Market Priced For Perfection

Inflection Points Matter to Market Returns, which is why I study so closely sector rotation as a theme for outsized trading gains.

Post OpEx is typically a “Window of Weakness” for markets and an opportunity for bears to enter the arena. They need to do more than growl, but given equities are priced for perfection, I bet they give a good show at least after this week.

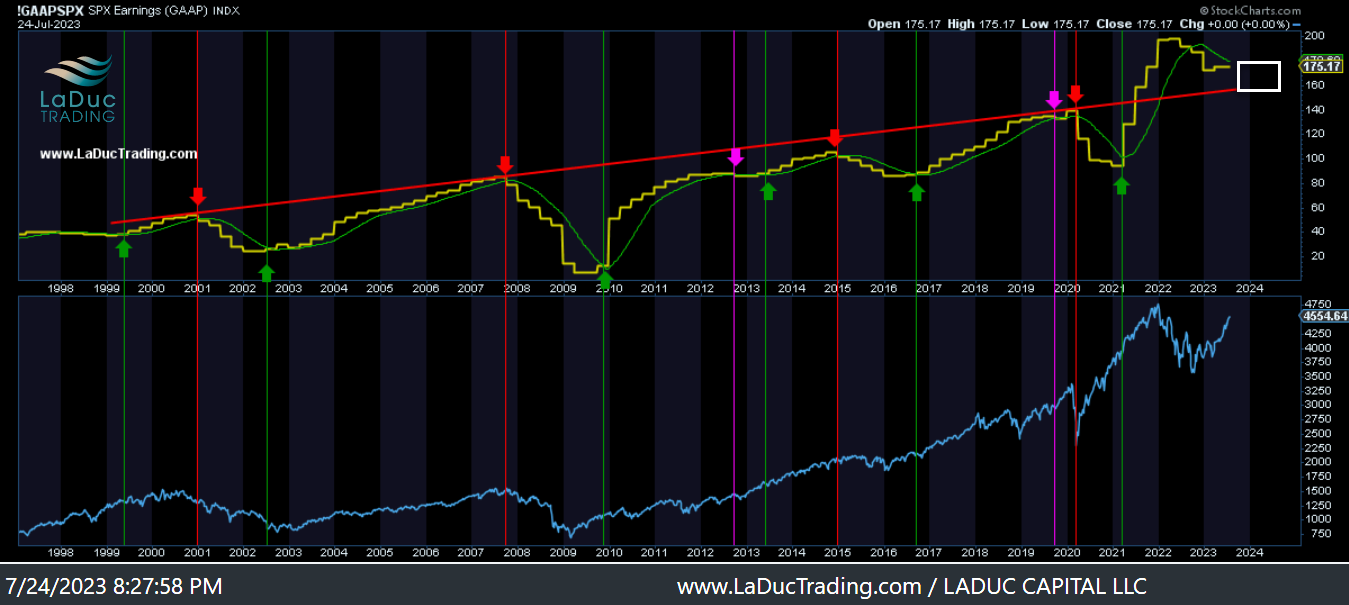

Earnings season is here and bar is low to jump over with many sell-side analysts expecting an EPS trough. I say not yet as my GAAPSPX chart (below) is not done going down, wage inflation is not done going up, and SPY is trading for 20x forward earnings, even as estimates decline! That what I call A MARKET PRICED FOR PERFECTION.

Speaking of which, I was interviewed by Brent Kochuba of SpotGamma last week with my thoughts on macro, markets and how I use options in particular to help guide clients. I explain why I feel markets are due a pullback to potentially SPX $4000 by end of September.

It's also FOMC week, and expectations are high Fed will hike 25bp then skip September.

We really haven't had a proper chance to "Sell the news of a pause". Market is still in "Buy the rumor of a pause".

With that, we could continue to grind higher into my SPX 4660, although I suspect that to an overshoot - or as I like to call a "fake breakout, fast failure".

