Long Stocks Equals Short Dollar

Let's unpack size of USD transaction market vs its role as reserve currency by global central banks vs nominal price of USD relative to FX peers vs real value of USD relative to things/asset prices.

»CLUB/EDGE client post Tuesday, December 5th.

Money Printing Is Not Bearish Equities

Government debt fueled by money printing is liquidity for equities. We know this to be the reason-for-the-season in all functioning areas of the equity, treasury and credit markets: liquidity is bullish; lack of liquidity is bearish.

Let's go one step further: money printing is not bearish in the short-term as it provides liquidity which equities love, but money printing is worrisome over the long-term because it is helping to devalue the dollar. And no country has ever succeeded, big picture, in devaluing their currency into prosperity.

But, in the near-term, it sure feels good to wealth holders when equities and home prices and wages are rising!

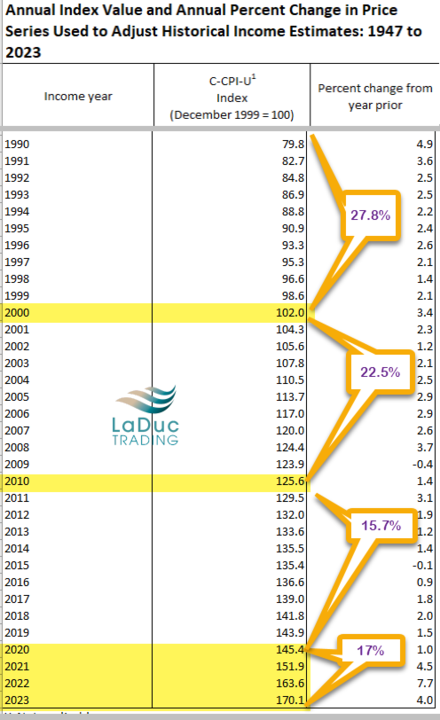

Problem is, most attribute the stock market rally to a future economic growth narrative and future earnings growth projection - from aggregate spending made possible from government printing that devalues the USD. All the other attributes of government largess - leverage, option flow, financialization, Fed/Treasury policy intervention, etc - are also measured in future dollar value using nominal terms. Little time is spent assessing rising asset prices as a result of falling real dollar terms.

Let's review a few concepts first - as both reminder of what real vs nominal means - and then to revisit why this matters when bullish asset prices.

How Inflation Distorts

Nominal (or current) dollars gives you only part of the story. What's missing is how inflation can distort the Real (or constant) value of the dollar.

Current versus Constant (or Real) Dollars

Current dollars are based upon the value of a dollar in the year in which it is received or spent unadjusted for inflation.

Constant or real dollars is adjusted for purchasing power or said another way, adjusted for inflation so as to measure real purchasing power over time.

We know conceptually that the dollar does not have fixed or constant purchasing power. Based on inflation, a $ can buy more or less services and goods.

Incomes from the 1970s compared to now are meaningless unless factoring in price levels then and now.

Example: Even if total income in current dollars is 10X now what it was then, real income would have only gone up 10X IF prices remained constant, and we know they didn't.

