"Everything is Bullish"

Except US Dollar and Yields!

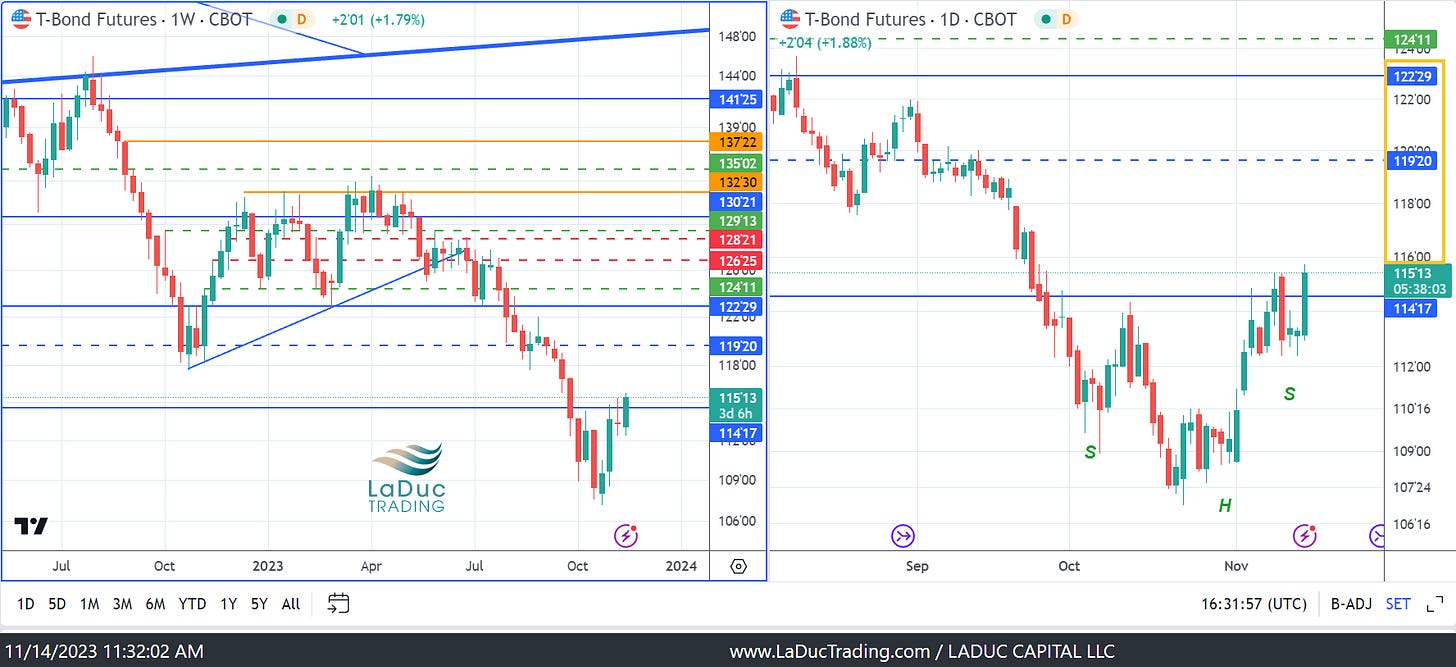

I warned DXY looked done going up Nov 1st then warned in a detailed post Nov 10th (see chart) with yields confirming once they got/stayed below 4.9% yearly pivot.

This week it looks mighty convincing in hindsight that USD + 10y were done going up, but now we need a bounce in both to help this melt-up fade.

OK, so my DXY short with softening yields theme this month is really picking up speed!

So much so that stocks and bonds are still bullish - but especially small cap stocks as the rally has broadened out.

In fact, the S&P 600 (SML chart I track for clients daily) had it's best day in 12 years yesterday with 97% of the stocks closing green!

It makes sense, then, that calls for IWM are the most traded evah.

As such, the chases from my live trading room have been very successful: IWM, TSLA, SPX, TGT, ENPH, JD.

.

New Chases are doing great.

Old Trend-long portfolio is doing great.

