In Lieu of Sector Rotation There Will Be Volatility

Unwinds Are Forced Selling

Don’t look for news intraday that triggered algos to dump stocks. It was my warning for weeks that BUYERS HAD STEPPED AWAY and we had ENTERED AN AIR POCKET OF RISK.

Selloffs ALWAYS go like this: they start slowly then pick up speed.

It was time and well-timed.

I reminded clients live this morning:

That I posted a massive market, sector & stock review Wednesday for clients in that I expected NVDA earnings to beat, for IV crush to follow, and specifically VIX to get crushed post Wed VX expiry AND Nvidia earnings afterhours AND September jobs report Thursday premarket. All of that happened. We had the quintessential “Gap & Crap” this morning.

Then this morning I also said, “but nothing has changed“ from my post title: “Still Bearish - Even If Nvidia Doesn’t Disappoint”.

I called for the bounce to get sold and gave exact levels to short against - all live:

VIX 19.29

SPX 6764

QQQ 613

NVDA 195.62

“SPOT ON ABOUT THAT REVERSAL” Client Tim

By noon, the VIX reversal off that 19.29 level was already pushing into 27 - where it ‘topped’ soon after at 28.27.

Wednesday I has already given you my target in SPX for Friday:

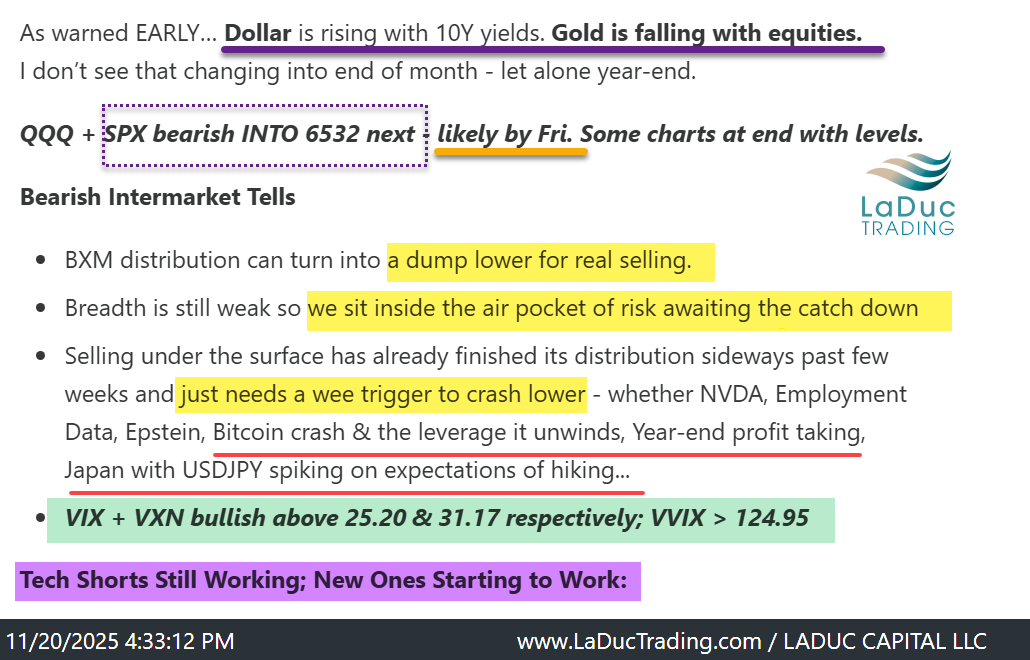

“QQQ + SPX bearish INTO 6532 next - likely by Fri.”

SPX hit 6534 today - an intraday reversal of 3.47%. QQQ dumped -4.57% intraday.

The DETAILED write up I did for you Wednesday gives you everything - from higher USD & USDJPY to “TAIL risk is still bid” to lots and lots of shorts including the MEMORY SECTOR DUMP of SNDK, MU, WDC, STX which was EPIC today.

As posted Wed:

Now, Despite the 350-point drop from its peak, SPX is still only down -6% and QQQ down -8%. I said after timing the first week of November drawdown that we were only “HALF WAY THERE”, so this 2nd drawdown (since Nov 12th) is a critical test.

Technically, the SPX is now on its 21W EMA, approaching its 100D, where it **should** chop sideways through Thanksgiving and into FOMC.

It’s important to note that we have not experienced a prolonged negative gamma environment, but we are getting closer.

And as I keep reminding, we haven’t even triggered the real big CTA or volatility-control selling.

All that is avoided, as I explained, as long as there was sector rotation - XLV of late for example, or CSCO, WMT, AAPL & GOOGL holding everything up.

But in lieu of sector rotation, there will be volatility. And volatility reprices EVERYTHING.

I warned: SENTIMENT HAS TURNED for a reason.

The market is smelling what I caught a whiff of early through the structural cracks that are no longer easy to ignore.

I write about these all the time in my market thoughts if you read them.

Same for my live trading room reviews, for PRO/FOUNDING members, like this epic short theme:

Nov 13th: “SNDK just needs to break 240 and the memory market will be at risk: MU, WDC, STX. Yup, that’s next.”

Nov 17th: “Another great case of overtrading a bubble - this one in memory. I’m expecting to hear a flushing sound soon.”

Nov 19th: “SNDK, MU, WDC, STX - called this parabola last week - it’s done going up - just needs 240 SNDK to give sway and all will fall hard.”

For PRO members, have a look at your charts and the sectors and stocks I highlighted Wednesday for a review: some have reached their target and some others still have room to go. It’s a dance. And right now, investors are dancing right out the door.

To become a member and GET THE TRADE BEFORE IT HAPPENS: