Expectations Were Met

Lucky or Good, I fully expected Fed to hike 50bp in May because the Fed follows the (bond) market. I also expected the bond and equity sell-off into FOMC with potential for a "short-lived, short-covering" relief bounce this week. Although I am not sure how much of a relief we will get, it was a fairly predictable "sell the rumor, buy the news" of rate hike.

I wrote this to clients pre-FOMC:

"The last time the Fed hiked, the market found a short-term bottom.

But it wasn't "the" bottom."

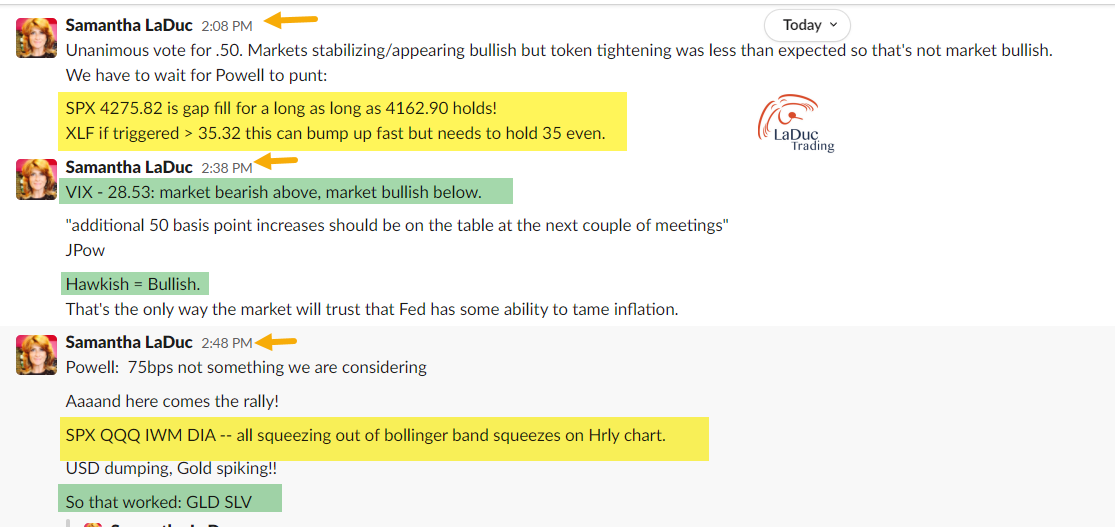

As you can see from my #chase-ideas channel entries this afternoon, it was also very profitable to live commentate and position during the FOMC event. We had set up long just in time as well as in advance for gold and silver, also swing and trend long the oil + gas patch cuz ENERGY IS ALPHA. In fact, my SPX $4306 PT was hit!

Big Expectations Ahead

Yields matter to market returns so my focus now will be watching very closely how shallow a pullback we get in the 10year yield, as I expect back-and-fill before it launches higher. TNX tagged my price target at 3% today (FOMC DAY) and TLT has been supported by that V.I.P. line-in-sand $117 I've talked about past month. Basically, Fed hiked to meet market expectations and with that yields paused there in the expectation Fed will at least 'try' to fight inflation.

But as I warned last week, below $117 in TLT and $138 UST IS highly unstable.

A Hedge Fund client wrote:

50bps 25bp 75bps: 20B, 40B 95B of QT. Doesn't MATTER. They are tightening into a slowing economy. High inflation and going to be a struggling consumer. Earnings are coming way down. All while we are a stone from ATH. This will get ugly. Stay focused on the big picture.

I couldn't agree more but the market doesn't see it yet. And here's why.

Bonds topped August 2020. (I warned you then.) Equities ran into Nov 2021 high (I warned you then). Bond market has always topped (about a year) before equities. This is another reason I made my 2022 Predictions in January with the call that markets won't see highs again for a very long time.

Risk Parity Broke

So that's why it is not so strange to me to see both bonds and stocks going into bear markets as rates rise to control inflation.Charlie Bilello on Risk Parity returns:

Going back to 1976, this is the first time ever that both US stocks and bonds are in a drawdown greater than 10% at the same time. The S&P 500 is in a 13% drawdown while bonds are 11% below their 2020 high (note: using monthly total return data).The result: by far the worst start to a year for a 60/40 stock/bond portfolio in history…

So here we are in a chart: RPAR has retraced all the way back to pre-covid highs!!

[NOW you know why I track RPAR every day in my trading room. When it's moving up, stocks are generally bullish. When it moves down, stocks are generally bearish. But when trading bonds, like I have been recommending aggressively short since Sept/Oct 2021, this chart gives us an intermarket Tell.]

So with RPAR on support at 21.40 and TLT on support at 117, we need them to hold and the 10Y to stay < 3.1, but when they don't... it is a very good tell to expect BIG market weakness.

Also keep in mind market expectations to tame inflation can change. Currently, my VIX read is that it will digest higher through summer. Here's one of my Tells in tracking VIX inversely with SVXY (short VIX short-term futures ETF). I am very comfortable calling for lower SVXY/higher VIX but the moves will be chunky.

Critical Levels

My line in the sand of QQQ is weekly close below $315 and below $4129.48 weekly close for SPX. We'll get there, but not in a straight line.

Unless and Until my baseline bet of Oil and Yields and USD move sharply higher - basically my thesis since THINGS OVER PAPER started. If so, don't be complacent. Risk can and will happen fast.Here are my new weekly levels to trade against:

Bullish Yields > 3.1

Bullish USD > $105

Bullish Crude Oil > $109

Back-n-fill is still bullish. In fact, it makes my thesis even more bullish and durable, but I don't suspect it will take long, because my Risk Indicator Algo for QQQ has triggered a "flash crash" warning in my system very few times since 2018:

OCT 15, 2018

MARCH 10, 2020

JAN 20, 2022

It triggered again: APRIL 12, 2022 and again April 26.So... I'm holding my swing shorts + crash puts with baseline bet: lows aren't in.