Hurry Up And Wait

I opened the trading room this morning saying I didn't expect much movement today as we have 'a ton of SPX 4000 calls and SPX 4350 puts decaying' which will help to pin price until we get a trigger to move above/below respectively. Until then, NVDA chase long continued above my $465 price target and IWM chase short to $170 overshot as well.

Oh yeah, and JETS had some strength, but that isn't really what I would call a strong sector to bet on - any more than a bounce at wkly 127.5 Fib support I discussed last week in light of my rec'd oil short. There are some very nice wkly breakouts in former swing longs: ADBE, ROST, UBER. But I'm not excited about adding new positions when I'm expecting a pullback to digest last week's big move.

I will note that lots are focusing on oil crashing. Yes, I likely closed my XLE swing short early, as oil/diesel/nat gas continues to fall with gold and copper. At some point the growth rotation will turn south and energy will likely get supported. For now, no new trends long or swings of high conviction as market feels like it's tired.

There was no real apparent selling in indices as VIX closed red 8 days in a row with SPX up 8 days in a row and QQQ up a historic 9 days in a row!! Something's gotta give and my bet is that it is not higher before a pullback to potentially $4250 area.

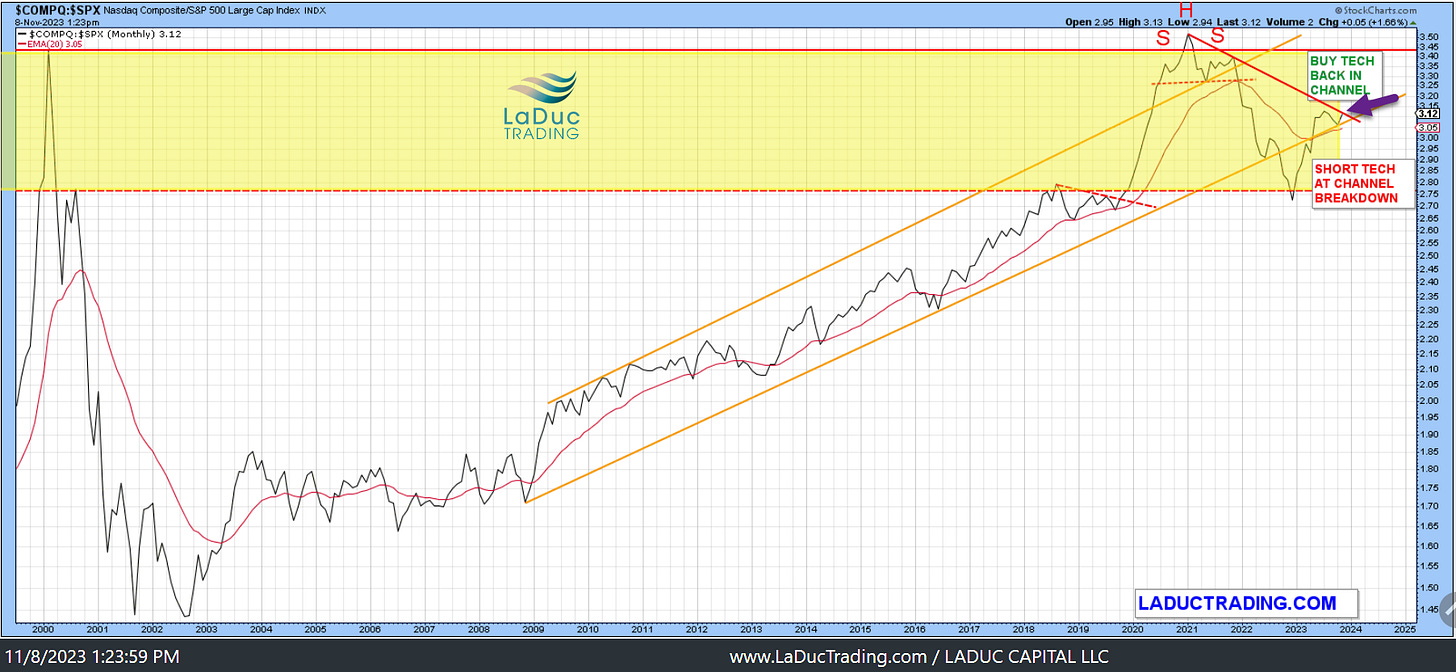

Under the surface, I did spy some strong net selling in NYSE and continued strength in MAG7 - to the point we are now at monthly trendline resistance in my COMPQ:SPX chart below. Again, Something's Gotta Give!!

Gamma Game

We flipped into Positive Gamma with CTA buying grinding realized volatility to a halt.For those quant-inclined, you have noticed that:

“realized vol is coming down which is driving systematics to bid like it’s 1999.” @jaredhstocks

Fundamental focused investors/analysts think it’s earnings. Macro remind it's about Treasury issuance and Yellen kicked the can on the heels of Fed punting (pausing).

Technicians are just excited what matters is above the 50D! And Sentiment folks credit ‘seasonality’ as reason for the buying.

In a nutshell, we are still in the window of "Flows over Everything Else" until we get a trigger for doubt.

Most are waiting on CTAs to force-buy, or Treasury auctions to conclude, so all eyes can focus on CPI next week.

Thinking out loud before CPI next week

Since continued disinflation remains a critical pillar of this rally, markets want to see flat Core CPI and PCE, and preferably, a greater-than-expected decline.

That's how bulls keep hopes alive for the "Immaculate Disinflation" of falling inflation against steady economic growth.Short-term picture: I expect the numbers are stronger than expected.

Big picture: Inflation is entrenched and above trend:

https://twitter.com/SamanthaLaDuc/status/1679604297485434880?s=20

Recession And Stagflation Debate

Given sticky prices and unemployment starting to tick higher, it wouldn't surprise if recession risk gets pulled forward by end-of-year and into Q1.

Even looking at NFP for September, we saw ALL the job gains in September came from the US government.

Otherwise we would have missed big as private/non-government jobs fell by 400,000!

So a worrying trend and one that bears watching for next NFP print December 8th.

For now, Craig sums up the Fed reaction function and the stagflation risk to risk assets succinctly:

Oil market rapidly transitioning to being concerned about global growth momentum deteriorating. The issue for markets is that the labor market remains too firm and wages too strong such that core services inflation stays too high for too long, preventing the Fed from reacting to any growth deceleration. The Fed will be late to ease policy and the impact of eventual rate cuts will take longer to actually improve conditions. Stagflation environments are real tough for risk assets.

Maybe this is a 'tomorrow problem', but our jobs are to at least consider it today.In the same way, the recent QRA announcement is fraught with risk.

Craig again:

The Treasury needs to compete with the RRP for capital. It needs to keep selling t-bills at greater than 5.3% in order to incentivize demand to move. If yields on t-bills fall below the RRP rate, it will be harder to get the money to move and in fact, we could actually see more funds go into the RRP again (higher yielding, especially into year end) and that would mean that net liquidity falls because the incremental supply of T-bills would then have to be met by bank reserves falling.

Liquidity matters to market returns and long-term yields dictate the quantity and quality of that liquidity.

Craig and I will unpack this more tomorrow in our Macro-to-Micro Power Hour after the close:

Is Santa Claus Coming to Town Early This Year?

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!