Fed is Behind The Curve And Leverage Is Behind It All

CLUB/EDGE client post Monday, August 12, 2024. Focus on DELEVERAGING - yen, oil, treasuries, equities.

» CLUB/EDGE client post AUGUST 12th, 8:37 PM.

Highlights From Last Week

Charlie Bilello does a great summation of last week's drama:

The S&P 500, which was down over 4% early Monday morning, would end the week down just 0.04%.

After hitting a high of 65.73 on Monday morning, the $VIX would end the day at 38.57. That 41% decline was the largest peak to close move ever.

And yet, the $VIX still ended Monday 136% higher than where it was just 3 trading days earlier, one of the biggest short-term spikes in history.

But when it comes to volatility, mean reversion is a powerful force. And over the the next 4 trading days the $VIX would decline 47%, its largest 4-day decline ever.

Charlie also does a great job summarizing the two biggest power players in market sentiment:

Buffett and AAPL:

Berkshire’s Cash Pile spiked to a new all-time high of $277 billion, increasing by a record $88 billion during the 2nd quarter. $75 billion of that came from stock sales with Berkshire selling nearly half of its position in Apple.

Berkshire Hathaway is now holding 25% of their Assets in Cash, the highest percentage since 2004 and well above its historical average (14%).

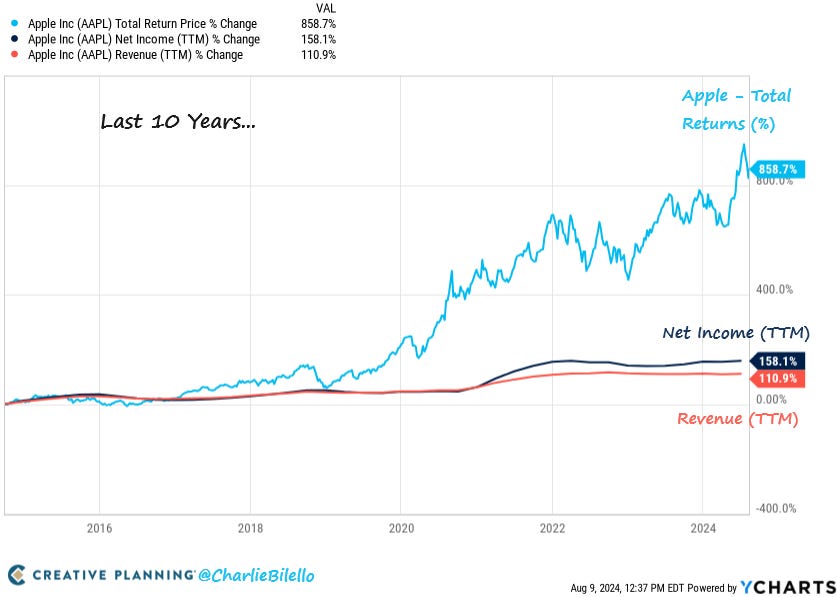

...and when it comes to valuation Apple is in a very different place today as compared to when Buffett first bought the stock back in 2016.

Its price to earnings ratio has moved from below 10x to above 30x and its price to sales ratio has moved from 2x to 9x (the highest in company history).

Which is another way of saying that its share price gains (+859% over the last decade) have far outpaced its fundamental growth (+158% increase in net income and +111% increase in revenues).

Apple has bought back $646 billion in stock over the past 10 years, which is greater than the market cap of 491 companies in the S&P 500.

Charlie doesn't even talk about the yen carry trade, but that is what every talking head wanted to talk about every day last week.

And for which you already had my warnings.

Yen Carry Trade Unwind Is Just Part of the Deleveraging Underway

I wrote this March 24th on yen carry trade unwind for clients.

“So now that the BOJ has removed negative rates from its policy... Does the Carry Trade Unwind Threaten?

I have said before, that the USDJPY is akin to rudders in an attack submarine.

-DXY is the engine.

-JPY is the ballast.

-10Y the diving planes.And the Pressurized Hull of this stealth sub is what keeps everything inside it under water from being crushed.

But this is not a new concern. Refer back to my November 2023 #macro-to-micro-support client post - which was the basis of my podcast last year with @RogerHirst3

‘Japan is the largest holder of US debt and equities, holding over 1.1 Trillion US dollars worth.