Closed Swings make for a clean palette as I'm stalking set ups I need to trust for more than just because "Everything is bullish".

Because at every peak coincides with max call buying - like IWM, NVDA et al.

And every peak coincides with VIP stocks getting sold in a 'factor rotation hedge fund short covering rally' which I've talked about since last week - ala micro-craps.

Basically, now that 'there is no one left to buy MAG7' after squeezing, funds have migrated to small caps/Russell and expanded to low float small cap names.

Falls right into my mantra: "In lieu of sector rotation, there will be volatility."

We are getting the rotation; then comes the volatility.But for now, "Everything is Bullish" with quants, funds and FOMO folks chasing desperately not to miss Santa until they have a reason to stop.

Because Portfolio Managers MUST hit their benchmark by end-of-year or risk getting fired, so market is set up as short-term bullish on narrative of Goldilocks economy and Seasonality.

This is because most firms were blind-sided by or lightened up considerably during the Aug/Sept/Oct sell-off, so they are now playing catch up post Fed intonated pause and Yellen bill-over-bond Treasury issuance announcement November 1st.

Fast forward two weeks, and since the CPI print Tuesday, CTAs DRASTICALLY decreased their positioning.

At this stage in the rally, I will say we are approaching the SOLD-TO-YOU moment.

Monthly OpEx is Friday, which often sets free the bear soon after.

Trend-Long Update

Trends long have humming along, regardless of inflation prints or retail sales.

I have enclosed a copy of the latest portfolio results with the tickers blacked out since the #trend-ideas channel is private to Club and Edge members only.

As clients know, these are select stocks within strong sectors and long-only.

https://laductrading.com/pricing/

Swing Potential

Chases are multi-hour/day affairs with Swings multi-week/month plays - either long/short - whether buying breakouts, counter-trend bounces or oversold bottom fishing.

But to be sustainable Swing, we need a healthy period of digestion/back-and-fill.

Since we are still in the short-covering melt-up mode, it's dang hard to position for multi-week/multi-month SWING LONG or position for confirmed SWING SHORT, since we don't have any yet.

But there are a lot of 'hedge fund factor rotation' short-covering plays in heavily shorted, oversold, left-for-dead plays, although I prefer picking stocks from a sector rotation theme.

Mostly, I am still focused on large cap stocks that can benefit from falling USD, as discussed past two weeks... and falling yields.

Particularly, the growth-to-value rotation plays in the strongest sectors.

And instead of chasing growth at overbought levels, I much prefer buying oversold value.

"No Inflation, No Rate Hikes"

Yes, CPI delighted and with it, rate cuts were pulled forward.

But "Everything is Bullish" does not mean "Inflation is Dead".

Wall Street's measure of inflation (by economists) has fallen.

It means the Fed Pause and Yellen Yahtze are working.Main Street inflation is still sticky and entrenched and still trending much higher post Covid. .

It means Fed is Trapped and Treasury intervention offers up diminishing rates of return.

BULLS rejoice:

Nov 1st QRA by Yellen equated to a "$75B notional injection into markets" plus "treasury is engineering a rundown of the reverse

repo facility". Michael Howell, CrossBorderCapital

Rising short-term Treasury Liquidity and Falling CPI has ignited a massive short-covering, seasonality-rally amongst quants, funds & FOMO folks for the history books!

BEARS know:

Monetary Liquidity and falling 'Wall Street' inflation is short-term bullish, but MONETARY INFLATION is still rising, and US Treasury collateral is under pressure!

Don't lose sight of the big picture: Fiscal Spending IS Monetary Inflation, and US needs to refinance 1/3 of its enormous debt in the next 12 months."Everything is Bullish" on falling US dollar and yields has a dark side.

US is becoming Brazil, not Argentina.

"Nominal GDP was booming between 2013 until 2022 in Brazil with a sluggish economy (low output in units, with high nominal GDP growth), so stocks doubled while the ccy went down by half." #graphcall-macro-education

And with that, falling USD is so bullish, it's bearish!!

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!