Is the FORCED SELLING done in tech?

CLUB/EDGE client post July 17th. Focus on FACTOR ROTATION, CONCENTRATION RISK & SAFETY PAYS.

» CLUB/EDGE client post JULY 17th, 6:31 PM.

NOW You Know Why I CLOSELY Track Hedge Fund Factor Rotation

Last Wednesday, July 10th, I warned clients:

“Option Flow is Stalking A Market Top.”

Then Thursday, July 11th:

"TIMING DEFLATION & QQQ TOP & ROTATION"

I wasn't kidding, so I doubled down, and posted Friday morning, July 12th::

"the narrative shift can absolutely contribute to a sizeable unwind in the Concentration Risk that has suppressed volatility.

Know what you own.

But even before all of these market posts, I smelled the hedge fund factor rotation short-covering rally LAST MONDAY.

And why do I sniff around for it in general?

Because once market neutral HF shops get off-sides from value rallying, they are forced to sell their growth plays.

THIS creates a condition of FORCED SELLING out of overbought VIP growth/tech stocks and into oversold 'JUNK' value cyclical stocks.

A nicer way is to say LARGE CAP TECH into SMALL CAP VALUE.

And it is a totally wicked awesome sector rotation to trade for outsized profits!!!

Then yesterday, July 16th, history was made.

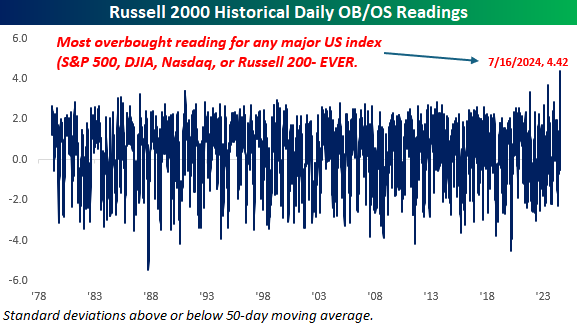

The Russell 2000 closed 4.4 standard deviations above its 50-day moving average.

No other major US index (Dow since 1900, S&P 500 since 1928, and Nasdaq since 1971) has ever closed at that much of an extreme.

Bespoke. H/t Chart below

I literally told clients yesterday:

Growth pullback expected to pick up speed now that IWM has gone parabolic.

MAG7 Short Working:

QQQ < 496 = 486.86, 479.19

META weak to 486 still working from 508.37 gap down

MSFT 456 updated stop to 451 break on daily to 446, 443.40 PT

NVDA sitting on 21D at 125.60 looks ready to give sway down to 121 to start

Overnight, HF shops couldn't take it anymore! Tech Selloff Picked Up Speed!

And with that, here were some of the top headlines today:

The biggest outperformance of small-cap stocks over large-cap stocks, over a 5-day period, in history.

and

Nasdaq $QQQ on track for biggest loss since December 15, 2022

Is the FORCED SELLING done in tech?

I don't know, but I do think we have more risk of selling GROWTH/TECH as the rally in SMALLS/VALUE has taken hold, even if for the wrong reasons.

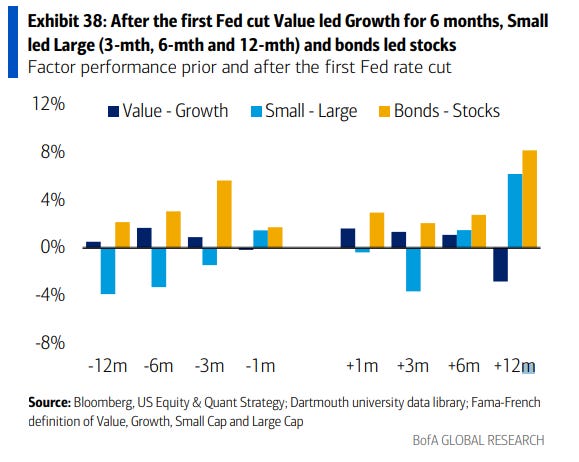

There were a few charts going around twitter that focused on how bullish it is for SMALLS after the 1st rate cut - which is currently priced in for Sept FOMC (100% odds after last CPI went negative MoM). The one below highlights how:

After the first Fed cut Value led Growth for 6 months, Small led Large (3-mth, 6-mth and 12-mth) and bonds led stocks.

IMPORTANT:

I want to point out that in all of these occurrences, Smalls led Large out of a recession - not potentially going into one!

So getting back to THIS rally in Smalls.

I believe it is because (and as discussed in my live trading room premarket July 16th):

1. Hedge Fund Factor Rotation Short-Covering

2. with Correlation at ATL begging to revert3. after a breathless rally in Growth that was due a pause/profit-taking into earnings

4. at same time market bets on Trump POTUS win pushing up value/cyclical plays

5. all the while US dollar + yields soften as tailwind for it all.It's a squeeze that can turn into a trend reversal.I said this last week.

But for now, it is a helluva 4.4 std deviation factor rotation squeeze of size.

That likely forces more tech selling. Just sayin'.

And that's what happened.

Tech sold off and the the VXN (Nasdaq volatility) warning I gave clients Monday was a great tell when it popped above the 200D and no one noticed but little ol' me.

And then VIX got to/above 14.49 today, but now needs to get to/above 14.88 to create fear for more than a day.

Safety Pays

Best place to hang out while we find out: XLV (new ATH today), XLP (nice bullish flag breakout on wkly as expected), and XLU (with lesser concentration of non-cyclicals but will do just fine).

And for the fixed income warriors out there: bonds!

At least until the 10Y yield tests 4% - my summer price target.

Shorting: XLK, SMH, XLY, XLC is akin to betting on 10Y2Y INVERSION now.

And right now this is prone to many head-fakes, but pig picture, I think it's the correct take.

Also, the "boring but profitable" defensive sectors don't use anywhere near as much leverage as MAG10 + AI TECH plays, so they are better reads on economic direction, in my opinion.

XHB is a tell on falling 30Y yields, while...

XLB, XLE, XLF, XLI are mostly tells on reflation.

At some point, absent more policy interference by Fed/Treasury, the higher-for-longer narrative will unwind too when we get the employment rate above 4.2%, the 10Y yield staying below 4.2% and the 2Y breaking below 4.2% as Fed Funds Rate prices in more rate cuts.

That may be seen as bullish Smalls over Large, but as I wrote a month ago, a deeper inversion will pull down banks AND tech, with a rotation into SAFETY.

That's why I highlight the safety plays now.