Laggards Unite & Ignite!

After a stupendous, nearly 9% return (8.92%) for SPY in November, and a late day buying program Thursday (= to $6.5B MOC Imbalance to the buy side), Friday captured the bull stampede into oversold laggards while VIP stocks in MAG7 took a break. Growth To Value was clearly in play.

I was bullish small caps from Monday and bearish large cap tech, as you can see from the many #chase-ideas short in NVDA, MSFT, etc.

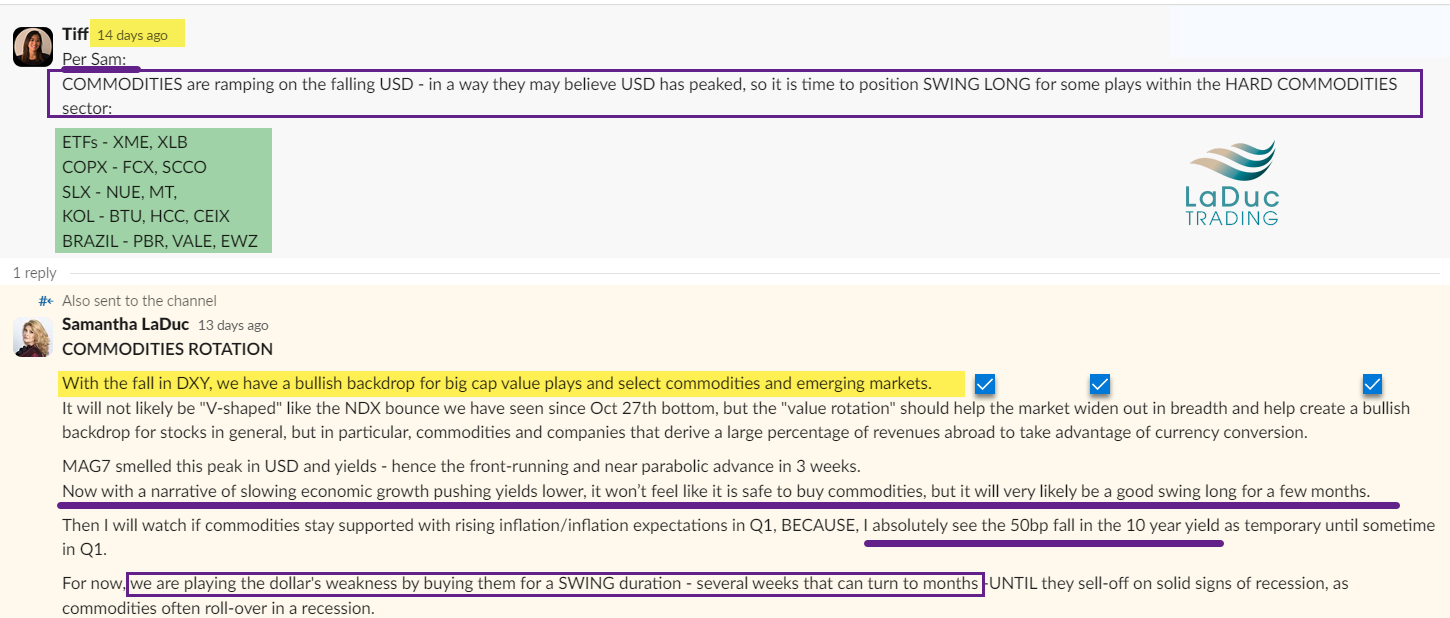

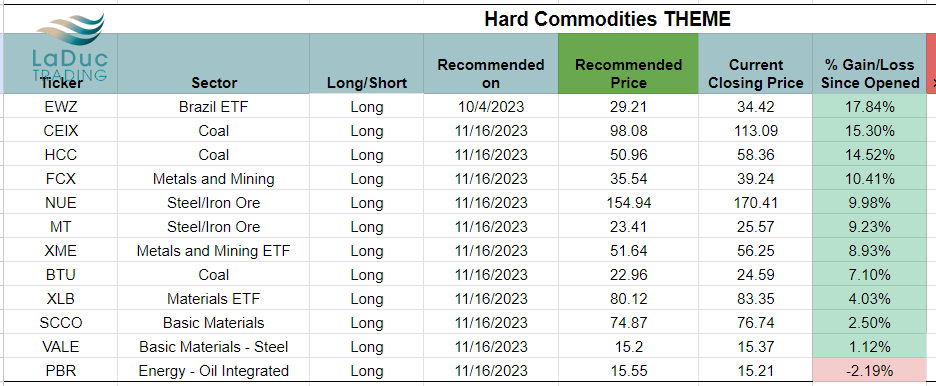

From my #swing-ideas channel, you can see my theme of underperformers has really delivered from single stock names like ENPH, KHC + ISRG (positions since Nov 14th), or my overarching "USD Has Likely Peaked" theme with emphasis on my high conviction bet HARD COMMODITIES would rally. (See Nov 17th screenshot below from #swing-ideas channel.)

With Fed Pause narrative pulled forward by the Fed Fund futures, and 10Y yield falling 52 bps in November, the breadth and net buying in NYSE has been my focus.

Friday saw the large outperformance in IWM, IWN, KRE, XME and all the companies that benefit from falling dollar and yields.

I even went on Bloomberg with my bullish bet on MAG7 weakening and Small Caps outperforming this past Thursday.

I felt confident in this theme as my growth-to-value intermarket tell triggered this week (see chart below).

My bet, as expressed often in my live trading room, is that this indicator signifies it is a great time to be positioned: short Nasdaq, long Russell.

