Not Breaking Out And Not Breaking Down

TRADING ROOM NOTES SUMMARY FOR TUESDAY-THURSDAY DECEMBER 5TH-7TH:

After nearly a 500 point rally in November, SPX has been in distribution and chop since Thanksgiving, but really November 20th.

Not able to break out above its $4600 call wall but not able to trigger negative gamma and volatility below $4540 to sell off to $4500 put wall.

It's been highly predictable in its unpredictability: every day we have a new intraday gap to fill - very lucrative for our live trading room scalpers.

But I'm more focused on the rotation that I called out last two weeks:

Shorting 2023 winners that are getting monetized (wait for Jan!!)

And buying losers that are getting bid up into year-end (wait until shorts are forced to really cover in Jan!!).

Case in point: How long can BYND with 45% short interest and over 200% borrow rate stay down?!? But I digress.

Markets/Sentiment are still in a positive period with Dec Opex next week, but I can clearly see signs of exhaustion/distribution in indices.

Typically, folks expect Santa about this time, but I contend, you already received your candy or coal.

USD Bounce & 10Y Trounce

My timing on falling USD + Yields early November was near perfect. See chart of DXY below. I even timed the USD bounce of late.

This dollar weakness call corresponded with my warning that the 10Y would pullback below 4.9% yearly resistance on way back to 4.1% with overshoot to 4% - once we got below 4.6%. See chart below of US 10 with DE10Y from Nov 6th when I expected 4.6% to fail.

I had recommended USDJPY from 150 to 145/144 since Nov 17th - along with the call for higher Yen, Gold + Bonds. Thursday, USDJPY flushed to 141.66 on Japan’s Gov Ueda triggering bets on a BOJ rate hike after hawkish language by Ueda and his deputy spooked markets. Swaps at one point signaled a 45% chance of a policy shift this month!

Why does BOJ matter?

I've written about this in detail (NOV 10th): "USD Has Likely Peaked" in CLUB/EDGE #macro-to-micro-support channel.In a nutshell, higher JGB yields would remove liquidity from global markets.

The BOJ has been providing liquidity to the global economy by buying bonds, which then provides liquidity/cash for Japanese investors (think large insurers et al) to invest in the US/abroad.

This is a massive "flow of funds" into US Treasuries and equities that helps the USD and US 10Y from rising sharply.

