FED DAY - HAWKISH CUT

- FREE TO ALL - Pricing Out Rate Cuts; Market Reaction; HISTORIC Value Stock Decline; Why Santa Clause Why? Bonus: Afterhours Review

Pricing Out Rate Cuts

»CLUB/EDGE client post earlier today, December 18th.

As expected and posted past few weeks, Fed announced 25bp rate cut and intonated a January pause:

US RATE FUTURES PRICE IN JUST TWO RATE CUTS IN 2025 AFTER FED EASES BY 25 BPS.

This is down from four.

WSJ already warned (showed this live in room):

The Fed’s Game Plan on Interest-Rate Cuts Keeps Shifting

Investors widely expect a third-in-a-row rate cut this week. Officials are ready to slow—or even stop—lowering rates after that.

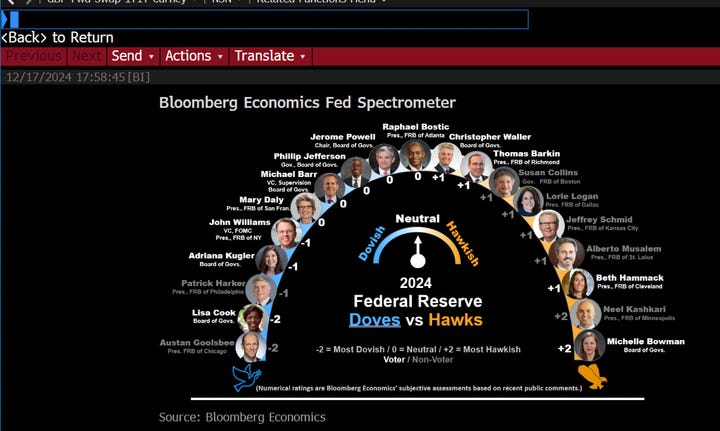

The Fed Spectrometer shows no consensus, and most have no idea what's coming.

Here's the big picture according to Geoffrey (emphasis mine):

"The Fed has to cut for fiscal reasons not monetary ones, hence the reaction on term premium.

Wang @FedGuy12 sees a Fed more dovish than people think into next year with weakness in USD and stocks (I would also add weakness in long-end UST).

Dovish because r-g is not negative enough for the US Treasury.

The recent deficit in the last 2 months is very high. So the Fed needs to lower the cost of debt for the US Gov while pumping it nominally - with or without inflation, it does not matter at this point.

That's the reason for dovishness: Fiscal Dominance."

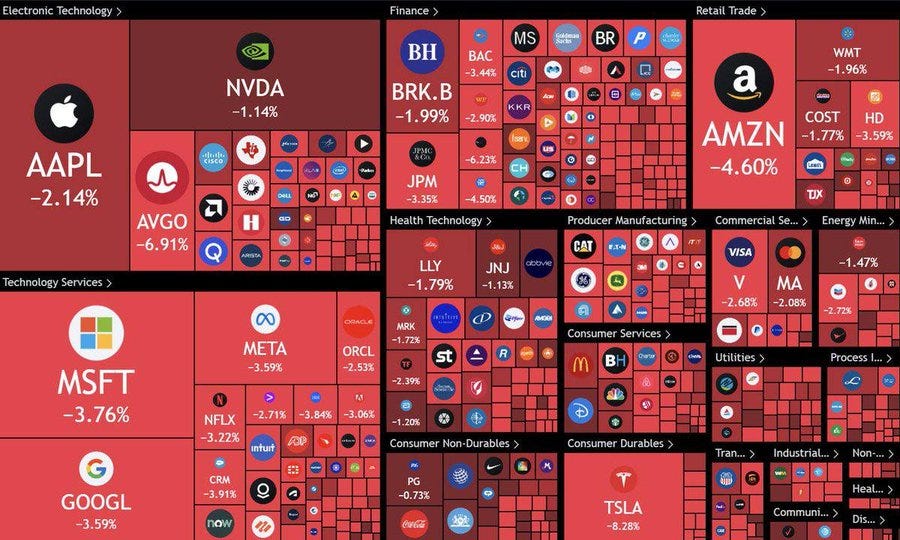

Market Reaction

As expected, and posted for clients December 12th: YIELDS ABOUT TO BREAK HIGHER

"I see USDJPY heading higher >152 into 155 (Jan timeframe)"

"In which case, a rising USDJPY means US 10Y T-note futures should fall with yen, and gold/silver could continue to chop sideways/stay on the weak side."

Today, we see not only US dollar and yields spiking higher with USDJPY, USDCNH, USDCAD - all set ups I gave clients for higher - but everyone can see bonds, yen, gold, silver and equities falling hard as I predicted.

Further, I posted yesterday in trading-room-notes:

Do they all smell the yield spike now?

I showed not only the continued breadth breakdown and net selling under the surface but also warned that ‘crashes occur from oversold not overbought’ territory. And my repeated mantra: in lieu of sector rotation there will be volatility.

I showed my VX3:VIX ratio warning that it would likely push below 1.20 ratio and pull market lower. It did.

I showed my US-JP yield differential as bearish and how it would influence stocks. It reversed lower Dec 4th and now QQQ with SPX are looking as a catch down trade.

DIA en route short to 433.20 ~100D with 422.62 overshoot if we see that 55D break, and IWM at my 230 PT with 55D just below at 230.30 looking unlikely to hold so 224.23.

