Gold & Silver Update - The Macro

Is an Equity Correction Coming? With focus on Gold & Bonds; FX & Treasury Intervention

(CLUB/EDGE client post April 5th, Friday 3:45 ET)

Remember Wednesday when I wrote I expected a -2% SPX drawdown soon?

We got it next day. Lucky or Good?

There is Macro. There is Technical. I follow it all: Quants, Options Flow, Sentiment, Fundamental & Intermarket. Sometimes it comes down to A TRADER'S GUT.

Here is what mine is saying about this precious metals rally that has gone parabolic.

First, the good news:

We gotcha positioned for this rally in advance AND helped you stay for the big weekly silver squeeze: up 10% IN ONE WEEK.

Now, it's time to realize the bad news.

Equities, Bonds, Dollar... Big picture, these are in trouble. Gold is our Tell.

Given obsession on Fed rate cuts & Inflation, it's pretty easy to see that rising commodity prices - soft and hard, precious & industrial - will force higher inflation & inflation expectations.

This is on top of a strong labor market & renewed manufacturing health & entrenched inflation & war & never-ending fiscal spending &&& ...

But it is the spiking higher gold with oil that will force Fed to pivot - removing all those cuts the market has priced in.

We already have a good clue what that means for equities, but have you considered what it means for gold + silver?

Gold loves loose monetary policy, so Powell coming out and directly talking tighter monetary policy and removing cuts ** should ** slow this rally in precious metals down.

Rest of world will stop cutting when Fed pivots.

Gold is also rising on all the reasons Craig, Geoffrey and I have highlighted past few weeks, which has culminated in this historic breakout on the eve of yet another war in the Middle East: FX devaluations - everywhere!

Geoffrey is spot-on:

"the "rule" of FX as reserves has been SUSPENDED. Meaning FX USD in trade surplus will be systematically AND Continuously DUMPED into the Gold market, until a less aggressive administration is chosen."

But spiking higher gold with oil is something Fed/Treasury/White House will want to stop.

I am now expecting a coordinated effort from our Central Bank to spike the USD and dump 10Y yields.

I know this is a sudden call, but I'm actually bullish bonds here/soon - TLT.

I am expecting gold + silver to come in - maybe quickly next few weeks.

BIG PICTURE I AM STILL VERY BULLISH PRECIOUS METALS

But I think it is time to expect intervention.

That's what my gut is telling me anyway.

________________________________________________

(CLUB/EDGE client post April 6th, Saturday 2:18 ET)

Is It Time For US Treasury & Currency Intervention?

I posted my market thoughts yesterday that I am looking for a possible Fed/Treasury intervention - where the USD gets supported with bonds.

Then last night we learned:

US OFFICIAL: US ACTIVELY PREPARING FOR POSSIBLE SIGNIFICANT ATTACK BY IRAN IN RESPONSE TO ISRAELI STRIKE IN DAMASCUS

That works too - sort of.

Mostly, it puts a strong bid in gold.

Now Gold is rising strongly for lots of macro reasons - debasement of the US dollar chief among them. War escalation is another.

But longer-duration bonds are not getting bid. And equities are growing more uncertain.

Is an Equity Correction Coming?

Another way of looking at the weakness in indices can be attributed to plain-old profit-taking after a stellar Q1!

Or maybe folks lighten up ahead of earnings season to avoid potential disappointment.

Again, many have made their entire year in just the 1st 3 months of 2024. Why risk it?

If the market is a forward-looking discounting machine, then this market could definitely be viewed "as good as it gets", especially given strong labor data out Friday, coupled with a strong GDP, and still-expected rate cuts coming this year.

With CPI data due out Wednesday, this latter thesis will get tested. And with that, Fed cuts likely continue to get pushed back and priced out.

Regardless of the reason, corrections and trend breaks often start out this way: momentum wanes and then selling picks up as Sharks Drown When Not Swimming.

So now we are on the lookout for any additional news that raises doubts on the goldilocks path that bulls expect:

Will this data point or that be interpreted as weakness in banks or the consumer or the economy at large.

Will this data point or that be interpreted as inflation is worsening and rate cuts might be postponed at best, cancelled at worst.

Will we get a macro trigger to upset the bullish trifecta of option flows (as discussed in my Crashing UP Market) note.