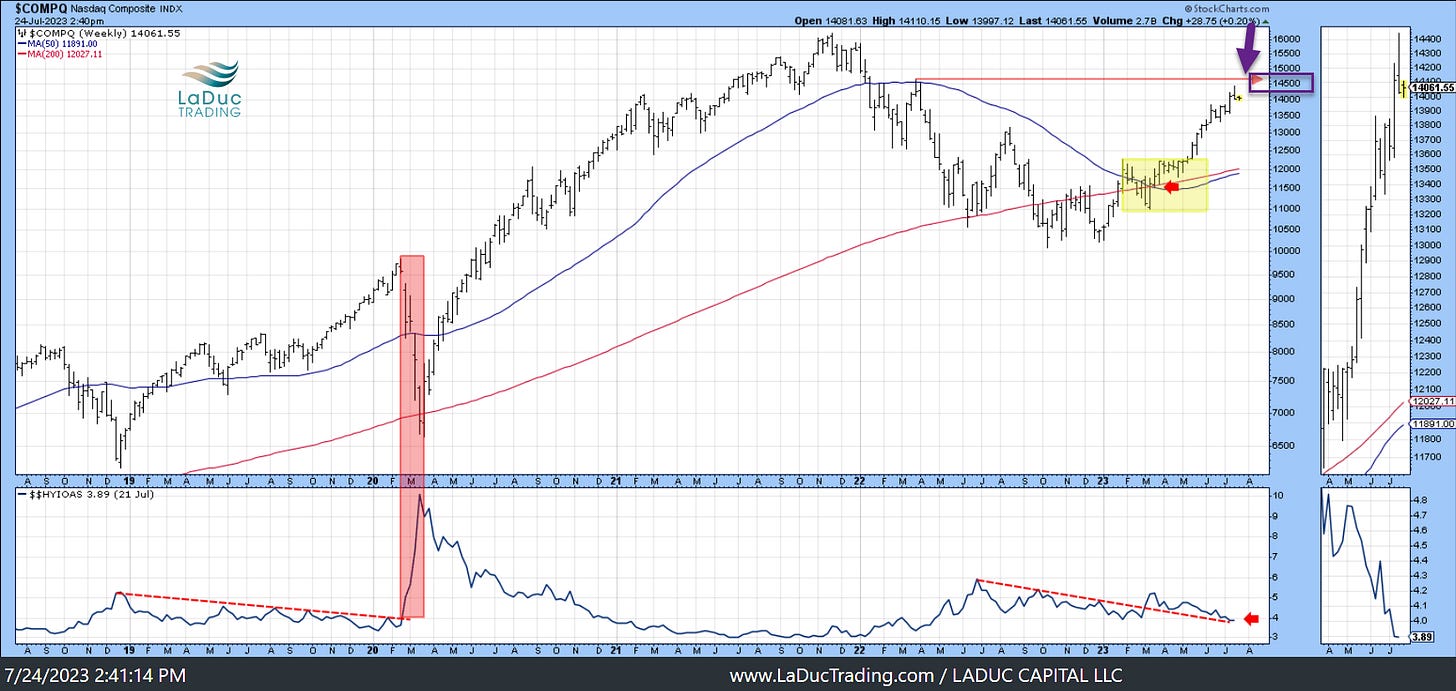

Nasdaq is tired and approaching a key technical inflection point as COMPAQ tags my 14,500 resistance (see chart) AND my Growth-to-Value rotation continues since June 1st "Stalking Value Rotation".

Boring is back!!

Defensives picked up speed since UNH took off Friday the 14th - we caught it live and it was 'the tell' that other health care, staples. utilities and energy would follow.

They followed. Fast forward: XLV is up over 5% in one week and XLP and even XLU outperformed last week before XLE spiked higher on refiners and CVX earnings.

Today, we had already positioned for the ramp in Chinese ADRs after China promised more stimulus;

China’s Politburo Signals Property Easing, Debt Risk Plan - Bloomberg

China Has Ample Room For RRR, Rate Cuts to Boost Economy - China Securities Journal

*US DISCUSSING LIFTING SANCTIONS ON #CHINA IN FENTANYL DEAL: WSJ

The bid in Chinese equites with oil & gas helped keep market breadth and buying bid, with VIX suppression still in play.

NYFANG continues to be a case of tech in distribution.

As Craig warned, the Goldman "most crowded basket" is rolling over so, again, DON'T BE A PIGGY with your swing longs in Jr Tech + Dash-for-Trash.

If they close below the 8 or 21D (depending on your timeframe, option tactic, market opinion), take care they don't unwind. Otherwise, this is digestion not correction.

When Volatility?

I am expecting a correction this summer. I just don't have confirmation of that yet ;-)

The Federal Reserve’s policy decision on July 26 could signal the last rate hike of the cycle, but more likely a "Dovish Hike" with divided members on board for a September skip.

The June PCE deflator data on Friday should mirror the trough June CPI report, while the July CPI report on Aug. 10 may display similar disinflationary pressures before it turns north come September.

Dealers enter short gamma on any "bigger" move to the downside - like 2.5% selloff - but we have yet to trigger such an event. We have potential this week as...

Green VIX + SPX like we had today foretells a divergence worth watching, especially as VIX seasonality shows July as 'the low'.

MSFT + GOOG report Tuesday afterhours, and represent about 13% and a combined 7% of the NASDAQ 100 Index (NDX) respectively, along with about 6.7% and 3.5% of the S&P 500 (SPX).

FOMC and/or Powell surprise Wednesday; ECB Thursday and BOJ Friday - just as the USDJPY got above 140.80 (important) and US 10Y hovers above its 10W (important).

In the meantime, better performing stocks have higher earnings' hurdles than relative underperformers. And SVXY has tagged my 161.8 Fib retracement at 87.87. I will be looking for a reversal signal at that level to indicate we are ready for another shake-n-bake moment.

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!