As I’ve also repeated: Fed likely cuts as expected in Dec, and tries to pause in Jan. Tries in that once they suggest it, market gyrates as it needs to price OUT cuts.

HISTORIC Value Stock Decline

Prior to that note, the backdrop was clear:

S&P 500 Value Stocks have declined for 11 consecutive trading days, the longest losing streak in history. December 17th, Barchart

VALUE had been crushed/left for dead as TECH frolicked and SPY was at risk of drowning.

When did value stocks start their decline?

DECEMBER 2ND.

When did I warn BIG growth-to-value rotation triggered?

DECEMBER 2ND.

What did I write yesterday if it was done?

‘crashes occur from oversold not overbought’

Breadth Matters

Then Mon and Tues when volatility started rising with spot prices I said "careful".

Even prior to today's FOMC announcement, I had already caught the growth/value rotation with the warning that it’s only so long before my mantra triggers:

“IN LIEU OF SECTOR ROTATION THERE WILL BE VOLATILITY”

BTW, Nomura posted yesterday that this bad breadth was the 2nd largest streak of negative breadth in the last 20 years AND the only "up" period for SPX over such a streak...ever.

And I saw and have warned clients since Dec 2nd:

IWM DIA #Value would fall

QQQ #MAG7 would rise

I showed each day the breadth breakdown, net selling, falling yield differentials (US-JP)... all indicating weakness under the surface.

Well, breadth matters - especially when the soldiers are injured and only the generals are left on the field.

Why Santa Clause Why?

And now what...

OPEX FRIDAY shows we have 10:1 calls to puts coming off the board on the largest monthly options expiry evah..

DEBT CEILING DEADLINE FRIDAY may not go as smoothly as planned given calls by Musk, Vivek, others to vote no...

BREADTH AT 20 OR 40 YR LOWS and less than 18% of SPY stocks up on the month (before this sell-off) being disguised by the MAG7 strength...

FOMC JANUARY PAUSE intonated with rate cuts getting priced out ...

And don't even get me started about the (US/Ukraine) assassination of a Russian General yesterday who heads Russia's Chemical and Biological Defense Forces who accused Biden admin + Hunter Biden of covert biolab funding + research in Ukraine.

Or the Avian flu trending.

“The US Has Relocated Ukrainian Bio-Labs to Africa and Are Planning to Release Avian Flu a bioweapon To Start Another Pandemic, and Blame It On Putin.”

The Dead Guy referenced above who was just assassinated.

What's up next?

Jobless Claims Thursday morning - before OpEx and Debt Ceiling deadline.

Imagine they rise with continuous claims and market has to pull forward recession risk even more.

Then weekend risk and holiday trading volumes next two weeks with hopes Santa makes a call.

“If Santa Claus should fail to call, bears may come to Broad and Wall.”

Yale Hirsh, Stock Trader’s Almanac

GET OUT OF THE POOL is an expression I've used before, but today I see this downdraft as a washout from the culmination of the bad breadth we were already positioned for - if you followed any of my warnings from my live trading room, trading room notes, intermarket analysis, market thoughts etc.

Yes, ALL of my indictors are crashing lower intraday - but I also told you yesterday they weren't done falling!

Slowly then all at once. Ditto with VIX.

That's why I had posted several VIX trades in #SWING for protection!

Ironically, it wouldn't surprise me for QQQ + SMH to get its mojo back next week.

But for now, I'm sick and not making that bet. Also why I closed all THREE of my live sessions today. First time evah. I always work when sick - that's not the issue - I have no voice, other than the one that sounds like Charles Bronson.

Thank goodness my team is fabulous!!!

THANK YOU for covering for me this morning in my live trading room!! @archnakj @Rithika @Mikey Bot.

And so sorry I have cancelled the Macro-to-Micro OPTIONS Power Hour with Hans.

Let's see how I feel tomorrow.

I will post updated charts on my indicators then.

For now remember one thing: SPX drawdown of -2% will set free a VIX move that many don't expect.

Don't be a hero or complacent. Just take care.

Hope to speak tomorrow.

AFTERHOURS REVIEW

OK, so SPX closed down exactly -3% and VIX spiked 74% today, but 97% since Monday when I warned. VXN bounced off noted weekly support of 15.12 into 28.16 for 86% gain. And SVXY called out as short from 200D stop on break of 52.43 cascaded lower nearly 9% and still has 100W near 47 to hit.

Hans had the best VIX trade, as he discussed yesterday in our Slack #chase-live-huddle and as posted in his channel:

I told people don't fck around with an upside calls, just BUY convexity. sell the Feb 15 put and buy the 23 call. Up massively. boom

Powell’s speech post announcement ended up evaporating $1.5 trillion from the US stock market today.

And just as many would like to catch this falling knife, I would defer to my favorite and most bullish chart which is bearish equities…

Remember when I warned DECEMBER 13th:

We are all bond traders now.

It was one of the key charts, but not the only one… Still it really helped me make the calls I did for clients to help you position, protect & profit.

Speaking of which, not a single call I got wrong. How often does THAT happen?!?

fed, bonds, metals

dollar, yields

usdcad, usdjpy, usdcnh

iwm, dia, spy, qqq

vix, svxy and spx>-2%

Congrats to clients who joined our Black Friday sale! ;-)

That's all I'm gonna say about that.