BOJ is making hawkish sounds just as the rest of the world's central banks are pausing/cutting.

2021-2023 were the years when the Yen had an incredible bear market due to YCC – which happened to take place during the fastest Fed hiking cycle in history.

So what happens to US bonds AND equities if the opposite occurs in 2024-2026?’

If/When BOJ reverses negative rates and pivots, there could be an exit from the dollar to the yen.”

This is just an excerpt from my client post but you get the idea. I have been watching for this and it really helped me time this recent yen move for clients.

So now that EVERYONE is talking about the 'yen carry trade unwind', let me remind: it is not just the yen carry that unwound last week!

It is DELEVERAGING across all assets - currencies to bonds to equities. And my bet: it is not done.

Especially as the Fed Is Behind The Curve; Recession Risk is Pulled Forward; Nikkei Crashes & Buffett Bails

The Other Side Of the Yen Carry Trade Unwind

Given the extreme move in the yen short-covering rally past month, we likely will see months of basing (read: gyrations) before further Yen appreciation.

With that, there will be periods where investors unwinding Yen carry trades will sell US Treasuries they purchased with borrowed Yen. This would help depress bond prices forcing higher yields. But I wouldn't trust it. There are positioning adjustments that will be made that look like more than they are.

The bigger question is when will the INFLATION narrative pivot to DEFLATION - beyond just STAGFLATION RECESSION vibes?

Most likely not until the 10Y US Treasury yield gets/stays below 3.8% major support.

In the meantime, there will be investors who close out carry trades (and sell US Treasuries), so they can convert those USD back to Yen and repatriate those funds back to Japan. If not, and BOJ continues to talk about hiking rates, then US Treasuries get supported, pushing US yields lower.

But lower yields can also happen as the basis trade (short 10Y futures note, long nasdaq 100) is further unwound.

And lower yields can also reflect market instability, oil weakness and/or economic growth concerns.

Lots of reasons yields can fall - especially in front of a Fed rate cutting announcement and/or cycle.

What makes this trade trickier now is the intersection of yen carry trade unwind WITH basis trade unwind WITH concentration risk unwind, etc.

It will be very difficult to identify the motivation behind each gyration, but my baseline bet is that the collateral trades of OIL, BONDS & GOLD bear watching, and can domino - pulling equities lower and recession risk forward.

Technically speaking, I do not believe VIX is done going up and RSP:SPY is finished mean-reverting - BIG PICTURE.

Macro Views In a Nutshell

I've talked a lot about the Fed behind the curve.

I even did a podcast a few weeks where I detailed my thinking: Fed Rate Cuts Coming As Recession Risk Increases

As for election risk: I believe #RFK is not to be ruled out.

I had - in DECEMBER 2023 - that Biden would not make it to the ballot and Harris would.

That happened.

I had - in early part of 2024 - that #RFK would make it on the ballot and could break the 2-party system which market is not pricing in let alone knows how to price in. This is happening although heavily dismissed. Just try to keep an open mind.

As I mentioned, I fear narrative will flip from inflation to deflation into EOY.

We stay at "disinflation", and equities digest the mayhem, if 10Y yield > 3.8%, Crude oil > $70 and Gold > $2300 - all on wkly closes.

But I do not see higher yields against this backdrop of slowing global credit demand, falling oil demand and collateral trades based on bonds, oil & gold that are getting hit from VAR shocks in FX, Bonds & Equities.

With that, my bet is oil breaks, yields break, gold breaks, equities break.

THIS violent move lower since I warned July 9th looks impressive with NDX -15.61% and SOX -27.65%, and yet, I do not believe - big picture - it is even half-way done this year. For active traders, there will be many bounces we will size up and trade, but big picture, my stock/bond ratio is intonating higher volatility not lower and HYOAS credit spreads are at risk of rising more quickly on the next sell-off as we move into Q3 with earnings rolling over into year-end and US dollar getting bid. Both are my assumptions, but it bears watching.

In a nutshell, it's just not a great backdrop for risk even as yields fall and Fed cuts aggressively.

The leverage yet to unwind is still threatening, and the amount of leverage to unwind is the greatest markets have ever seen.