DOES TRUMP WANT TO PUNISH NVIDIA?

"You have the most leverage, and you won't get your wrist broken."

Gordie Howe

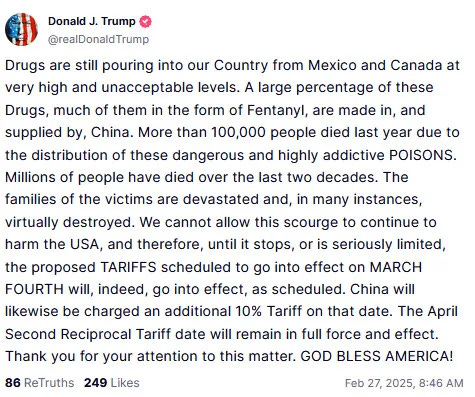

We know not if or when Trump will follow-through with threatened 25% tariffs on semiconductor chips to US from (mainly) Taiwan, but he did announce additional 10% tariffs on China today … post Nvidia earnings … on top of the already planned 10% tariffs expected to take place March 4th.

I can’t help but wonder if this tariff timing is more than forcing the expedited re-investment of manufacturing back home, but also as leverage for Trump to push China to stop buying (via backdoor) and Jensen (Nvidia CEO) to stop selling to China (by skirting chip restrictions by using Singapore).

The 25% Semiconductor Chip Tariff Threat

I’ll address the ‘Singapore Sales’ below, but first…

Trump suggests 25% tariffs on autos, pharma and semiconductors that could go even higher

Neither Jensen nor his CFO gave a satisfying answer on the conference call when asked about tariffs. And semiconductor tariffs in particular will matter given the outsized reliance Nvidia has on Taiwan-based semiconductor companies.

The 20% China Tariff Threat

8:46 AM ET: Trump proclaims “China will likewise be charged an additional 10% Tariff on that date” - meaning in addition to the 25% tariffs effective March 4th (next Tuesday) on Canada and Mexico.

And then, later in the afternoon, Trump doubled down:

My bet, Trump timed his announcement today on additional 10% China tariffs on purpose - after NVDA announced earnings, as NVDA is still trying to make opaque their “sales by destination. Assume it matters to US regulators, but it should also matter to investors, as client George @Vera_Icona_23 pointed out early & often:

"US sales relatively flat. Sales growth almost all due to "Singapore" and China."

Trump knows these tariffs are going to hurt Nvidia's precious 72% gross profit margins (that keep falling every quarter btw).

The “Singapore Sales”

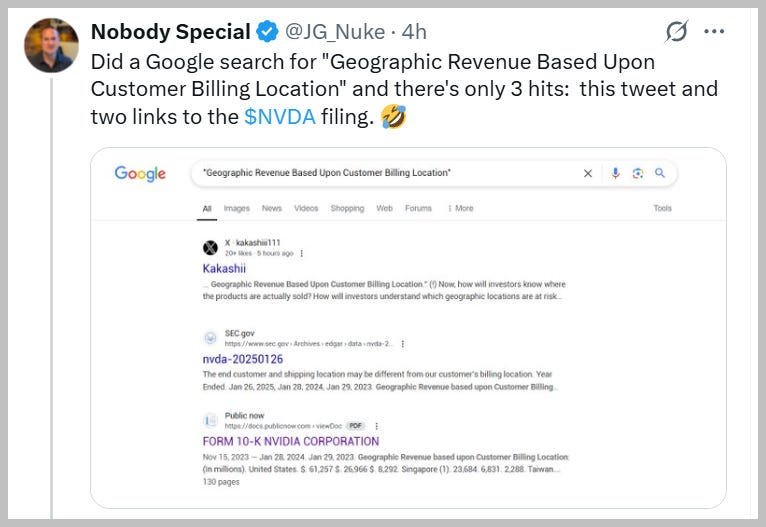

NVDA got creative! They literally invented a new definition: "Geographic Revenue Based Upon Customer Billing Location" to 'explain' Singapore sales

Kakashii has been the proverbial fly-on-honey for over a year regarding Nvidia’s regulation-circumventing Singapore Sales:

After some concerns were raised by certain individuals regarding Singapore's revenue, NVIDIA added a disclaimer for the first time in its Q1 2024 10-Q filing. The disclaimer stated that Singapore is essentially a billing location, and the actual goods were shipped to other countries. Naturally, these concerns have continued to be raised by me and others, and eventually, the "DeepSeek moment" occurred, forcing the officials to investigate these revenues. Since then, everyone has been asking about the Singapore revenue.

As a result, PwC, in a stroke of "brilliance" with Nvidia, came up with a creative solution. In this 10-K, they decided to create their own definition for the SEC’s Regulation S-K and U.S. GAAP requirements regarding revenue associated with geographic areas.

Instead of showing revenue from foreign customers or countries that constitute a significant part of their materials—like every other public company is required to do—they decided to fulfill this requirement by renaming the section from "Revenue" to "Geographic Revenue Based Upon Customer Billing Location." (!)

Now, how will investors know where the products are actually sold? How will investors understand which geographic locations are at risk due to regulations, wars, or other factors in different countries?

Investors will now have to guess where these customer billing locations are actually tied to and where the products are being shipped.

It’s funny-not-funny that NVDA is inventing stuff to keep the charade going.

NVDA The Story Stock

Even after last night’s earnings, the dream lives on: NVDA long-time bull, Gene Munster posted:

Investors are buying into what Jensen is saying: Be in NVDA for the long-term because we’re still in the early stages of AI, and the compute layer will be 100x bigger than many expect.

Many, including client George, have tracked NVDAs advance as they have led their sector by best-in-breed chips that serviced the explosive sectors of bitcoin/crypto mining to AI to now robotics.

Munster again:

Long-term NVDA investors should take note of the auto and robots segment that was up 103% yy. While less than 2% of revenue today, it has the potential to be a measurable growth driver in 3-5 years as self driving and humanoids ease into reality.

NVDA also has tentacles in healthcare and many other important sectors. I get it. But it is also important to lawyer both sides of the trade.