December 19, 2025 Live Trading Room Market Recap & Trades - (Samantha and AI Briefing notes)

Macro-To-Micro In A Nutshell

Japan Raised, So Now What -

Bank of Japan raised interest rates to 0.75% as expected - the highest level in nearly 30 years - after Fed cut last week.

Some call this “normalization”, but it’s largely to accommodate rising inflation in Japan that is running above target post Covid.

The reaction was also as expected: USDJPY spiked higher, yen lower, as GOLD rose with the 10Y JGB. Nikkei rallied with NDX, as investors view this hike as code that financial conditions will stay accommodative.

I still have USDJPY 160 for months now, where they start to think about yield curve control (YCC) again - first through talk then intervention.

The challenge ahead is often debated - that of balancing Japan’s persistent inflation against a weakening yen and rising public debt that is purchased/monitized by the BOJ. But the fact is that real rates are still negative and Japan still has an ultra-loose policy:

stimulate/print yen,

buy yen & bonds when tremors are felt,

juice markets (Japan & US) with a (seemingly) unending appetite for debasing ones currency into prosperity.

We will know when BOJ is serious when a future rate hike RESULTS in a strengthening yen - which can then trigger the feared Yen Carry & Basis Trade unwind. Until then, this financial repression will continue and markets will rejoice on the prospects that the liquidity hose of Japan has been released to suppress volatility, repatriation, and true price discovery.

Venezuela Surrounded -

I wrote about this in detail Thursday. Trump’s war drums are heating up.

Trump doubled the bounty on Maduro to $50 million

CIA operations were authorized inside Venezuela in October

Venezuela mobilized troops near the oil-rich border of Guyana

Guyana says the “Zone of Peace is in peril.”

Congress hasn’t approved but Trump has threatened conflict is imminent

This is our weekend risk, even bigger than redacted Epstein Files.

Santa Rally Odds -

Seasonally speaking, stocks rise in the last FIVE trading days of the year plus first two days of January: December 24, 26, 29, 30, 31, Jan 2, 5.

Given the CPI & MU assist to bulls past two days, and the early innings of a mini-growth bounce into my Growth-Value ratio, I would say odds are favorable.

Especially since I said pre-earnings that MU into 271 is likely before it meets with any resistance.

But truth is, many won’t be around to find out - as most have closed their books to avoid the higher probability chop into year-end during thin liquidity, light economic data releases, and a recessed Congress along with ~90% of Epstein files redacted.

Housekeeping -

I will run my live trading room and our member slack live-huddle will run daily as usual this coming week on Mon & Tue as well as the following Mon & Tues (last week of the year), but the day before & after Christmas and day before & after New Year’s both will be closed.

I’m giving my entire team some much needed R&R. Doesn’t mean that if something totally wicked happens we won’t post in our slack channels, but I wanted to set expectations.

Also, today will be my last Live Trading Room Review for the year so I can focus on some year-end FinTech projects next two weeks.

