Make Hay While The Sun Shines

CLUB/EDGE client post July 10th. Focus on timing a market pullback.

» CLUB/EDGE client post JULY 10th, 8:37 PM.

This has been my mantra for awhile. No clouds = No selling.

Lucky or Good, I have stayed bullish for clients even AFTER my SPX $5340 2024 price target (given in January) tagged in late May.

Then June 5th, after SPX had pulled back from the May 23rd NVDA earnings high of 5341.58 to retest that high, I said above 5340 on weekly close and we would see growth plays continue higher. My constant tracking of IWF:IWD (growth:value) ratio has been key for added confidence and positioning. (ergo TSLA, AMZN, etc have worked beyond great for us.)

I also reminded June 5th that QQQ had ** only ** traveled up 76% off the Jan 2023 bottom, and we could run through my $472 price target (given Jan 2024) and up “into $504/507 area before next area of digestion”. (Note: $520 would be a 100% advance similar to the 1999 run into March 2000 bubble.)

Fast forward: here we are at QQQ 503.52 and SPX 5635.39 the eve of CPI, and I am seeing hedges coming in of size that bears watching.

Option Flow is Stalking A Market Top

Today we spiked higher in the last hour, and I don't just mean in price action but also under the surface in cumulative volume (strong net buying).

Do they "know" something like how CPI will print pre-market?

Or was it a dealer hedging after a large VVIX spike (+6.15%) that I noticed during my live trading room all the while VIX was red, until EOD when VIX too closed green +2.72%?

