Going Nowhere Fast - Must Be OpEx

Today is OpEx, and OPEX is notorious for chop and pinning.

Even if SPX is caught in a 12pt range, there are plenty of other stocks/sectors to chase and position.

We had solid follow-through from recently added Swing Long ISRG right into 1st price target $306 from $285. This is a play symbolic of a lot of stocks showing continuation from bounces or breakouts.

Others I have stalked on watchlist/rec'd past month as Swing or Trend longs, un-related to the massive bounce we've had past 3 weeks in NDX and SPX but surely helped, were reviewed in depth this morning live:

GD, AVAV; OC, BLDR, VMC; FN; CBOE; LPG; SNPS, CDNS, PLTR; DKNG, MELI, DDOG, UBER; ZS, CRWD, MDB; CRPT, AVGO, KLAC, QCOM, INTC; WSM, ROST.

CLUB and EDGE members can find them in the Zoom recording from this morning posted under Live Trading Room page "Archive".

Retail had a strong push this morning with GPS +32% having its best session 26 yrs! Fave ROST along with BKE, AEO, VSCO, GES, BURL and freak-of-nature ANF continued to rally all morning and many look good for follow-through. Sell the rumor of consumer spending slow-down, buy the news?

Another sector of strength: the ARK Genomics/XBI Crispr trades of CRSP and EDIT. Congrats and thanks to Tim and Alexander for keeping us up to date on the FDA review and their trades in these plays past month.

Oil Flows

Crude, XLE and Energy plays are having a strong bounce, helped by Biden admin threatening to revoke the recently-awarded licenses to Venezuela if Maduro doesn't offer up fairer elections - by end of November. LOL. It's all part of the intervention collar! They giveth and they taketh away when it suits them. Also, remember my warning this morning: EVERY FRIDAY following Thanksgiving in a thinly-traded market, there has been a strong move in oil - one way or the other. I can't help but wonder if this move will be an outsized bounce, even if just for a day.

Again, that might time with a wee bounce in US dollar and yields, helping to make bulls take a break. (The 20Y Treasury auction Monday might also help.)Big picture, I will always heed bob's warning when it comes to oil since he is the physical oil trader on the desk, and he just sent follow up chart and analysis in #bobs-oil-and-gas which helped us navigate that WTIC/XLE short nicely past few weeks:

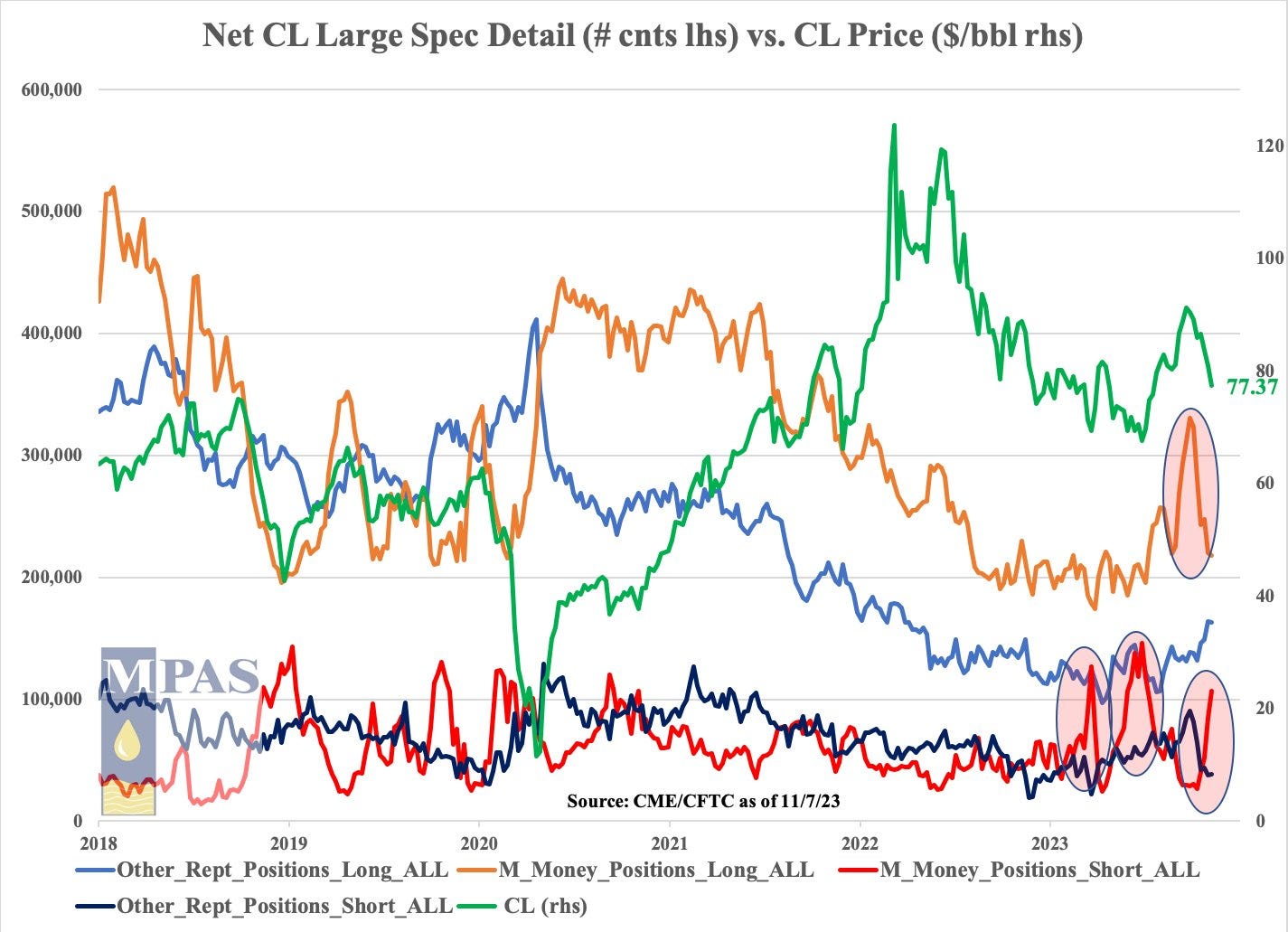

NO FLOW NO GO!

CL has a "liquidity problem", losing -566k contracts or -26% in open interest since the start of the RU/UKR war, along the way we have had 3 separate short attacks by money managers and one good bout of organic buying that pushed prices to $95/bbl, the top of our INTERVENTION COLLAR, absent these select events the market is left to "fall on itself" as it can't maintain higher price levels without new flows.

Liquidity, demand and INTERVENTION remain the framework to navigate pricing in the current environment.

So next up: looking for oil speculator flow Friday ;-)!

Macro Event Risks

Craig posted in #macro-advisor-craig his take on upcoming macro data as well as option flow "window of weakness" we have now entered during the 3.5 day holiday week:

Expiry today. A good chunk of exposure in SPX comes off at the open but SPY and single stock is at the close. Next week, markets can trade a bit truer and will have to come to grips with the reality that yes, the economy is slowing and yes, inflation is stalling but neither are really slowing rapidly enough for the Fed to provide as much accommodation as the market is expecting for next year (4 cuts priced in).Given some of the late reporters (WMT HD CSCO PANW) started to talk about more sluggishness in recent weeks/October, there is going to be growing doubt about earnings growth trajectory into year end and this idea that bad news is good news for equities is going to be called into question.Next week is important as we have a 20 year auction which will be closely watched on Monday after the big rally in bonds over last 2 weeks and the basically failed auction we had on 30 year auction last week. I wouldn't expect gangbuster demand for this issue which could pressure the long end again.We also get Fed minutes, Umich survey on inflation expectations and a flash PMI so we will have more data on how the Fed is thinking about the hiking agenda into year end and whether they seek to push back against some of this market pricing since the last meeting. Most of the Fed speak this week was still not fully convinced that inflation is return to 2% and would like more time to assess but the more financial conditions loosen, the more likely they are going to speak more hawkishly to prevent inflation expectations from re-accelerating.I think we are going to see softer equity markets in the coming days as we digest the big moves for November and struggle to push yields much lower than we have already seen. However, the flows will start to become important again as we turn into December given YE dynamics around quarterly opex, YE opex and January opex for single stock calls/Leaps. Broadly speaking, I would continue to expect Mag 7 to outperform into year end and think shorts in small caps, cyclicals and Europe should still work on growth deceleration without Fed response. but I think the bigger opportunity to get negative on slowing growth and a Fed on hold will be come middle January after the seasonal dynamics are behind us and the market comes to grips with the reality of policy that is too tight while earnings disappointments are taking over.

Outrageous Prediction 2024:

Falling US dollar - the only reason to be long stocks - and the US 10Y to pull back to 4.3 maybe overshoot to 4.1% then shoot higher to 6.5% by end of 2024.I am pretty sure no one is talking about a BIG USD surprise AND a BIG spike in yields.But here is another one I that looks bullish but is actually bearish:Tech Concentration Risk is now starting to look a lot like the run-up in 1999. The big difference is the BIG MONEY is even bigger now (Blackrock, Vanguard, et al) and chasing tech stocks with other BIG MONEY:

"BlackRock’s model portfolios have about $100 billion tracking them. Salim Ramji, global head of iShares and index investments at the firm, predicted in July that the overall industry could grow to $10 trillion over the next five years, from about $4.2 trillion." Bloomberg

Geoffrey #graphcall-macro-education has a solid point:

"Betting on stocks going down nominally in fiscal dominance is risky."

Predictions are hard. For more on my market predictions for the year ahead, here is a podcast I did with Roger Hirst last week!

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!