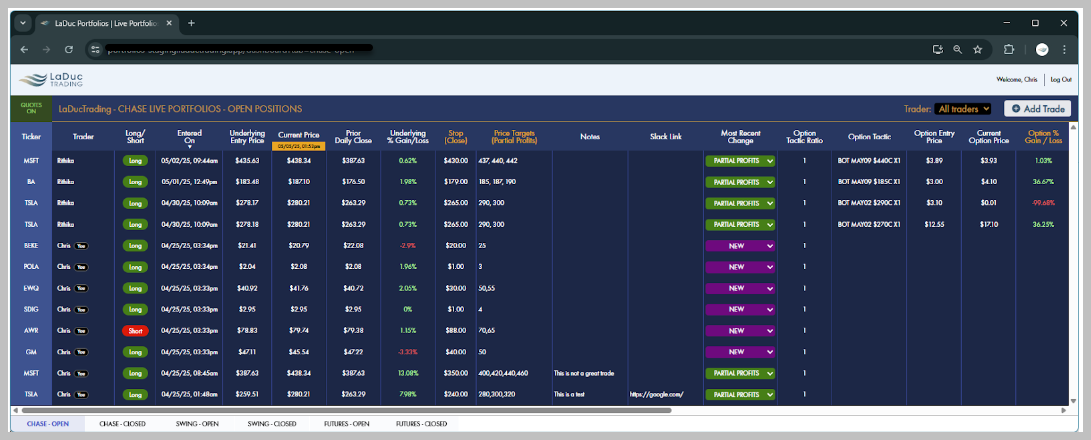

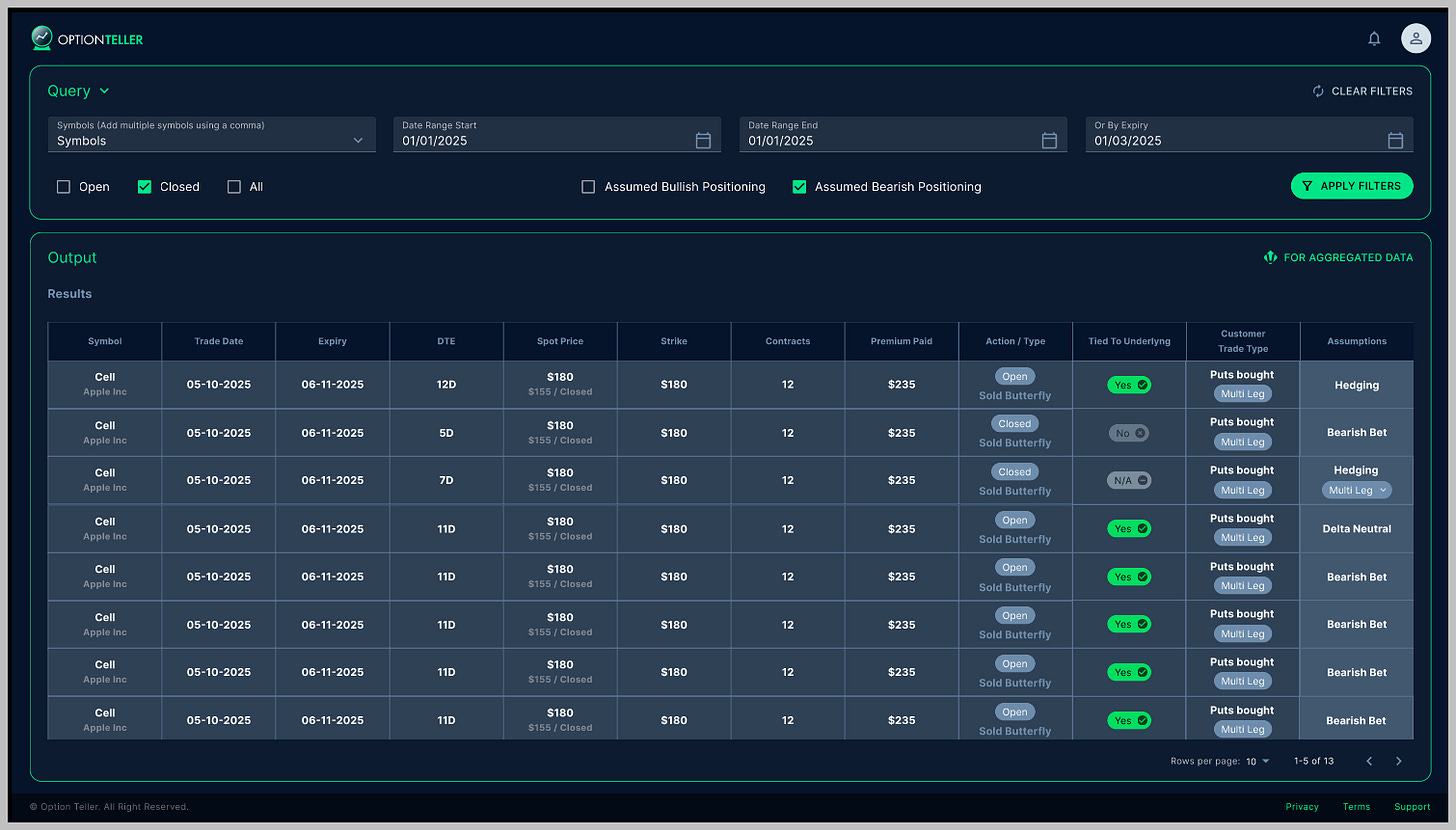

I might squeeze in a deep-dive market though on 2026 I’ve been working on, but my priority is finalizing PORTFOLIOS & OPTION TELLER - my holiday presents to you. XOXO

Portfolios will be launched January 1st for our return on Jan 5th - to be populated by Mike, Archna, Luke, Alex, Geoffrey & Myself to start ;-).

CHASE members will have access to CHASE & FUTURES

CLUB members will have access to CHASE, SWING, TREND, FUTURES

EDGE members will have access to all plus GEOFFREY’S

Prices increase Jan 1st as well, so if you are interested in any upgrades, please consider doing it now.