Don't Be A Piggy

Drifting into the July OpEx with positive market gamma, you can see clearly below that Tech represents the largest inflow.

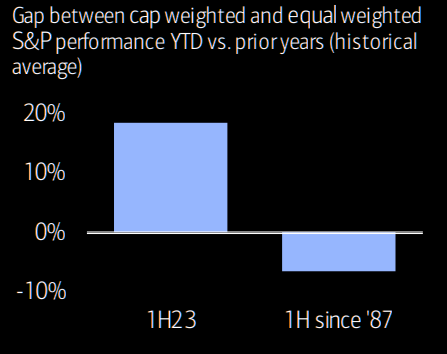

BofA warns the top 7 stocks:

1 … drove 73% of S&P 500 gains in 1H, each up 90% on average in 1H

2 … have a market capitalization of roughly equivalent to half of US GDP

3 … trade at a Price to Trailing Earnings (P/E Trail) ratio of ~40x. The S&P 500 Ex-7 trades closer to 15x

4. … is expected to represent all US corporate earnings growth and then some in 2Q – a 21% YoY gain vs. a 10% YoY loss for the rest of the S&P 500

5 ... TMT represents 8% of US GDP, 17% of S&P EPS and 40% of S&P market cap

Bernstein weighs in with the obvious: Mega-cap Tech is extended into earnings.

"The sector is now at its highest relative valuation to the market, a 54% premium, for the past 45 years, ex dot com. Earnings have been upgraded, but that looks priced in. Particularly for some of the mega-caps like Apple, Microsoft, NVDA & ORCL." Bernstein

Semis have also run hot and DB says the AI rush has limited upside now:

The SOX has rallied strongly into 2Q reports, similar to the situation a quarter ago, on investor optimism about an impending cyclical fundamental bottom and a robust, AI-driven recovery.

However, the optimism seems to be already factored into the SOX's performance (up nearly 50% YTD and outperforming the S&P 500 by ~30%)...

The number of companies poised to reap near-term financial benefits from AI tailwinds is limited (such as NVDA, and to a lesser extent, AVGO, MRVL, and AMD), which could make delivering the anticipated recovery more challenging.

Basically, the Tech FOMO has likely seen funds - CTAs, mutual funds, etc - fully exposed versus massively underweight beginning of the year.

Also a KEY consideration is that there are fewer funds who can buy the top tech stocks given the % of concentration risk. This is why, in part, Jr Tech has rallied off the May lows.

Having said that, I still like TSLA and AMZN as swing long "catch up" plays in the megacap space.

And I still like QQQE Nasdaq equal weighted play.

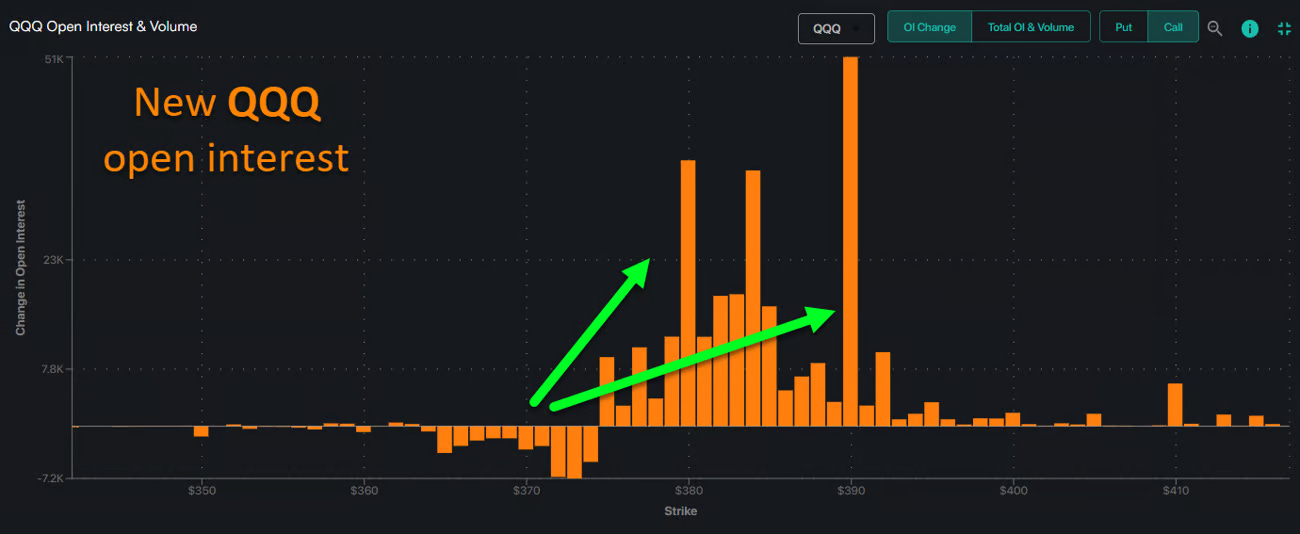

And I still expect SPX to tag 4545 and QQQ into 386.50 - with SpotGamma pointing out the 390 open interest of size.

Interesting to note:

The volatility crush is pricing very small moves for the earnings season.

The bar for earnings has been lowered so ** should ** be easier to beat, but...DataTrek reminds:

US Big Tech stocks are, on average, trading only 2 percent higher than Wall Street analysts’ consensus price targets. This suggests that a raft of downgrades are coming unless these companies beat expectations in the current earnings season.

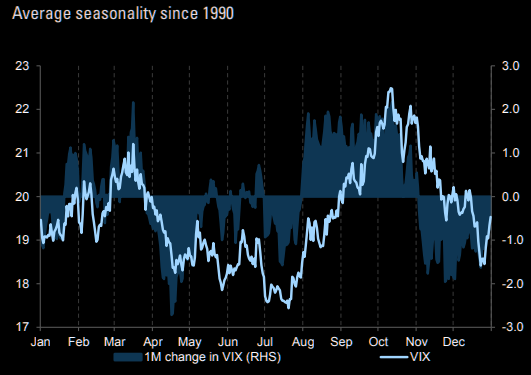

Don't forget VIX seasonality: July typically marks a low for the year.

WE'VE HAD A FABULOUS RUN IN JR TECH, VALUE AND DASH-FOR-TRASH past few months in addition to the MEGA CAP TECH CONCENTRATION.

It really would be prudent to trim, add time, protect.

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!