Now everyone can see that outperformance is now mainly concentrated in YTD underperformers!

Goldman has other reasons to be long the laggards:

1. we have had a 2 year rolling bear market for the S&P 500 ex top 7, and breadth in the market bottomed when rates peaked.

2. sales per employee in the Russell 2000 (where ppl expect job cuts) has never been higher.

3. many input costs are trending lower y/y, and inflation is downshifting.

4. margin story for many companies looks especially attractive and the bar is low for next quarter

The result: oversold plays which have been heavily shorted are now being covered/bought and the result should be selling of the V.I.P. stocks of mega cap tech.

This can actually create a lot of volatility, so I will track this closely.

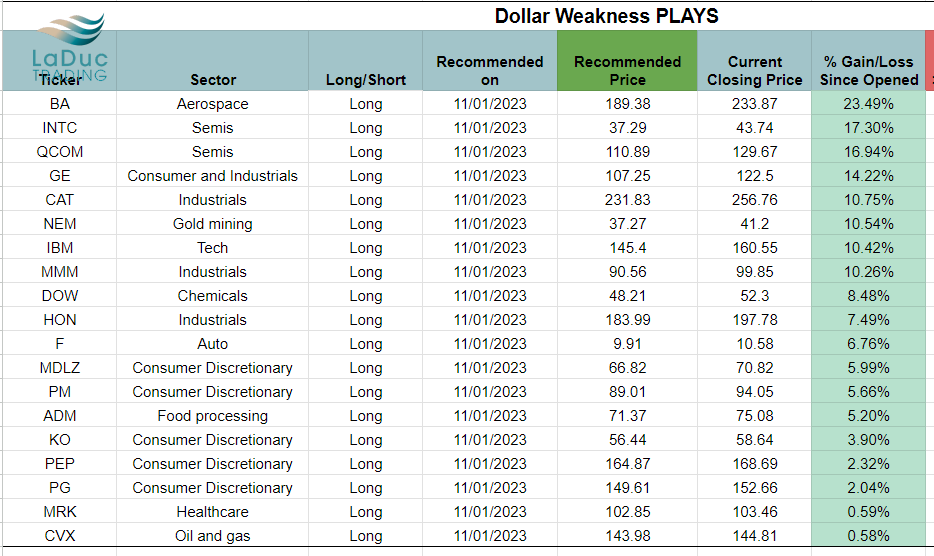

In the meantime, lower dollar and yields combined with recent dovish Fed commentary have encouraged the rotation out of YTD winners into YTD losers.

From high-quality value to low-quality micro-craps, the chasing is clearly in play and what is keeping this market from selling off big picture, but as soon as SVXY turns red, watch out.

Quant Flows

November was the best month for global stocks in 3 years, wherein the US dollar suffered its worst month in a year.SPX is now grinding higher above my 4575 gap fill target and 4600 SPX Call Wall. But there is currently very little gamma above it to roll it up higher.