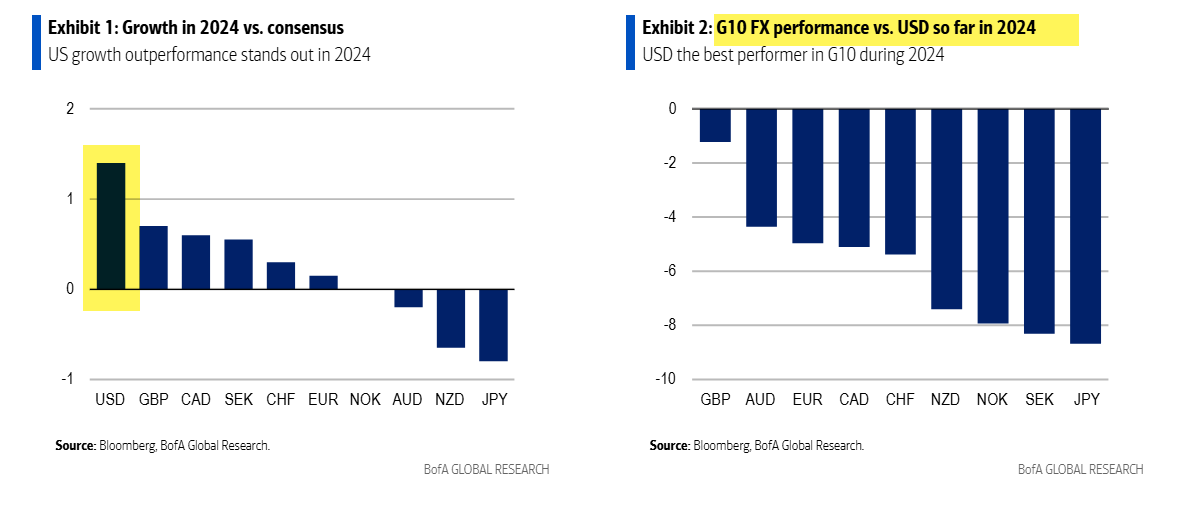

Perception is Not Reality

Perception of belief is that the USD (in nominal terms, relative to some of its peers - like the politically contrived yen and euro) is strengthening or rising against FX.

It all depends on the currency and again, most are measured in nominal terms.

"...The FX value of the US dollar is a nominal yardstick..."

"...and can fool you into notions of strength when the price of real safe assets already scream weakness"

Zoltan Pozsar

Reality matters. And the truth is that dollar value in real terms is falling - and its rate of change, or descent of its fall, is quickening post-Covid.

The Central Bank Affect

As discussed often over the past year, central banks, notably China, have actively been settling foreign trade by selling their USD to buy gold. It is what Geoffrey calls an "external drain":

"USD can go into commodities, that's the historical discharge...and

That's why the USD is not making a new high versus CNH since 2022, DESPITE China having lowered rates the whole time.External drains are the norm in 400 years of history, and China has dusted off that old tool.

And by the way it's why cost of living is rising in the US."

Another affects is that CBs globally - especially ones that have joined BRICS - prefer to settle more trade outside the USD and therefore require/demand fewer USD.

In nominal terms, the DXY may be strengthening against some of its FX peers, but in real terms, CBs are rebalancing their reserves to keep the dollar share constant (i.e. by selling USD). That means the dollar share of their reserves is actually declining.

A report by Stephen Jen of Morgan Stanley in April 2023 showed how the US dollar has “suffered a stunning collapse” as a reserve currency.

Jen estimates that if you adjust for price changes the dollar’s share of official global reserve currencies has gone from about 73 per cent in 2001 to around 55 per cent in 2021. Then, last year, it fell to 47 per cent of total global reserves. - via FinancialTimes

It should not be a surprise that USD as reserve holding fell after US seized Russian assets.

Jen continues:

The USD is losing its market share as a reserve currency at a much faster rate than is commonly believed. After steady declines in its global market share for the past two decades, in 2022 the dollar lost market share at a pace 10 times as rapidly.

Analysts have failed to detect this big change because they calculate the nominal value of the world’s central banks’ dollar holdings without considering the changes in the price of the dollar.

Adjusting for these price changes, the dollar, we calculate, has lost some 11 percent of its market share since 2016 and double that amount since 2008.

None of the above dismisses the fact that the USD is dominantly used in global finance and trade:

the US dollar’s share of all currency turnover has actually climbed from 85 per cent in 2010 to 88 per cent last year. In global finance it is similarly dominant.

-via Bank for International Settlements

So let me remind that when it comes to global transactions, the USD dominates - "because of its huge, liquid, and reasonably well-functioning financial markets," as Stephen Jen shows. The slow process of global central banks moving away from the USD will take time to be truly felt.

But my focus in writing is to remind that it is important to separate the size of the USD market of transactions (which is huge)... from the declining use of the USD as reserve currency by global central banks (which is falling strategically as a way to minimize dependency on the USD)... from it's price of USD relative to FX peers (which is artificially bid in part from competitive devaluation in FX terms and as priced nominally)... from the value of the USD relative to things we consume and why asset prices are rising unabated.