Looking At Bonds For A Tell

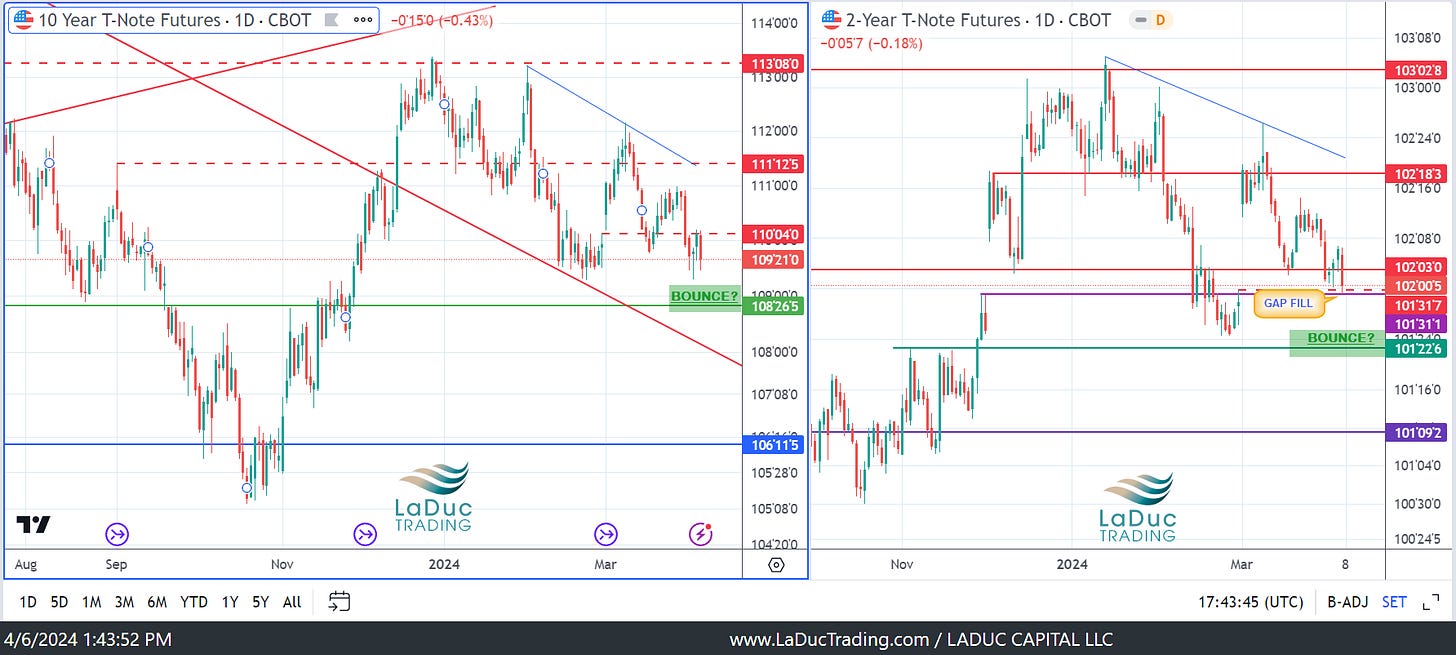

An astute client pointed out that the 2Y T-bond futures filled that daily gap fill I've been waiting for - late Friday, on the dot.

I was really convinced we would get that tag in the same way I am convinced, in time, the 2Y10Y yield curve will deeply invert to fill the -.58% daily gap fill.

But in the meantime, that instrument is firmly neutral, and needs a push one way or the other. We've got time.

For now, bonds continue to act fragile. Most expect we will have to wait until Yellen's Quarterly Refunding Announcement April 30th - or FOMC May 1st at the latest. I wonder if they can wait that long.

Given I am a Big Picture Bond Bear, some will ask why I expect lower yields?

Given I am a Big Picture Inflationista, you might also wonder what's up with my 'bond bounce view'.

I mean, why would yields fall against a backdrop of sticky, entrenched, re-accelerating, potentially un-anchoring inflation??

Because gold is rising, and USD is weakening relative to hard assets as countries far and near devalue their currency and slowly disentangle their trade balance and reserves away from USD.

So What's The Trade?

This is complex! Some patience please.

This is more than "oh, bonds are rising so stocks should fall." As we have seen past few years, both stocks and bonds can travel together. They are no longer an assumed inverse pair trade or risk parity play.

This is more than "oh, yields are falling so stocks should rise." As we have seen past few years, we get to a point where stocks rallying on bad news (Fed cutting expectations) can very much become unwound - much like a 'buy the rumor sell the news' event.

