Market Is Getting Nervous

Top Ten Reasons For Market Selling

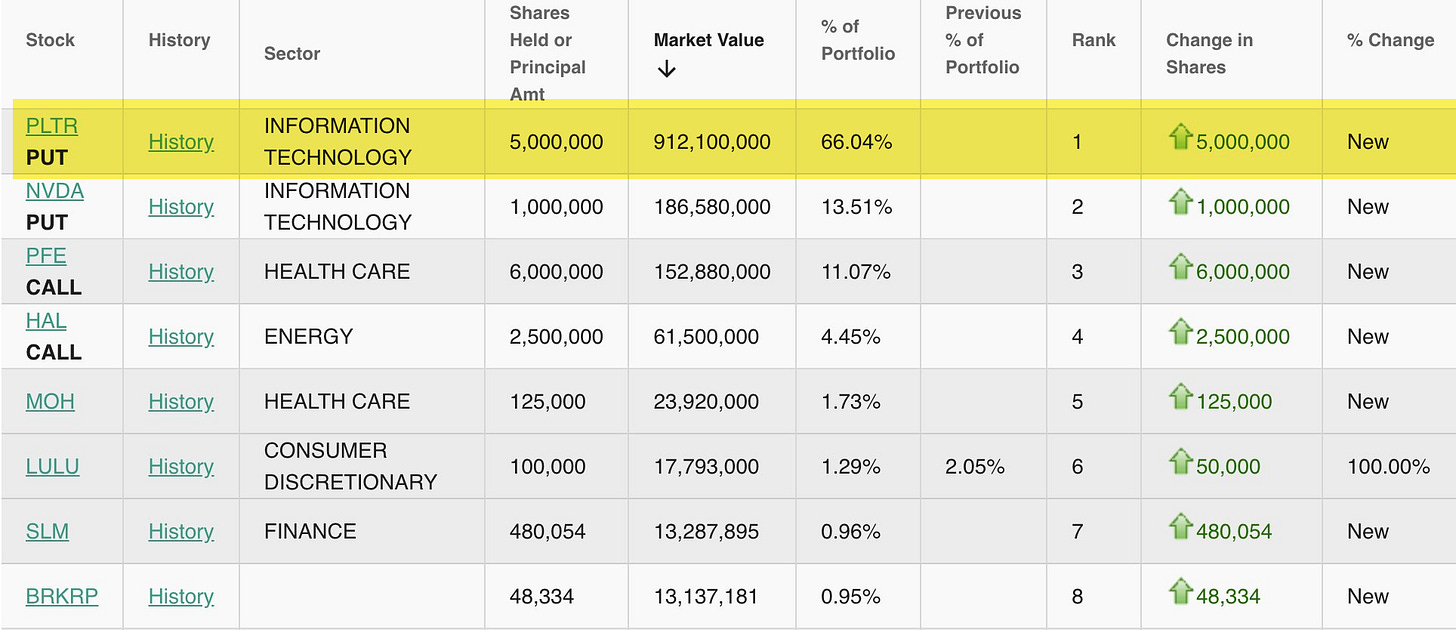

Some blame recent AI story stock weakness on Michael Burry and his big bearish positioning in NVDA & PLTR - especially PLTR.

Others are quick to point out valuations are just too high and need some ‘adjustment’.

Client Anne made a good comment as we run into NVDA earnings Nov 19th:

“When the NVDA stock machine quits being able to generate the money needed to keep the pump primed, these companies will have to have money from somewhere else, like customers.”

I’ve been warning the BREADTH destruction under the surface would trigger that ‘Air Pocket Of Risk” - when Generals finally look and see the Soldiers have fallen way back.

Don’t forget my timely warning that a rising USD would remind that FX volatility bleeds into Equity Volatility.

“Despite being a big dollar bear, big picture, I am still betting we see a surge that can trigger both FX & Equity volatility.” Me to clients 10/27

That, and Buy The Rumor of US-China Trade “Framework”; Sell The News of No Trade Deal “Formalized”.