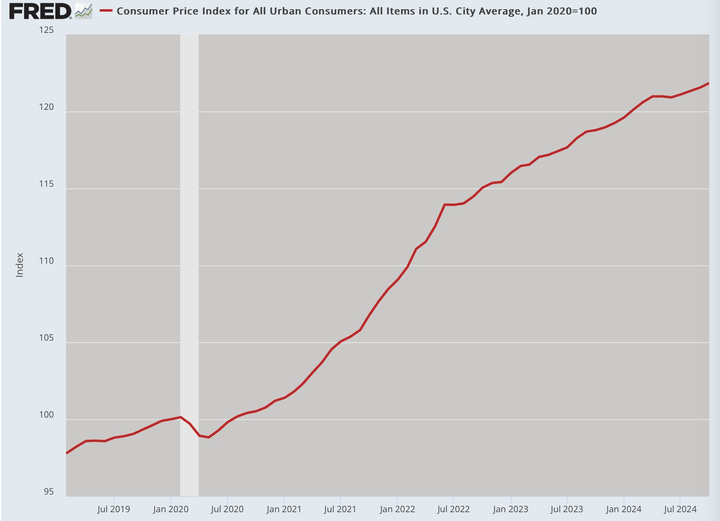

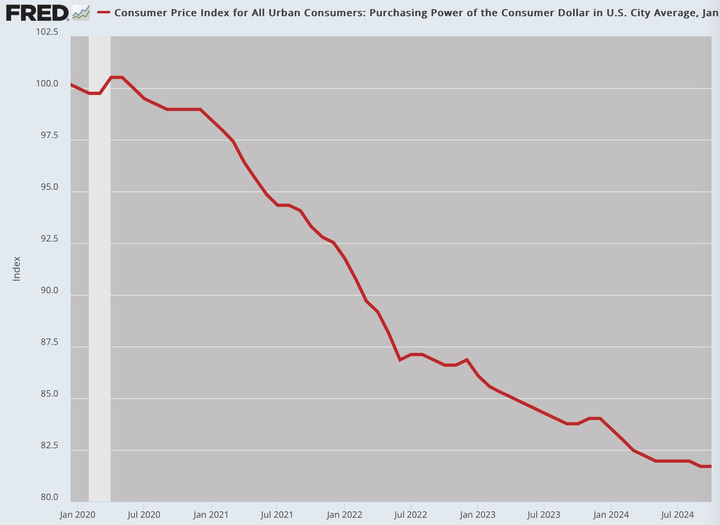

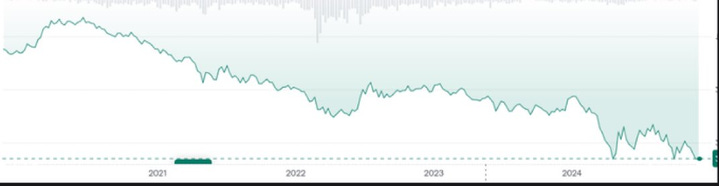

Visualizing The Falling Real Dollar Value

Cheekily, I include a chart of soft commodities, DBA, but inverted. (h/t Geoffrey!)

ONE USD buys you the SAME QUANTITY OF COMMODITIES pre-covid to now.

This is to demonstrate the USD value (falling) versus this basket of select food/agriculture commodities (rising).

The basket hasn't changed, but the USD buys less and less of the stuff.

Perception Meet Reality:

Post-Covid: inflation has compounded in THINGS even if the rate of inflation has fallen.

The real value of the PAPER dollar has fallen relative to the rising costs of THINGS.

As an example: You need more dollars to buy the same amount of food you bought pre-covid even if CPI has fallen from 9.1% to 2.6% because the prices in food on the aggregate have risen over 25% the past 4 years.

Anyway, this is all a round-about way of saying: Ignoring a melt-up in stocks as anything less than a short USD trade is silly.

»And is one reason, some investors have migrated into gold (and past few years, digital gold - bitcoin) as a hedge against currency debasement.

But big picture, I wanted to remind:

Asset prices in general (including housing) and equities in particular (especially large cap) have had an un relenting bid as Long Stocks Equals Short Dollar - without most realizing WHY.

Lots of atta-boys for trading speculative assets long without realizing the real reasons.

Lots of narrative salve and waxing on about 'fundamentals' of a stock, a movement or macro backdrop without giving credit where credit is really due.

But the truth is that a falling dollar hides the risks that can trap complacent bulls.

Being over-confident about US economic superiority and financial asset inflation without also measuring the direction of the real value of the biggest asset of the financial world - US dollars - is why many will not realize that it the US dollar debasing (real value falling versus nominal price rising) AS the biggest reason to be bullish the US and our equity markets ... until it isn't.

Two thoughts: 1) Equities as a dollar short is spot on. There is truly no alternative to stocks—something I wish I knew back when Bernanke ran the printer after the GFC. As long as M2 keeps rising, our cash ice cubes are melting and we’re stuck in the market for better or worse. 2) Demand for $USD assets will remain substantial so long as large trade deficits remain—those dollars have to get recycled back into Treasuries or similar instruments. But Trump tariffs may take a large bite out of both the trade deficit *and with it* demand for a place to park formerly surplus $USD.