FINTECH PROJECT ROADMAP 2025

New Member Features AND New Stand-Alone FinTech Products Coming SOON!

Happy Summer All!

While many take a slower pace during the summer months, I have not been hanging at the beach as excuse for writing less. I have been busy!! Stuff you can’t even see so I decided to share what I’ve been working on when I’m not running my live trading room Mon-Thurs, providing daily custom client engagement, and keeping my scheduled weekly live webinars, podcasts & interviews - while posting my Intermarket Sector Themes AND deep-dive macro analysis for clients like:

The reason the daily Market Catch has been MIA last few weeks is partly due to earnings season which is a lot to process in my non-AI-brain in addition to all the Trump-isms hitting headlines & economic data I must parse, but it is also because I have been working intensely behind-the-scenes to scope, refine, test current fintech projects that I am committed to completing this year. Here’s an overview so you have a sense of what’s coming. ;-)

»MONEY MATTERS: Greatly Enhanced Member Feature To Launch Soon

I started LaDucTrading.com as a financial research firm with focus on macro-to-micro analysis, education and trade set ups. Along the way, I found clients we attracted were more likely to be sophisticated active traders & investors who had experience managing their own risk and/or other people’s money. It’s been a joy to collaborate with clients who are subject experts in their own right, take personal responsibility for their trades, and potentially share my world view.

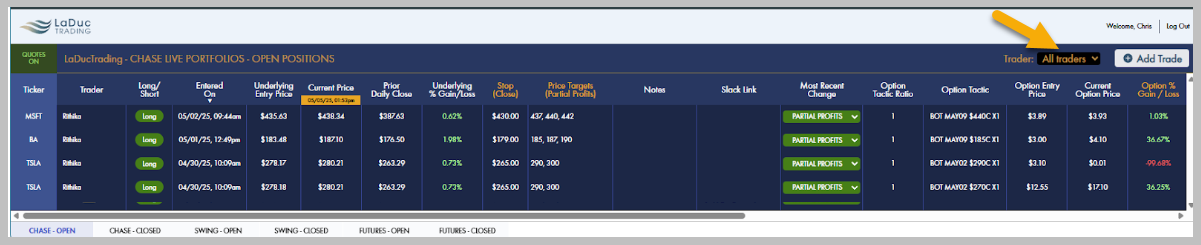

I came to realize, however, that the majority who find me who trust my analysis really want to see how I manifest the trades - across assets and timeframes: chase, swing & trend; using options as well as the underlying; from macro to micro. They also want to see it real-time from my entire team with a running PnL by trader.

So…. I commissioned a project last year that will allow LaDucTrading members to view our trade set-ups - stocks, options, futures - with real-time stock/options/futures data - with all of the stops/profit targets/rationale - in portfolios with sortable PnL by contributor - tied to slack trade notifications - according to these five PORTFOLIOS:

CHASE

SWING

TREND

INCOME

FUTURES

The bad news: I had three childbirths - naturally - that were less painful than this seemingly-simple project. The good news: I’m on my 4th developer, and he swears we are close to launching - end of month if stars align. Too bad developers lack the sense of urgency of their clients, but thank goodness for Rithika & Mikey as power testers these past few months to get us to this point. We are much closer.

»MONEY MIRROR: New Product For New Year

Don’t laugh. I started this project in 2020 from a GoogleSheet and it was tied to IBKR through a kludgy interface & integration. After the developer bailed in early 2021, I sourced another to make it into a proper app that was scalable, stable & secure. Then the new guy had a mental breakdown/bailed and I needed to hire a lawyer in Vienna (Austria) to retain my intellectual property. Long story short, I thought the project was a total loss but I am nothing if not persistent, so… I pushed hard to resurrect it. Not only did I miraculously push it through IBKR compliance (three rounds) but miraculously got the development team in place to complete. Then I found a separate development team to do the functional & load testing. And now we are working on the user flows & wire boards to create a new user interface - and member pages.

Oh, what is it you ask? Brokerage-Triggered Trade Alerts.

I built a 3rd party app that sits on top of IBKR, that allows the user (me, my team, or any lead trader who wants to use it), to access their IBKR account and enter/manage/automate their trades - with traditional conditional orders or my custom conditional orders/hot buttons/automatic triggers - which then populates the real-money trade to members via a dashboard with real-time trade log & PnL with analytics.

It is really a MONEY MIRROR not a copy-me platform. I don’t want to be Webull and have members link to my account so it auto-trades for them. I’m not an RIA or manage other people’s money and I don’t want to get into that business, but I suspect there are fair number of subscribers in the ‘trade sharing’ business who want to TRUST BUT VERIFY that the lead trader they are following is really putting their money where their mouth is. And so I created a trading platform that does this - with an advanced options matrix - and where the lead trader can set their subscription fee - not be relegated to a Slice of the pie but get the whole pie.