“Pretty sure this Oct 30th China news did not make it into the White House spec sheet: …tungsten, antimony, and silver are now under stricter export supervision requiring government review and approval (rather than being freely exportable). So, contrary to the rumors about “general licenses removing controls,” this Chinese government release actually confirms the continuation or expansion of export controls into 2026–2027.” Me, Sunday

We also have Powell last week post Fed meeting pushing back on December rate cuts. RBA (Australia) didn’t cut today. Market has some pricing out of rate cuts to do…

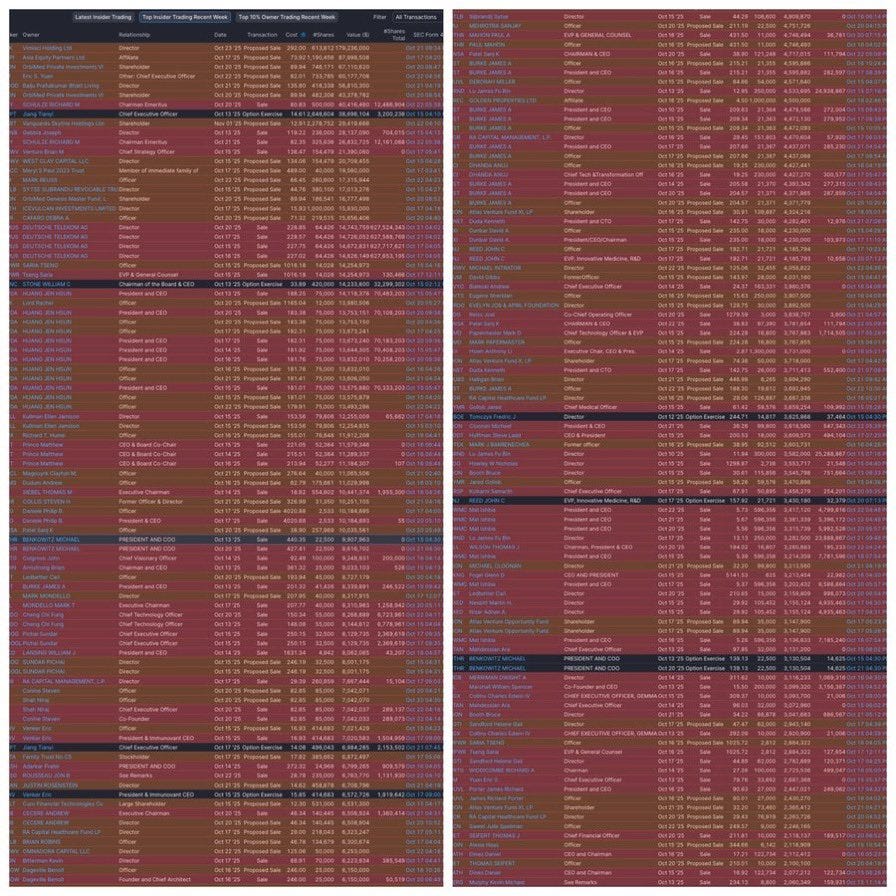

And 100% of the last top 200 insider trades were sells while no one is looking.

Plus…

“Companies offering negative surprises have been heavily, heavily punished. Misses have traded 5% lower on average the day after reporting, which is steeper than any other Q in the history of our data.” Jefferies

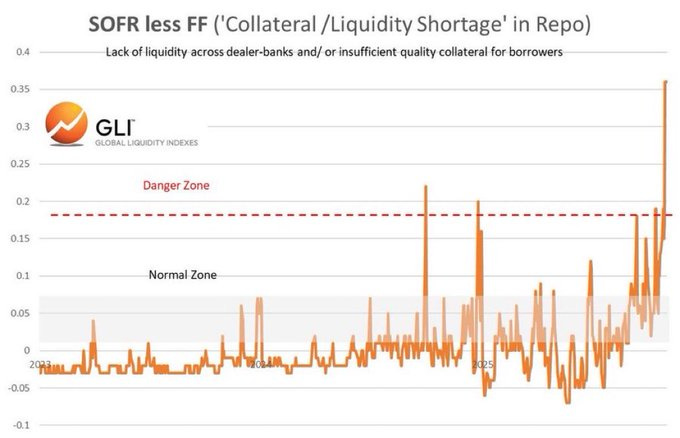

And then there is the Repo Risk - that depicts in a chart what I wrote about last week: Collateral / Liquidity Shortage in Repo

Last but not least, the Supreme Court is set to will hear arguments on Wednesday on whether Trump’s tariffs (using emergency powers under laws like the International Emergency Economic Powers Act ) are really a matter of foreign policy and national security, or if they require congressional authorization. At stake, $100B in tariff revenue, and a ruling on the powers of the presidency. If the Supreme Court dismisses, expect a large tariff refund for US importers but not necessarily inflation relief as corporations keep these proceeds. The manufacturers within the consumer staples & manufacturing space should likely find some relief. Just keep in mind. Trump has other means to enact tariffs, but just not as arbitrarily and of such large size as threatened should IEEPA limits be upheld by the Court.

Five Big Bonus Reasons The Market Doesn’t See Yet