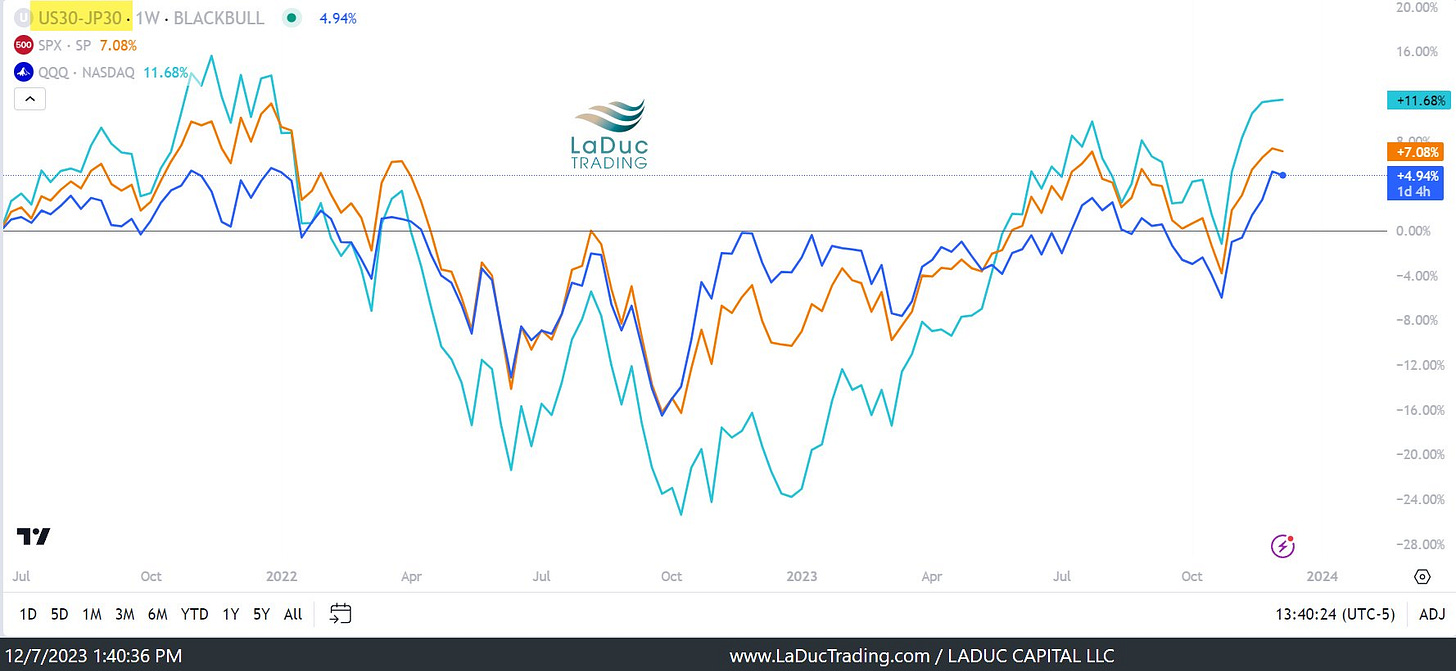

See the chart below that I track daily for clients comparing the spread of the US30Y - JP30Y overlaid with SPX & QQQ. See how closely they track?

Again, BOJ/USDJPY matters to US Equities.With the big move in FX Thursday, might we see stabilization/bounce in USD + 10Y that can introduce volatility?

That's my baseline for a 'shake-n-bake' into Dec OpEx next Friday.

Much depends on the catalysts coming up.

We have NFP Friday morning, a 10Y + 30Y bond auction Mon/Tues; the CPI print Tues and FOMC Wed with their updated dot plat plan.

Any/all can move the macro which can move the micro.

So let's have a closer look at what economic data matters.

Macro Data Matters

Last Friday, the ISM Manufacturing Index came in at 46.7 - still showing signs of contraction in the US factories. This was the 13th month in a row that the ISM was below 50, which is the longest streak in more than 20 years.JOLTS report on Tuesday showed job openings have dropped to a 2-1/2 year low in October. The number of job openings fell by 617,000 to 8.72 million, which was below Wall Street’s expectations for 9.4 million. For perspective: there are now 1.3 job openings for each available worker versus 2-to-1 at the Covid peak.

Oh, and the quits rate is down to 2.3% so that shows workers are quitting less.

For Friday’s jobs report, Wall Street expected to see a gain of 190,000 net new jobs - after October’s gain of 150,000 - as a result from returning auto workers.

We got 199K and a drop in the Unemployment Rate to 3.7% with average hourly earnings (MoM) increasing from .03% to .4%.

(Details below)

Market may interpret as: Labor market is still strong and Fed cut narrative is wrong. Go Small Caps!

But it's also a tell that recession has been pushed out not pulled forward.

Sahm Rule Revisited

We needed a 4.3% UE rate to trigger the “Sahm Rule,” meaning that the U.S. economy would be in a recession.

"The logic of the Sahm rule is that when the unemployment rate starts rising, it often picks up steam, and we end up in a recession." @Claudia_Sahm

The Sahm Rule says we’re in a recession when the rolling three-month average for unemployment is 0.5% or more higher than the rolling three-month low over the last 12 months.

To qualify for RECESSION, therefore, the monthly unemployment rate would need to rise to 4% for 3 months.

Here's how to calculate/track yourself!

Bond Yields Crash On Rising Productivity

Yes, I know I have written about the "Yellen Yahtze" since November 2nd as the main reason-for-the-season in why the issuance of more bills over bonds (in the last QRA) was liquidity-providing, causing bonds (and equities) to stop falling and triggering treasury shorts to cover.

But then the 10Y yield really picked up speed to the downside November 14th, and I attribute that to a fundamental reason that the Fed cares much more about than the Unemployment Rate.

Productivity is outpacing wage gains again!

Let's go back before we go forward:

Remember my premise here where I said the biggest threat to bonds was wage inflation outpacing productivity? That was 2 yrs ago in this client post October 2021: Deflation of Wages Ended with Covid. Fast forward to this summer where I revisit the theme: Wage Inflation Delayed Recession.

This view is still in play: Wage gains are outpacing inflation and that is helping the economy, labor market, stock market stay strong.