We need a trigger to break SPY above or below it's trading range. The low of the range is the 4500 JPM collar pinning expectation.Morgan Stanley’s PB Strategic Content team highlights that

funds were net sellers of global equities this week as they sold longs across all regions while short flows were muted.

North America made up ~75% of global net selling.

On Thursday Mega Cap Tech was sold in the 3rd largest amount since May 2022 and the Magnificent 7 specifically saw the largest selling day YTD.

US Equity L/S gross leverage increased by 2% to 190%, while net leverage dropped 2% to 48% due to the long selling. (MS PB)

Macro Musings

And from a macro backdrop, after making a strong call early last month that the "USD Has Likely Peaked", I also said I wouldn't be surprised if Fed cuts.

Now, as inflation falls (the Wall St version not Main St), monetary policy goes from accommodative to restrictive. And that is why I believe on Nov 1st, the combo punch of "Fed Pause" and "Yellen Yahtze" - written about here repeatedly - resulted in the 10Y topping out at 5% on way back down to 4.3% so as to avoid a hard landing.

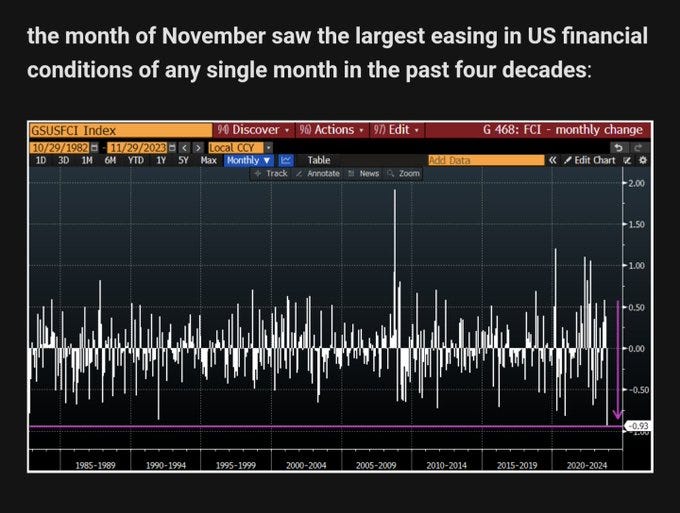

The result? The month of November saw the largest easing in US financial conditions of any single month in the past 40 years!!

The Fed enters its blackout period on Saturday before its Dec. 14 FOMC decision. Powell did not push back anywhere near hard enough in his 'Fireside Chat' Friday to discourage equity bulls, especially as economic prints this weak showed Wall Street's inflation metrics continue to ease.Reuters

Data on Thursday showed the PCE price index, the Fed's targeted measure of inflation, eased in October to its lowest level since March 2021, while the consumer price index, released earlier last month, increased just 3.2% on an annual basis in October, down from a peak of 9.1% in June 2022.Powell's job of shaping markets might have been made even more difficult this week when influential policymaker and usual policy hawk Christopher Waller brought up the possibility of rate cuts if inflation continues on its downward trend.Markets are now fully pricing a rate cut by the May meeting with almost a 50% chance they move in March, according to the CME's FedWatch tool. A week ago, that stood at a 21% chance.

Yields Make the Weather

As posted November 9th:

1. Last week saw the biggest weekly decline in the 10-year real yield of 2023. Yellen kicked the can on bond issuance and Fed intonated pause.

Equities rallied hard.2. March 2023 saw a sharp fall in yields from the SVB/regional bank crisis that resulted in Yellen intervention by way of BTFP program. Equities rallied hard.

3. Late September/early October 2022 saw global, coordinated central bank intervention. Matt King of Citibank later assessed at $1.5T in liquidity was added. Equities rallied hard.

4. July 2022 triggered global recession fears and weaker-than-expected US inflation data that resulted in falling yields. Equities stopped going down.

5. May 2022 pushed 10Y yields lower on rising concerns about risks to global growth from spiking inflation. Equities stopped going down.

6. Late February 2022 Russia invaded Ukraine which caused a sharp drop in yields before reversing higher, pulling equities lower.

7. November 2021 was the top in Nasdaq before yields turned strongly higher Jan 2022 and haven't broken trend long since.But they are pulling back since Nov 1st as Fed intonates pause and Yellen kicks the can on big bond issuance.So... you want a YE rally, don't take your eyes off the USD falling with 10Y!

The reverse is also true!

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!