Higher Wages Matter To The Fed

Update to: Biggest Ape Fight Of Them All (6/5/2022)

For the first time in decades, the central bank is more concerned with inflation than growth.

Inflation of what, though? I contend it's more than the price of gasoline at the pump right before mid-term elections. My focus since last year is that the bigger inflation enemy of bonds are higher wages. As as long as higher wage demands persist, so too will weakness in stocks and bonds as Fed tightens.

Latest Job Openings and Labor Turnover Survey (JOLTS) last week showed job openings peaked in March, the same month the Federal Reserve began raising near-term rates. Not a coincidence.

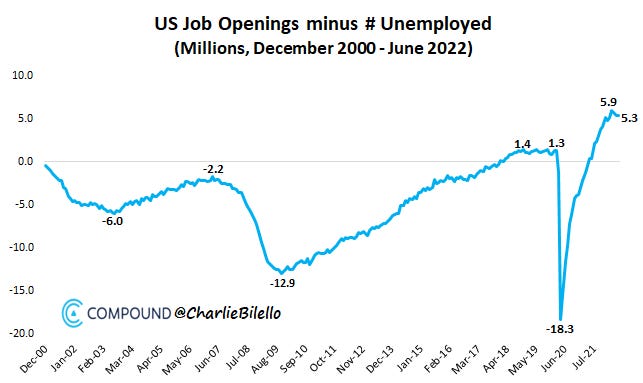

Despite the sharp decline in job openings this past April/May, openings would need to fall by 4.2 million to get back to their February 2020 pre-pandemic level. (see chart of US Job Openings minus Number of Unemployed). As long as this imbalance stays above pre-pandemic levels (1.1 mn more openings than unemployed on average from 2018-early 2020), Fed will stay hawkish.

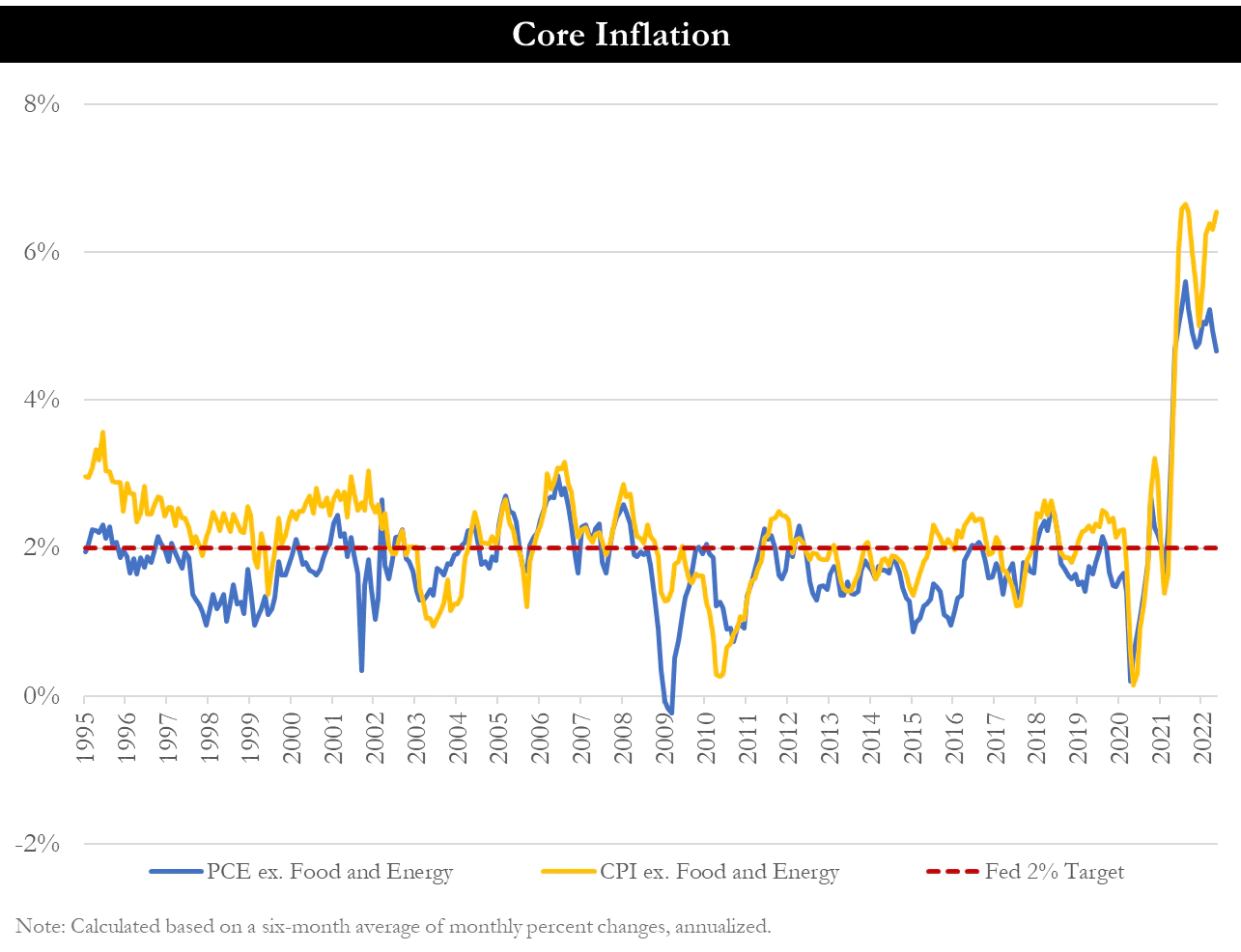

Both PCE and CPI measure the rising prices for everyday domestic goods and services excluding energy and food. Why? Because Fed can't control war, deglobalization, weather, energy policies and the like. So what makes up the largest component of rising prices? The labor market of course. In fact, it's the strongest since 1970s before run-away inflation.

So this is the irony: Finally, wages are moving higher and the Fed is on an aggressive path to stop them. So why would they pivot, or better question: when? After their 'restrictive policies' have slowed the economy enough to slow/stop higher wage demands that result in WAGE INFLATION. So as asset prices decline, the economy will suffer, but until wage inflation peaks, it is not wise to fight the Fed that is willing to sacrifice growth for lower wages.

Now we have that regime in reverse:

When inflation is low, juicing asset prices promotes growth. When inflation is high, crushing asset prices reduces demand.

In the current high-inflation environment, falling asset prices means the Fed is doing its job. Don’t fight the Fed.

@TheLastBearStanding

So far the market's reaction is to remain caution equities as it expects Fed to be incrementally more hawkish, but to also interpret the strong labor market as reason to stave off an imminent recession. But with the stock market representing the economy, I'm not sure this will be as successful as Fed or market bulls expect.

Ultimately, I am expecting 1970s style rolling-peaks of inflation with rolling-bottoms in equity markets, because ultimately, we are experiencing 1970s style of inflation and energy crisis, but without the rising demographic trend or economic growth and low debt backdrop to buffer the blows of a Fed tightening regime into falling asset prices.

The bottom line; Chair Powell and every Fed head before him deployed monetary policy that benefited the asset rich. The trickle-down benefits for the less wealthy were a side-effect not the goal. Now with the Fed tightening - and telegraphing their repeated mandate that their goal is to bring inflation back down FROM near 9% to 2% (see chart of just how far that fall needs to be) - falling asset prices are the side-effect of the asset rich as the Fed attacks the higher wages Americans are fighting to receive after nearly 5 decades of Fed-led income inequality.