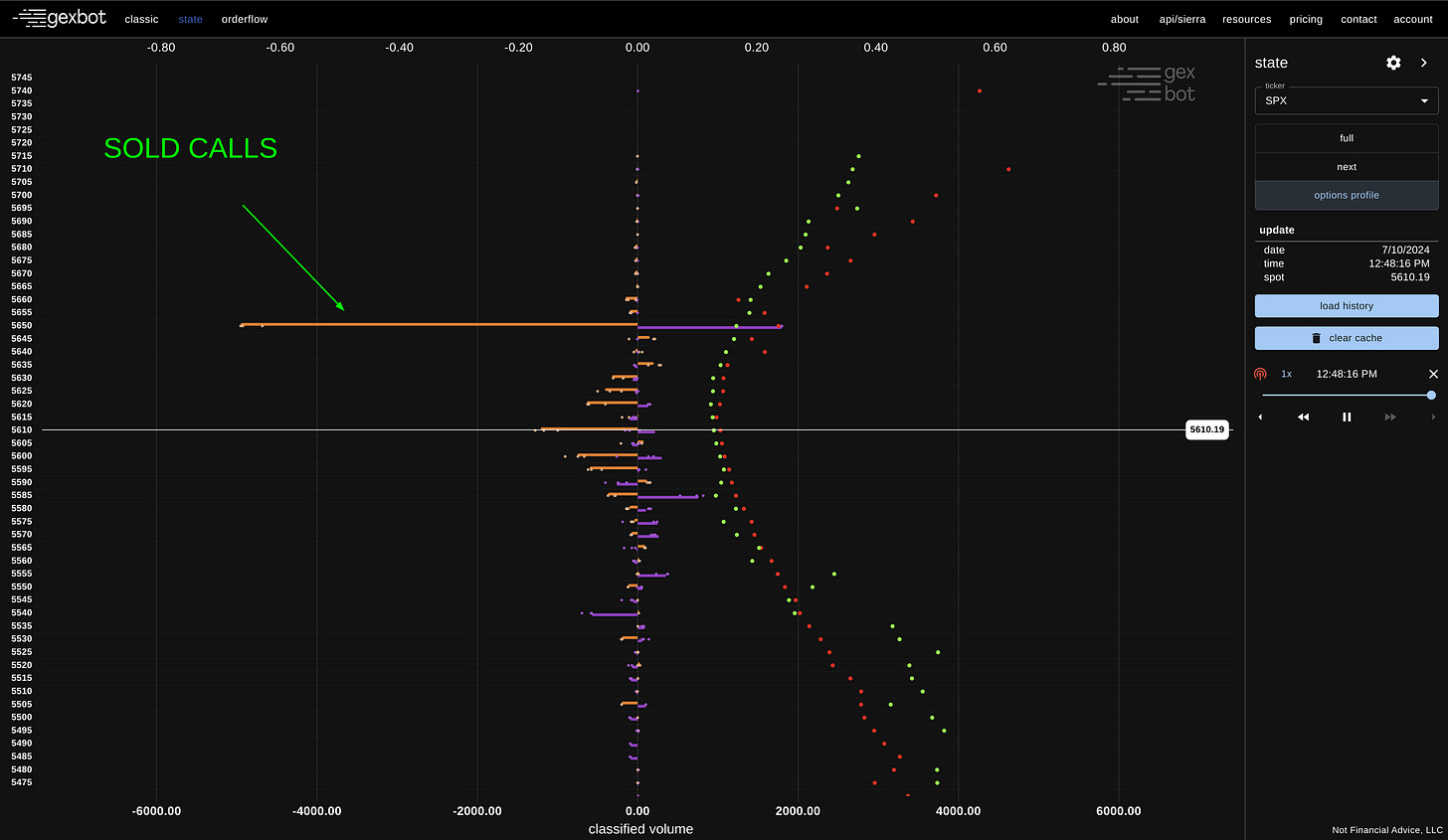

By hedging I mean, that someone came in today with a large synthetic short at 5650.

They sold call options and bought put options of size at the same strike to, in essence, create a wall where SPX price should stay below in order for them to profit. On the other hand, if they are wrong, and we get above that strike price, they will be forced to cover aggressively which could trigger a further melt-up. This is good to know as we head into bank earnings Friday morning. You have your level to play long/short against.

Next, you know I have been expecting my MAG7 ratio to tag the 161.8 Fib Level on the weekly, on or about 131.67. We tagged 129.43 today.

I have been hammering this theme daily in my live trading room AND #trading-room-notes in our Slack member workspace.

I expect the MAG7 price target to hit with QQQ 504/507 area same time.

Then we likely trade sideways during earnings season until mid-August, at which time we will have Yellen's QRA from July 31st known plus Democratic convention drama in full view and a pullback likely into end of September/October.

This is still my baseline bet!

Keep in mind: SPX just printed 5635 and there is a strong wall just above near 5665.

If earnings fail to deliver on top of AI disappointment picking up speed on top of election risk getting priced in, we are talking potentially unwinding market price action all the way down to November 1st Fed Pause & Yellen Yahtzee.

Die-Vergence Drama

I reviewed for clients my latest INTERMARKET ANALYSIS: WEEK ENDING JUNE 5TH: GROWING CAUTIOUS ON CONCENTRATION RISK (post + video).

But I want to call attention to My Most Bearish Chart: RSP:SPY video.

It is not a timing tool but it does represent a level of concern I have that Nasdaq + SPY could cascade lower should markets meet a macro trigger of size.

Craig and I discussed these potential triggers in our bi-weekly Macro EDGE Roundup webinar posted earlier today for EDGE clients:

AI Disappointment

Future Earnings Repriced Lower

Convention/Election Drama

Unemployment Rate > 4.2%

10Y yield < 4.2%

Geopolitical risks

Carry Trade Unwind

Leverage Unwind....

In a nutshell, MANY are expecting the market to broaden out and run higher. That'd be nice. But I have my doubts.

It's not just that Nasdaq seasonality and fund flows typically peak by mid-July with biggest outflows into a contentious election.

I see a Huge Air Pocket Of Risk for a catch down if conditions present.

I think that makes for a great time to buy protection and tighten stops/collar some positions.

If you need help with that, we have both our slack #custom-trade-support for CLUB/EDGE members as well as portfolio strategies with #options-mentor-hans!

For more options education and mentoring: https://laductrading.com/elevate-your-trading-with-expert-options-strategies/