.

Tariffs and Tax Cuts are also en route - how much and how soon they are rolled out is what is being debated. But I doubt they will cancel each other out in full.

Concentration risk in the market’s biggest companies - enabled by greed from financialization, political corruption, monopolization - will unwind as accountability grows + capital flows reverse from smaller US govt. The Wealth Affect from stock market to real economy works both ways - so do jobs!

How will consumers fare in the changed job landscape with potentially higher prices to pay, where corporations have wasted money on maximizing their market capitalization rather than investing in onshoring, CAPEX projects and people? I don’t know.

It’s all a bit hard to predict, especially given Consumption & Investment in the PRIVATE sector is now expected to replace the reduction of largess from the PUBLIC sector of government. This slack that companies are expected to make up is needing to drive GDP of ~3%/year as the government sheds fiscal spending and jobs... all the while Fed/Treasury is NOT expected to juice markets or inflation with more printed money and aggressive rate cuts.

It's going to be a feat if they pull it off!