Is The Coast Clear?

The S&P 500 rallied more than 3% on Friday to wrap up a big comeback week for the stock market that followed the worst weekly decline since the start of the pandemic. Some attribute this to the "rebalancing" narrative, in that Friday began the first "official" day of rebalancing season and by some accounts is expected to contribute $80B of inflows in the next week.

From Tier1Research:

With equities having sharply underperformed bonds both MTD and QTD, this is one of the larger rebalancings to hit markets in awhile. Depending on the source and the estimate, roughly $100B of US equities must be net purchased over the next five days.

International equities fare well as well, with roughly $59B of expected inflows.

Bonds should see roughly equivalent selling. Into a backdrop of negative dealer gamma, the potential for topside fireworks is high.

Textbook late month rebalancing looking very much like March 2022 and May 2022.

Friday morning saw fireworks in my cumulative volume indicator as highlighted in my live trading room. I saw no reason to cover chase longs as buying was strong! I suggested when I closed my room at 11am ET that it looked very much to be a 'trending DAY'. Indeed it was - all the way into the close.

All three major indexes snapped three-week losing streaks -- with the S&P rising 6.5%, the Dow Jones average gaining 5.4% and the Nasdaq Composite surging 7.5% -- but is the coast clear for $4000, $4100, $4200 like so many expect?

I have updated my #intermarket-tells to showcase that even though volume might follow through and confirm Monday for such an upside thrust, in no way has breadth confirmed. In fact, it is still a big die-vergence, or as I said: "sitting in an air pocket of risk; the market just doesn't know it yet." I still see "$3994 max" before rejection and hard fail.

Further, I still contend, the market has not found a bottom but a potential counter-trend rally off oversold conditions. We are likely in a 2014-2016 rolling bottom - but this time it is not an Energy Sector Recession but Tech/Growth Sector Recession.

And, I still contend, should USD, Yields and/or Oil spike , all bets are off and we risk a flash crash in equities down to a minimum $3600-3400 SPX.

Interest Rates Matter

You've heard the fear-mongering elsewhere on how the US financial system is fraught with leverage and debt, so no need to belabor the point here, but I do want to remind that I still much higher yields moving forward so this debt overhang actually matters to market returns:

There is $30.5+ trillion in national debt.

Total Public Debt/GDP ratio is 143+%.

Total (Public & Private) Debt/GDP ratio is 370%.

Rising and 'sticky' interest rates will make the interest payments on these debts unsustainable. Junk bonds are already pricing in 50% default.

Inflation is expected to print at/above 9% for the next CPI release in June and Fed Funds Rate forecasts a 3.25-3.5 percent fed funds rate by year-end. There is a massive amount of catching up the Fed should do given they have only risen to a range of 1.5-1.75 percent. Most analysts think they won't raise but cut rates given treasury liquidity concerns, economic growth slowdown, recession worries, unemployment rising and corporate earnings contraction.

I think the market will price yields higher as bonds continue to sell off on the back of very sticky inflation, oil shocks to come and geo-political conflict that continues to disrupt foreign currency markets (read: selling of US treasuries to access much-needed US dollars).

Higher US dollar is my baseline bet with lower euro and yen. Higher yields with lower equities is my baseline bet on spiking oil and gas from Eurozone energy crisis. Nothing has changed that macro view that has driven much of my THINGS OVER PAPER mantra since July 2020.

