Growth-To-Value In Full View

As shown in my live trading room daily, and warned here last week, my growth-to-value indicator triggered (updated chart below). We had outsized performance in IWM, IWN, IWC last week with follow-through today. The SPX closed lower with Nasdaq as investors were rotating out of the mega-cap growth complex (-1.1%) into small-caps (RUT +1.7%%).

My fave quant analyst, Charlie McElligott of Nomura, confirms: funds are monetizing winners as year-end liquidity is drying up.

But until then... net liquidity is the highest it's been since April 2022, and we are still in a long-gamma regime in SPX, but with little concentration in strikes above $4600 and few below $4500. A big move either way will be eventful.Goldman's Scott Rubner updates the quant run:

1, bought +$225bn in the last 1-month and are long $92bn of global equities - the biggest increase in exposure ever.

2. $58bn to buy in big up tape, $210 bn to sell in big down tape

Sectors Performing

This abundance of liquidity has been helping Bitcoin, a great liquidity tell, to rise up to 20-month highs at $42K monthly resistance just as GLD also hit monthly resistance at 192 before reversing violently. Is BTC next? It's already up 150% YTD.

As the US dollar and 10Y yields have fallen for three straight weeks, small caps finally played the game of 'catch me if you can' once MAG7 stopped going up last week.

With the USD bouncing off $103 support, does this end their streak? Not if market continues to bet on Fed soon (Q1) cutting interest rates.Last Monday's open >$178 I said was bullish IWM - it just needed to gather up the energy to jump the shark at the 200D ($180). If/Then to 185.44 then 188.

That escalated quickly! And that's part of the hedge fund factor rotation I warned about last week - when small caps get squeezed on hedge fund shorts covering at same time VIP stocks get sold. It's the classic growth-to-value rotation squeezing shorts. And today, IWM was up another 1.7% on rising breadth and net buying with IWN, IWC outperforming - as highlighted!

In particular, retailers, consumer staples, healthcare, and REITs outperformed today, and we saw clear weakness in mega cap tech plays which we are still chasing short:

See #chase-ideas for levels in AAPL, AMZN, GOOGL, META, MSFT, NVDA, NFLX.

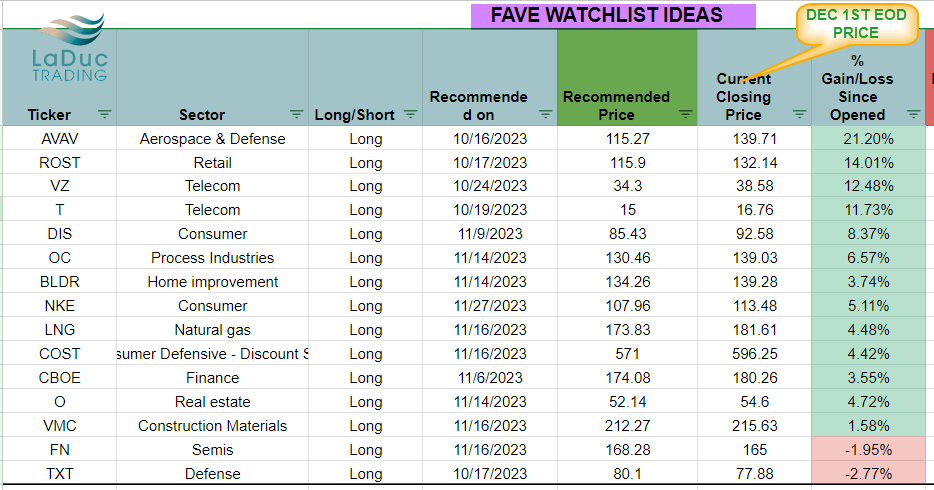

Our very productive/profitable #swing-ideas long are still working but should now be protected!

Our month-long play in JETS took off higher on news of M&A deal with ALK buying HA.

But even my #swing-ideas Watchlists of Mid-Cap-Tech and Faves since Nov 17th (posted below) had been hot-fire-flames into today.

We've tracked these names for clients every day in my live trading room. If still long, please take care.

As @Tiff posted earlier in Swing channel, with an update on all OPEN LONG POSITIONS, it is NOW time to tighten stops and PROTECT, as I expect volatility soon - potentially of size.

Finally, our #trend-ideas long Uranium positions moved higher helped by COP 28 headlines as several countries (16) have officially pledged to TRIPLE nuclear energy by 2050, including the U.S., Canada, Japan, France, and the UK.

In a nutshell, SPY needs to break 454; SPX 4541; QQQ 386.50 for weakness to pick up and with it volatility.

The intraday chart of QQQ (below) has worked well to make sure it stays below $392 as recommended last week.

Macro Musings

Joseph Wang, The Fed Guy, with a bullish view:

The coming months are looking to be very positive for equity markets as rate cuts are expected to occur in the context of significant deficit spending. In the modern financial system, Treasuries are money like assets so deficit spending is comparable to a form of money printing. As interest rates decline, Treasuries become less attractive and investors tend to rebalance into riskier assets.

Mike Wilson of Morgan Stanleu with a bearish one:

With 130bps of cuts now priced into the Fed Funds futures market through year end 2024, investors have set a high bar for cuts to be delivered. The cycle peak in front-end rates is typically a bullish signpost for equities assuming that inflation is contained. On the other hand, if inflation proves to be sticky despite slowing growth, the Fed typically maintains restrictive policy later into the cycle, only cutting rates when the growth backdrop deteriorates significantly.

Craig of #macro-advisor-craig was spot-on with his note and position past few months:

gold and bitcoin remain better expressions of duration in my view than bonds

Today, he reminds us of upcoming economic data that can be market-moving:

rates up, dollar up to start the week as we start to unwind some of the crazy moves seen last week that have taken rate cut odds for March above 75%quiet macro day today but lots of data coming this week, starting tomorrow with ISM services and JOLTS and then the rest of the week has labor data ending with Friday's NFP and Umich inflation expectationsthere is some talk about funding stress for year end developing again this morning. SOFR fixing at 5.39% was up materially from last close. Uncertain what is going on here but have to keep an eye on

Markets await key jobs data this week with the October JOLTs job openings tomorrow, private payrolls ADP on Wednesday and nonfarm payrolls on Friday.

REMINDER: Samantha LaDuc and Craig Shapiro will host their live, monthly ASK US ANYTHING Macro-to-Micro Power Hour WEDNESDAY at 4.00PM ET.

Is it beginning to look a lot like Christmas?

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!