Gold, Copper & Silver selling of late brought to you by...

CLUB/EDGE client post. Focus on precious & industrial metal selling.

» CLUB/EDGE client post Friday June 7th, 5:20 PM.

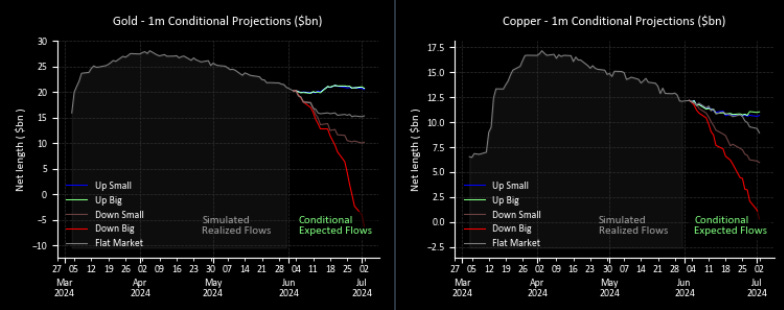

1. CTAs - it was time; selling was projected.

2. USD - especially after the spike higher in dollar but also yields today on labor market resilience and Fed rate cuts getting priced out.

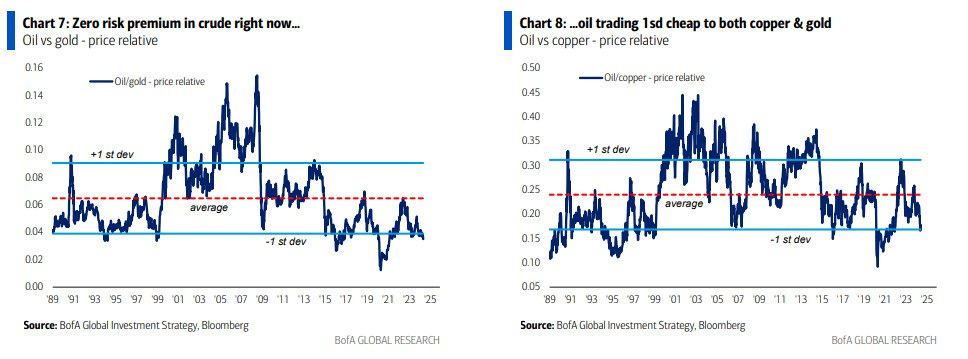

3. Oil - commodities travel together, sometimes with a lag. We had a big sell-off Monday in oil, and Copper has been reversing out of its parabola for weeks.

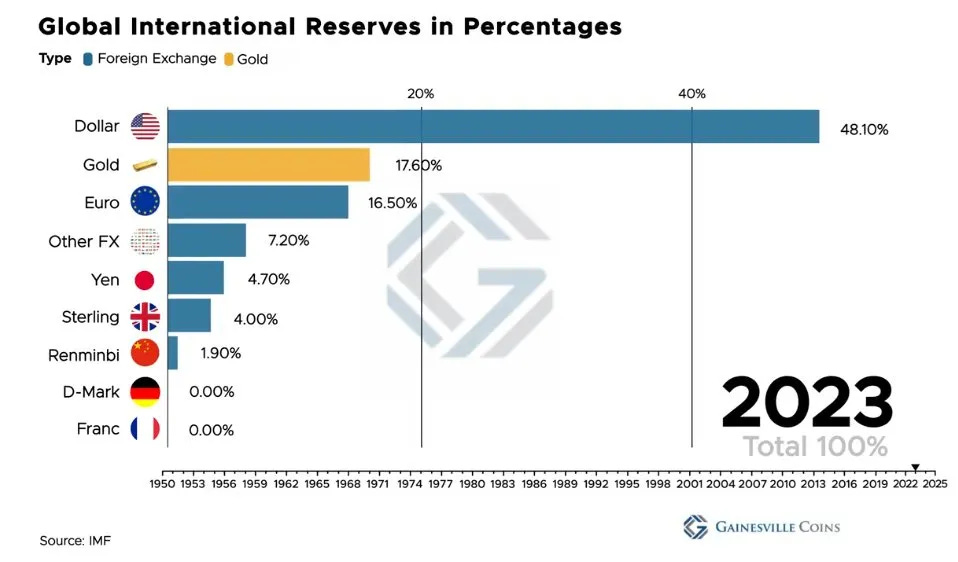

4. Bonds - we had run up a solid wk before NFP today. Can't rule out possibility that just as Central Banks have dumped treasuries for gold, they can do the reverse.

5. Global Central Banks - several countries this week reported selling gold of late, and in the case of China: they stopped buying after 18 months of solid accumulation.

My warning to clients on precious & industrial metals selling off:

#LiveTradingRoomReviews

Wed AM May 22nd posted to clients:

"I warned STRONGLY to protect gold, silver, metal and mining longs. I voiced that not only was protection a good idea but gave levels for a pullback in gold & silver that could surprise. Similar to the time I warned when SLV hit 27.17 April 12th and we pulled back to daily gap fill at 23.90. This pullback is a great chase back down to 27.17 monthly support on break of 28.84. After I spoke all of the above, the level busted. Continuous contract in gold was also a great short, working its way down to that trendline ~2230."

Fri AM June 7th posted for clients:

"Gold looks at risk of falling further as US economy shows resilience and Russia/BRICs move away from USD + settle more trade locally. Also news of China stopped buying after 18 month run."

Gold and Silver just had their worst days since June 2021.

I also told clients this morning;

"But with soft commodities bid and my 10Y 4.2% PT still my baseline bet, I suspect this bond trounce will get reversed after FOMC. And gold/silver will do fine big picture."

Next Week Highlights:

AAPL conference WWDC

AVGO, ADBE, ORCL earnings

CPI + FOMC Wednesday

BOJ Friday

and... a new CONTRIBUTOR ANNOUNCEMENT NEXT WEEK ;-)))