December 3, 2025 Live Trading Room Market Recap & Trades - (Samantha and AI Briefing notes)

Macro In A Nutshell

Powell’s Replacement Announcement - Today, Trump postponed the immediate announcement of his new Fed Chair pick until January, so we won’t get that nod next week. Odds still favor Kevin Hassett, who if nominated will wax on and on about the strength of the economy in every soundbite while he tries to herd cats (Fed governors) in support of aggressive rate cuts. Makes no sense, right? Falling economy = tight fiscal conditions = rate cuts, but that’s not the “Run It Hot” and “Cut A Lot” regime of Trump & his minions.

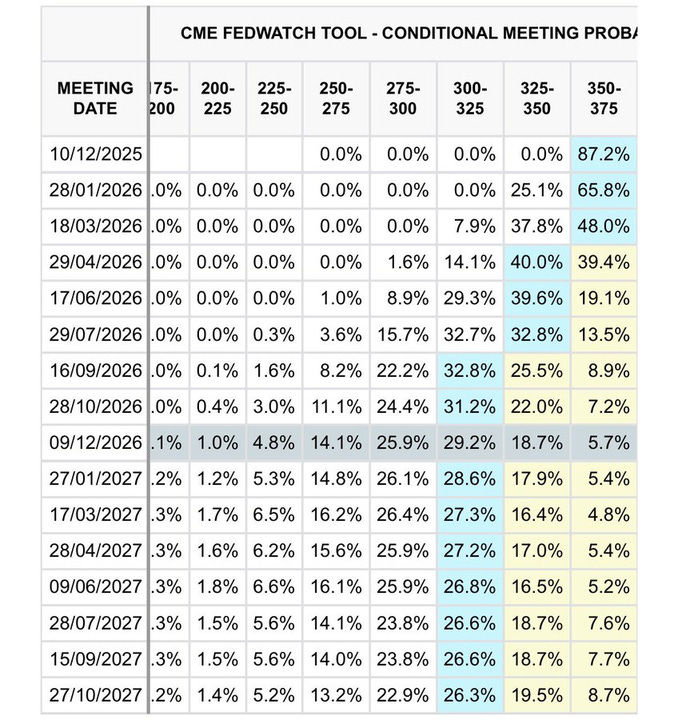

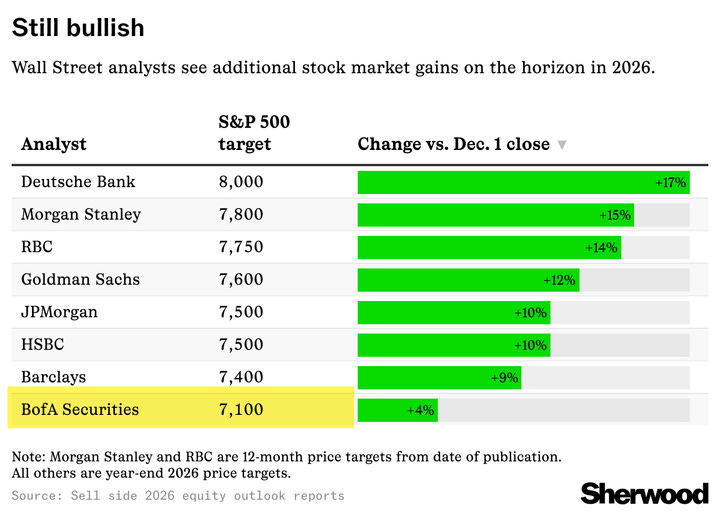

Expected Rate Cuts 2026 - Next year, market implies ~20% for 4 more cuts, which is equal to ~5% of SPX upside per cut, so 4 cuts is equal (in a bull’s mind) to ~20% gains - which market has been front-running of course and will continue to until earnings disappoint. But this is how CME rate cut table helps to generate SPX targets in part. I like the highlighted odds of only 5% higher or $7100 SPX 2026. It’s not good to get too greedy. Obviously, you can see there are no downside targets because * they * are not expecting Fed not to cut or earnings not to grow. Big IF true.

Employment Still Weak - My theme is still playing out, sadly: RECESSION INTO ALL TIME HIGHS

ADP commentary from Chief Economist Richardson: “Hiring has been choppy of late as employers weather cautious consumers and an uncertain macroeconomic environment. And while November’s slowdown was broad-based, it was led by a pullback among small businesses.”

US ADP EMPLOYMENT CHANGE ACTUAL -32K (FORECAST 10K, PREVIOUS 42K). Color below by @yieldsearcher:

Small biz (<50 FTEs): –120K. Mom and Pops getting decimated. This is a solid 1/3 of the private sector employment.

Construction and Mfg: –27K (cyclical sectors with high employment multipliers)

High-paying white-collar jobs (IT, finance, business services): –55K

Losses were partially offset by strong seasonal hiring in logistics and leisure (+14K) which will likely reverse after Jan, and in health/education (+33K) which is largely driven by increased govt spending (ie not a very productive sector)

We covered a lot of plays that are working so let’s dig in…