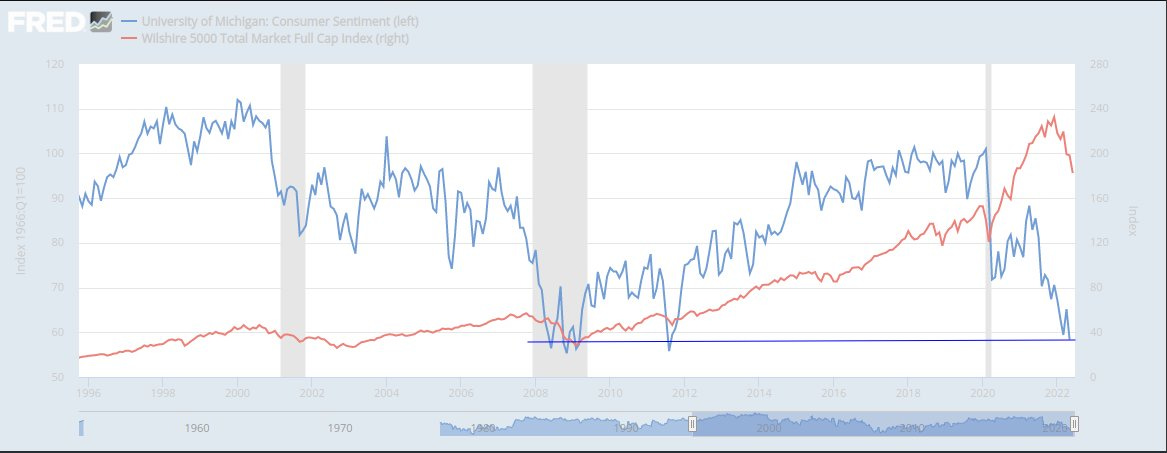

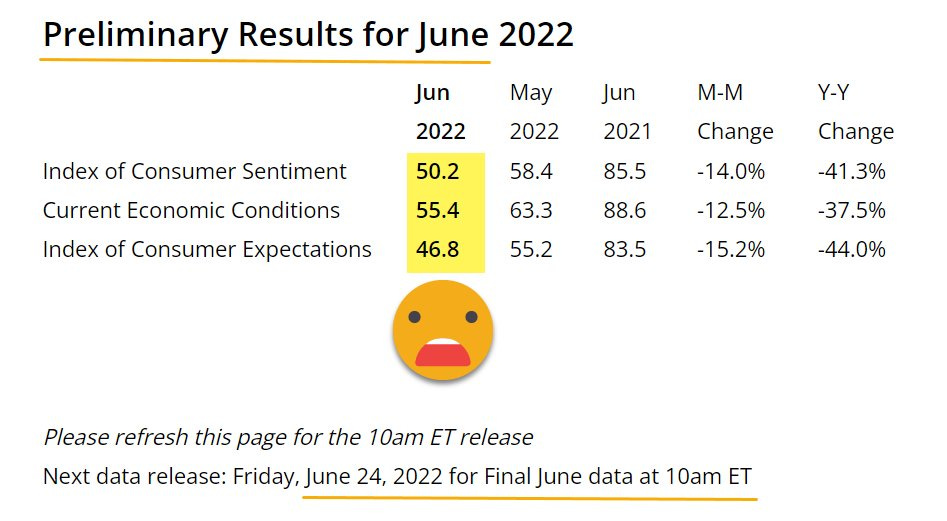

Even Wall Street analyst ratings at 20yr highs and consumer sentiment at all time lows (see University of Michigan charts below) hasn't changed my mind. Even as University of Michigan Consumer Sentiment is an early recession tell which often causes yields to fall. I contend: Recession + Inflation = Stagflation. We have experienced PEAK LIQUIDITY and PEAK VALUATIONS but I do not believe we have come close to PEAK INFLATION. We'll have some more data points next month:

Economic data releases of importance are after quarter end:

July 8: June Jobs Report (Fed wants higher unemployment rate)

July 13: June CPI Print (Fed does not want the expected 9% print)

July 15th: Q2 Earnings season kicks off (Fed wants demand destruction so EPS guidance will be tough)

July 27: FOMC Meeting (Fed is expected to hike another 75 bp)

July 28: Advanced Estimate GDP for Q2 '22 (Fed says no fear of growth slowdown but negative GDP growth is drawing closer)

In the meantime, optionality into End-of-quarter remains tight:As per SpotGamma:

Rallies into June OPEX should be categorized as “short covering” and subject to failure.

The $3600 JPM 6/30 short put strike (3620) is our major downside support into June 30th.

The $4285 JPM 6/30 long put strike is our major upside level into June 30th.

Having said that, big picture, Powell may talk of Fed's hope for an economic (and market) soft landing but is risking a hard one to reduce inflation running at the fastest rate for 40 years by raising rates rapidly. In order to position in the market safely, the question investors are asking themselves is whether this is a mid-cycle slowdown or a cycle-ending recession.

Central Banks and Wall Street may not want to tell us, but consumer sentiment and bond traders already have.