More good news: Productivity in Q3 (+5.2% annualized) was the highest since 2009. That means Americans earned more as they produced more. Fed sees this as non-inflationary growth.

Companies that manage to increase productivity can boost supply & more easily protect margins without raising prices in an environment of elevated wage cost & declining pricing power via @EY_US

Reasons for productivity optimism as per Barrons via @GregDaco:

Less labor churn (retention/training)

New technologies integration (AI & other)

High rates favoring more scrutiny on productivity-enhancing capital reallocation & innovation

Investment in supply constrained world

Here's an article that really digs in: Full Employment Can Support A Pickup In Productivity:

Amidst all of the understandable concern with inflation and recession risks, the evidence continues to foretell a welcome inflection point on the horizon—a rare procyclical upturn in productivity growth.

ALL OF THIS is helping bonds move higher and yields lower.

And why bulls will make the argument wages can go higher without stoking inflation.

Further, Fed said they “don’t care” about wages, unless wage growth outpaces productivity.

The one negative: unit labor costs decrease 1.2% (annual rates) and has been falling as Main Street Inflation has risen, firmly in contraction (below 50) all year.

This ONE DATA POINT will bear watching. Because as Geoffrey reminds:

“Watch the value of your money (e.g. dollars) in relation to the prices of other currencies, gold, and goods and services to understand what is really going on with the value of your money and what it buys. If you don't do that, you might fall under the illusion that the things measured in that money (e.g., stocks and bonds) are going up, when the truth is the value of your money is going down.” – Ray Dalio

UNIT labor costs matter, and they are trending lower. Don't be complacent.

Yes, productivity will absorb any negatives on higher wages OVER TIME, but falling UNIT labor costs will limit wage earners from outpacing inflation OVER TIME.

Fed Pauses And Pauses And Pauses

So now... I contend, Fed is less worried about inflation to have to hike BECAUSE productivity gains are picking up again!

I say they coast next few quarters.

I don't even see why they would seriously consider a cut in March given how the bond market has repriced the longer-end - unless we get a reason to but that's an unknown for now.

What is known:

The 1Month Treasury Yield is now the highest paying over any other duration.

The 13W US Treasury yield is reversing its trend (technically) - 1st time in 2 years. Might not see a 5-handle in 2024.

The 10Y has a date with 4% and then we will see: staying above is bullish, below is bearish.

The bond market is pricing in much lower rates next year.

Clearly the loose financial conditions have triggered the animal spirits in equities of late.

My bet: Fed will talk tough but continue to like coast/pause until Q2/Q3 of next year.

Yo-Yo Market Rotation

The Growth-Value Rotation theme will be my go-to even if it feels like it depends on the day.

I still contend, top line market indices are chopping (albeit violently) intraday while oversold value/tech/crap continues to serve as the best risk-reward.

Check out the #swing-ideas channel! Whether watchlist or open position, these are working GREAT!

Quant Flows Into Year-End

Stock market remains strong heading into year-end in large part because the last 5-week rally has priced in the end of a Fed rate hiking cycle, and even pulled forward rate cuts as early as March 2024.

Here's what CTA flows look like over the next month for EQUITIES:

CTA signals in equities have swung from one extreme to the other even more so than in rates. However, we believe CTA impacts on equities arc more modest due to their moderate positioning. We estimate -$10B of net selling in equities over the next month in a flat market, split 60:40 in ES and NQ futures.

MentorQ put out a note on CTA Convexity that bears watching:

IV continues to move closer to realized volatility closing that wide gap that we had been seeing in the last few weeks.

Obviously as when the gap is so wide, long gamma trades are great, but as with everything those arbitrages tend to become crowded.

We had pointed out that, last week, CTAs had actually been reducing their length as the market moved sideways - even when we saw that big bump on Friday.

The convexity is now clearly to the downside. You can see from the GS chart how much liquidity they can remove from the market. As we move through December, we think the market will sail into December OpEx which is one of the big ones for the year.

Nomura’s McElligott made a good point as well:

"the conditions simply aren’t there yet for any sort of equities crash risk because we just aren’t seeing funds long enough in the market yet. It’s only when funds are “brick long” that this forces them into a position where hedges are required, which then puts dealers into a short gamma/short vega position in a spot-down market. Only then can the “games begin.'

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!