December 5, 2025 Live Trading Room Market Recap & Trades - (Samantha and AI Briefing notes)

Macro In A Nutshell

PCE data for September came is as expected; market is good with that as they still have Fed rate cut for December priced in at 90%. Problem is the bond market is still worried... about Hassett, the deficit, and entrenched inflation as massive short-end Tbill issuance grows same time as rate cut odds. Classic fiscal dominance when long-end rates rise as front-end rate cuts get priced in. Hence the bull/bear steepener ready to set flight.

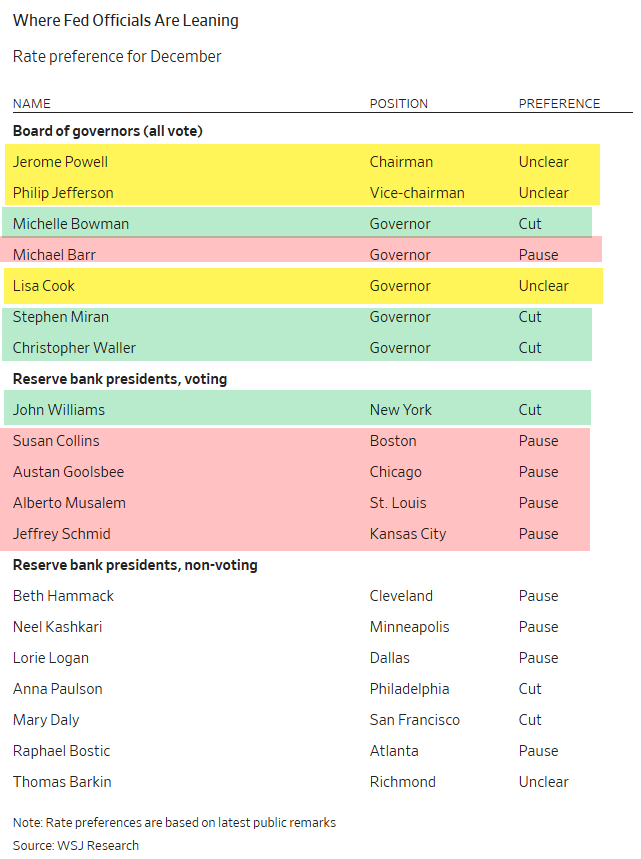

December rate cut odds may be 90%, but that doesn’t mean the Fed will agree. In fact, FOMC members are not in consensus which is a problem for bulls next week if they don’t cut. Japan also has a Fed problem if they don’t cut.

The final U.S. National Security Strategy was just published with an “American 1st”/Western Hemisphere focus - a kind of “Monroe Doctrine” update ala Trump’s version of isolationism. Some notable changes:

China downgraded from existential threat to economic competitor. Removes the values-based crusade rhetoric.

Taiwan deterrence not priority; secondary to closer-to-home initiatives (borders, cartels)

Tariffs quietly admitted as failure - “China adapted” and has “strengthened its hold on supply chains” - so US will find other ways to exert pressure

Allies will be asked to foot the bill; no more global cop role for US

Focus on US economic security with emphasis on reindustrialization, supply chains - my US GOVT AS VENTURE CAPITALIST theme

Arnaud Bertrand makes a great point:

“The contradiction is however obvious: unclear how you build an economic coalition against China while simultaneously waging trade wars against your coalition partners, demanding they shoulder more of their own defense, and treating every allied relationship as a deal to be renegotiated in America’s favor.

At some point these “allies” will be asking a very obvious question: why sacrifice our economic interests to prop up an America that can no longer compete on its own - and that offers us less and less in return?”

Micro In A Nutshell

NFLX, SPOT, DLTR, DG, ORCL, CRM, ADBE, LULU, NAT GAS/UNG/EQT

NFLX - fabulous premarket gap down on news they are striking a deal with WBD for $83B. It sliced straight to/through my 99.90 monthly support, where puts were monitized at open (read: profit taking), causing it to bounce back to 105 before it rolled over again to settle at 100 even on wkly close. Gorgeous continuation swing short with SPOT since early Oct with each monthly level acting as both trigger short and resistance on bounce. See chart.

DLTR & DG - continued to race higher since my rec’d long Nov 28th on “consumer cyclical” rotation. DLTR is up 15% hitting monthly trendline resistance it now needs to digest/get above to continue higher. DG surprised. Although also rec’d Nov 28th, I did not expect it to go parabolic from 109 to 135 for 24% gain in one week.