When it’s done, I’ll show you more, but I’m super excited about it because my vision is coming into focus five years later!!

If you are thinking, “She has no business being a software product manager.” I would agree, but clearly this has not stopped me. I love doing my day job of being a stock market analyst and identifying sector rotation and stock picks, following option flow, fundamentals and macro event risks… but I have another side too: creating a LOT of value for members. I think this will be cool even if I’m the only one that uses it! lol

»OPTION TELLER: Free/Member Feature For Swing Traders This Fall

Here’s a fintech project you will appreciate if you are an options trader interested in flow. Since I am paying for all these developers and market data, I thought about a product I would like to use that I thought my contributors would like to use that I thought my clients would like to use that wouldn’t be too much effort (cough cough) to build…

… a SEARCHABLE database of OPTION TRADE POSITIONS (not aggregate) on STOCKS/ETFs (not indices) of large size sponsorship (not 0DTE) in support of charts we are sizing up or trading. Given I am more focused on multi-week, multi-month swing & trend trading this tool is not about intraday chasing OR the dealer/market maker positions - there are services that do that well and I already partner with the best ones: SpotGamma and Vol.Land.

SpotGamma: My entire trading desk of ten contributors are power users of the SpotGamma tools which are retail-friendly tools for chase-trading market direction and sizing up unusual option flow in report form.

Vol.land: Jason (an RIA) is a contributor at LaDucTrading and has the best data for position/swing trading market direction.

But neither provide me with a really good look into the stocks I am most interested in trading that show me the actual big positions and specifically how they are positioned using option tactics. Lots of other places try, but they don’t provide a reliable database from which to scan and synthesize for longer-duration positioning.

My database will feature this view AND be free for a good 3-6 months to get user feedback. I hope to announce in a month. I want you to share this tool far and wide because other people providing ‘similar’ unusual option flow data are hacks or crooks or both. I hope to really help you see that once this goes live.

»SECRET SAUCE: Member Feature To Be Built

This is something I have run by three developers, but none have been able to figure out how to build so I will keep searching for someone who can!

Anyway, these are the Intermarket tools I have created from multiple platforms that help me time the market for clients. And if you have followed closely, you know I do not suck at this. Clients have a good idea since I share them with them daily but as view-only, so now I want to create them as stand-alone custom charts that have been annotated by me so members can track them independently on a timeframe of their preference: 5 min to monthly.

Anyway, these are member value-add features that I will get done in time. Because, if you have any sense about me it is this: I don’t give up.

»PROFIT PLAYS: New Product Needs Product/Talent Manager

This is such a cool concept I can’t wait to launch. It has been built twice - new UI twice - so I’ve thought about this carefully. It is a spin on a ‘stock trading prediction game’. Although the data is real-time, and can be used for short-duration/intraday chases, I built it for EQUITIES & FUTURES traders/trading on a SWING timeframe.

Nothing like it exists, but everyone I show it to says it’s “way cool”. Totally separate from LaDucTrading & our membership service, and not related to either our portfolios or brokerage triggered trade alerts platform projects … but a combination of all the things I have learned about TRADING COMMUNITIES and TRADE SHARING in one app.

Here’s how it works:

Lead Traders populate their trade set up - Index/Stock/ETF or Futures - with their price target by stated expiration. (No options this round, sorry.)

All trades/traders have a track record of Hit/Miss with analytics.

All Lead Traders can promote their membership or RIA service for free.

All Lead Traders can participate in revenue sharing on all Unlocked transaction fees received by Users of the platform.

All Lead Traders can set the Unlock Fee for their trade ideas.

Users have free access to track closed Lead Trader results.

Users can choose when to buy access to the open individual trade idea/s. No membership required. Users pay the Unlock Fee to gain access to the Lead Trader’s trade/s, so truly a Pay-As-You-Go platform.

Users are only charged the Unlock Fee when the trade idea Hits the price target the Lead Trader gives within the expected timeframe.

User is not charged any Unlock Fee if the trade idea Misses the Lead Trader’s stated price target within the stated expiration period.

Users have full access to the community of Lead Traders and can choose any trade to unlock or any lead trader to follow.

So ProfitPlays IS built and legalese submitted the T&Cs, but I need to do final testing AND source a Product/Talent Manager before I can get this one to market. If you have interest or know of someone who is VERY familiar with the ‘trader sharing’ (trader education) community with deep product/marketing experience, and can share in this vision for this new PAY-AS-YOU-GO platform for users and EARN-AS-YOU-SHARE platform for lead traders, please reach out to support@laductrading.com - and thanks!

Profit Plays' service is similar to https://www.tradealike.com, which unfortunately didn’t succeed—just sharing this for reference. On that platform, users had to purchase credits with a credit card, which could then be used to unlock alert services from various traders.