This is more than "oh, bonds are rising because they offer a risk-free yield-generating alternative to cash, equities, hard assets.” As we have seen past few months, gold yields nothing and yet it is getting bought aggressively by central banks to circumvent the USD.

And this is more than "oh, yields are falling on expected banking and economic weakness expected 6 months out." As we have seen past few years, and especially in an election year, markets will expect the invisible hand of INTERVENTION before cliff-diving.

So that brings me back to why I am pivoting from USD Watch to Gold Watch to Silver Watch to now Bond Watch.

My Early Read

I am not bullish indices - as I suspect we have some more gyrations into earnings kick off April 12th.

Even then, indices typically don’t break out or break down during earnings - unless there’s reason to (like a NVDA disappointment May 22nd).

Staying very selective and even defensive makes sense to me.

So right now, I have no great edge to start Q2 - as both bonds and indices are chopping sideways.

Even my 2Y10Y yield curve is in a clear wedge of indecision.

And yes, I can see early signs of continued weak indices with firmer bonds on softer yields for Q2.

Really on watch is my weekly chart of the 3M yield. It's going to have a big move - but which direction? Lol

I'm betting more toward breakdown, which would also cause the 10Y yield to follow suit.

Then we would get a strong bounce in bonds. But this looks a “few weeks” or more away.

For now, let’s see if bonds start to sniff it out by getting back into that TLT wedge I keep highlighting in my trading room.

If playing a break out of that wedge - in either direction - do add some time. Again, QRA & FOMC are ~ one month away.

Gold Bullish With Bonds

Given my call for the dramatic advance in gold since March 1st, I imagine owners of stocks and bonds are both watching gold to determine if they should worry or not.

My bet: they start to worry harder if big funds start to rotate into gold.

We already have the rotation underway in both soft & hard commodities, precious & industrial metals. But gold is the most 'macro' of them all.

To date, most of the physical buying is from central banks that aren’t chasing gold for its yield (it has none).

These countries are using gold as a neutral FX reserve currency - it's a bet on US de-dollarization.

And this train is firmly in motion and has many many MANY miles to go.

And because of all of the above, at some point, I firmly believe the Fed/Treasury will need to support the bond market, again, and that’s what I am on the lookout for most of all.

Stanley Drukenmiller Thinks Yields Fall As Gold Rises

Investing legend Stanley Druckenmiller has recently been buying large cap gold miners Barrick Gold (GOLD) and Newmont Mining (NEM).

Here's why (summary courtesy of @SpecialSituationNews):

Gold serves as a store of value over the long run.

Gold is a hedge against any devaluation of the US Dollar, high deficits, and high Federal debt levels.

Gold prices should go up in a scenario of lower interest rates, higher inflation rates or a combination of both.

His outlook for 2024 is that central banks in autocratic countries like China and Russia will likely continue buying gold. Meanwhile, interest rates are likely to come down.

Also, both Presidential candidates are not good for our fiscal stability. Donald Trump will likely move towards extending tax cuts, deficit spending, and perhaps easier monetary policy if he becomes President in November 2024.

Investors can get exposure to gold through gold bullion, ETFs, futures and gold miners.

Gold miners have underperformed the gold price historically, probably because it’s a commodity industry with management teams trying to gain at the expense of minority shareholders.

May 2023: “We own gold and silver right now. They historically have not done well in hard landings, but given that monetary and the fiscal authorities are kind of at the end of their rope. And given the fact that other countries have decided particularly autocracies not to hold their reserves in dollars, I'm betting for the time being against the history of the performance of gold in hard landings.”

October 2023: “We’ve gone from US$800 million in the Fed balance sheet to US$9 trillion, and if Donald Trump’s elected, trust me, it’s going to up a lot more in the next term… Trump is a big spender. He doesn’t believe in the Federal Reserve. And we go back to the Arthur Burns model times two. We have fiscal recklessness without abandon, just like he runs his business. And on top of that, he puts a puppet in the Federal Reserve. Under that model, you have to be open-minded to 8-10% inflation rate take-off like it did in the 1970s”

Ok, so now you know how Stan feels about gold, interest rates, and the economy & markets under a Trump presidency.

And you know that I believe the current administration - Fed/Treasury/White House - will do whatever it takes to make sure that doesn't happen.

Hence: FX & BOND INTERVENTION are my bet over Q2 + Q3.

After that, at some point later in Q4, I believe longer duration bonds will be a big short again.

But before an election? I don’t think so.