December 2, 2025 Live Trading Room Market Recap & Trades - (Samantha and AI Briefing notes)

Macro In A Nutshell

Bank of Japan’s Rate Hike odds have swung violently from high to low to back up to high (82%) again. Fed Rate Cut odds have swung violently from high to low to high (90%) again. As I posted November 20th: Japan Has A Fed Problem, so careful if Fed disappoints. Given the FOMC is equally divided, and odds of disappointment are not priced in... it wouldn’t surprise me if Trump plans his announcement of his future Fed Chair choice within 30 minutes give or take of the FOMC decision. What the market will ignore is whether or not the new nominee - who would still need to get approved and wouldn’t have a seat at the table until after Powell’s term ends in May - is whether he/she could drive consensus for a coordinated rate cut regime.

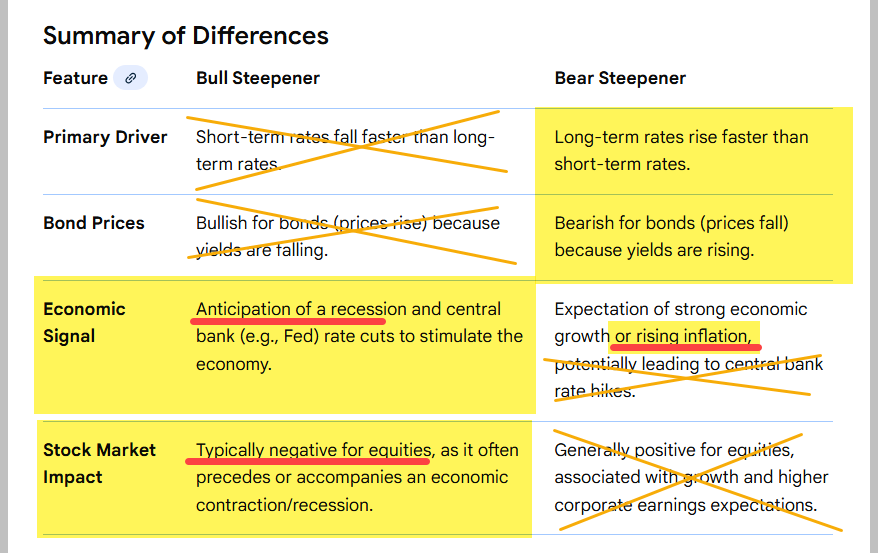

US 10Y2Y Yield Curve looks ready to steepen - after a multi-month flattening - since April tariff terrors froze credit & bond markets. I did a rant live this morning, but suffice it to say that in DEC 2024 when just above 0 (positive), I predicted the curve would steepen to +90bp before it was time to go long bonds. AND that it would not fit the traditional bear or bull steepener definition. I expect it steepens on the long-end BECAUSE of rising inflation and falling economic growth which is a headwind for equities. Time will tell…

Gonna have to (sadly) dust off this (occasionally) pinned tweet: WAR IS NOT PRICED IN

China’s Foreign Ministry issued a stern warning to the United States, urging it to refrain from any military action against Venezuela. Reuters

This statement comes amid heightened U.S. military deployments in the Caribbean, framed by Washington as counter-narcotics operations but criticized by Beijing and Caracas as veiled threats to Venezuelan sovereignty.

China is Venezuela’s largest creditor, having extended over $60 billion in loans since 2007, largely backed by oil shipments.

Chinese state-owned firms like CNPC and Sinopec control significant shares in Venezuelan oil fields.

In 2025 alone, Venezuela supplied China with approximately 200,000 barrels of oil per day, despite U.S. sanctions disrupting flow.

China’s position is deeply tied to its substantial economic stakes in Venezuela, making any instability a direct threat to Beijing’s interests.

As Client George called out:

Cutting off important Venezuela crude oil supply to China could be large part of story & Russia’s Western Military Base

Almost as if Lines are being drawn on Strategic Spheres of Influence: Ukraine - Taiwan - Venezuela

Venezuela today is much like Cuba in 1961 from US perspective

1961 invasion was staged under camouflage of Cuban Freedom Fighters

Moving on...