Healthy Payrolls Push Fed Rate Cuts Out, For Now

BREAKING: US economy adds 216,000 jobs in December, above expectations of 170,000. The unemployment rate fell to 3.7%, below expectations of 3.8%.

Clients know my price targets from Tuesday's live trading room.

SPX 4707 IS SUPPORT UNTIL IT ISN'T

QQQ at 400 PT, but I still expect expect to see 394 with SPY 465, SPX 4655.

Also, my 5 bar rule is no in effect (5 red bars).

This is likely where puts get monetized and we bounce next week.

Unless we break/stay below 4650 - then it will pick up speed and could get volatile.

»»»VIX 14.49 DAILY CLOSE MATTERS.

Traders of short-term interest-rate futures reduce bets on fed rate cut in March, after jobs data, to 50% vs 65%.

This repricing in equities lower is a reflection of a Q1 rate cut hope being abandoned, deferred tax selling of 2023 winners into start of this new year, and of course the solid bounce in yields and dollar - all of which Craig and I have been forecasting strongly. Even my macro levels are are working.

My Macro price targets from last week:

US 10Y yields MOVE violently intraday next few weeks into 4.1/4.2% before getting rejected, and reversing lower.

DXY bounces off $100 into $104/105 before getting rejected, and reversing lower.

USDJPY moves into 145/146 before getting rejected, and reversing lower.

Selling has been orderly. Will that change?

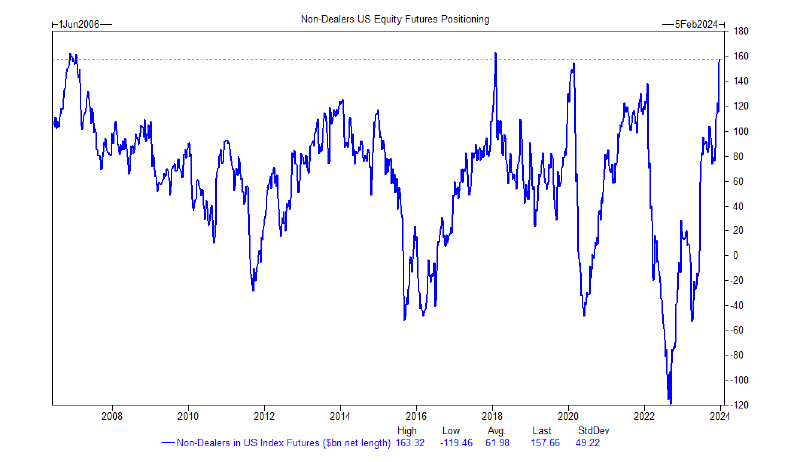

CTAs are price-insensitive, and at risk of selling aggressively the large bullish positioning they hold, but this pullback does not smell of the 'big unwind' to me, (yet).

That $4600 I speak about often is still a solid area of support. Take that out definitively, and then we'll talk.

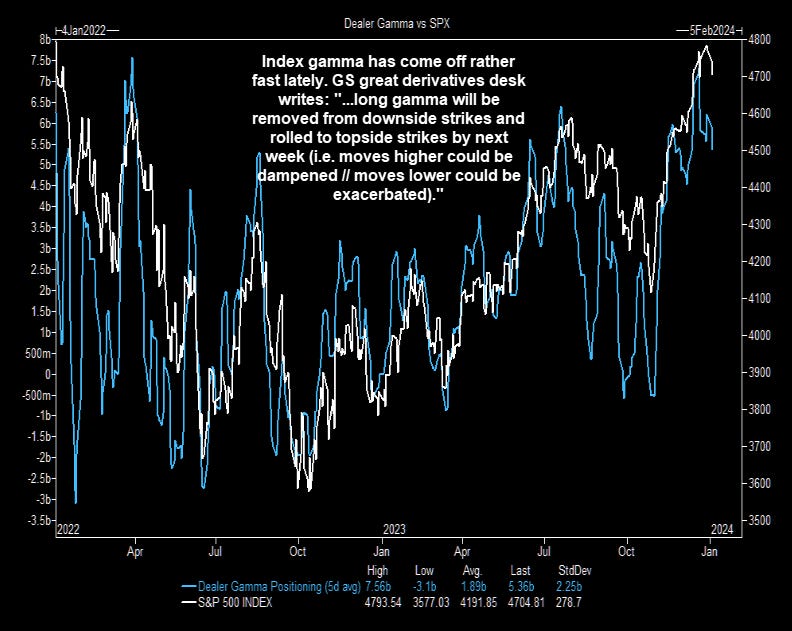

Recall: In a negative gamma environment dealers are forced to delta-hedge their portfolio by selling weakness and buying strength, which means directional moves become reflexive/get amplified.

In a worst-case scenario a sudden drop could push the market to 4,600, where we can identify the so-called 'Put Wall', a large concentration of put open interest, which translates in ever-larger gamma strike the closer we approach that level.

Put walls often act as 'trampolines': As the dealers are sufficiently hedged, volatility calms down, strike-level gamma decreases, and market actors start to buy back futures, which can often result in a forceful bounce. GammaLab

Key Levels to Watch, per GS:

Short Term 4618

Medium Term 4481

Long Term 4420

"Medium & Long Term Thresholds are more important for when the pendulum here really swings to big sales from this community."

Index gamma has come off rather fast lately. GS great derivatives desk writes:

"...long gamma will be removed from downside strikes and rolled to topside strikes by next week

i.e. moves higher could be dampened // moves lower could be exacerbated."

And for that reason, $4600 matters and Dealer gamma positioning bears watching.

Opening up my live trading room NOW!