December 18, 2025 Live Trading Room Market Recap & Trades - (Samantha and AI Briefing notes)

Macro-To-Micro In A Nutshell

CPI Beat. Well Sort Of -

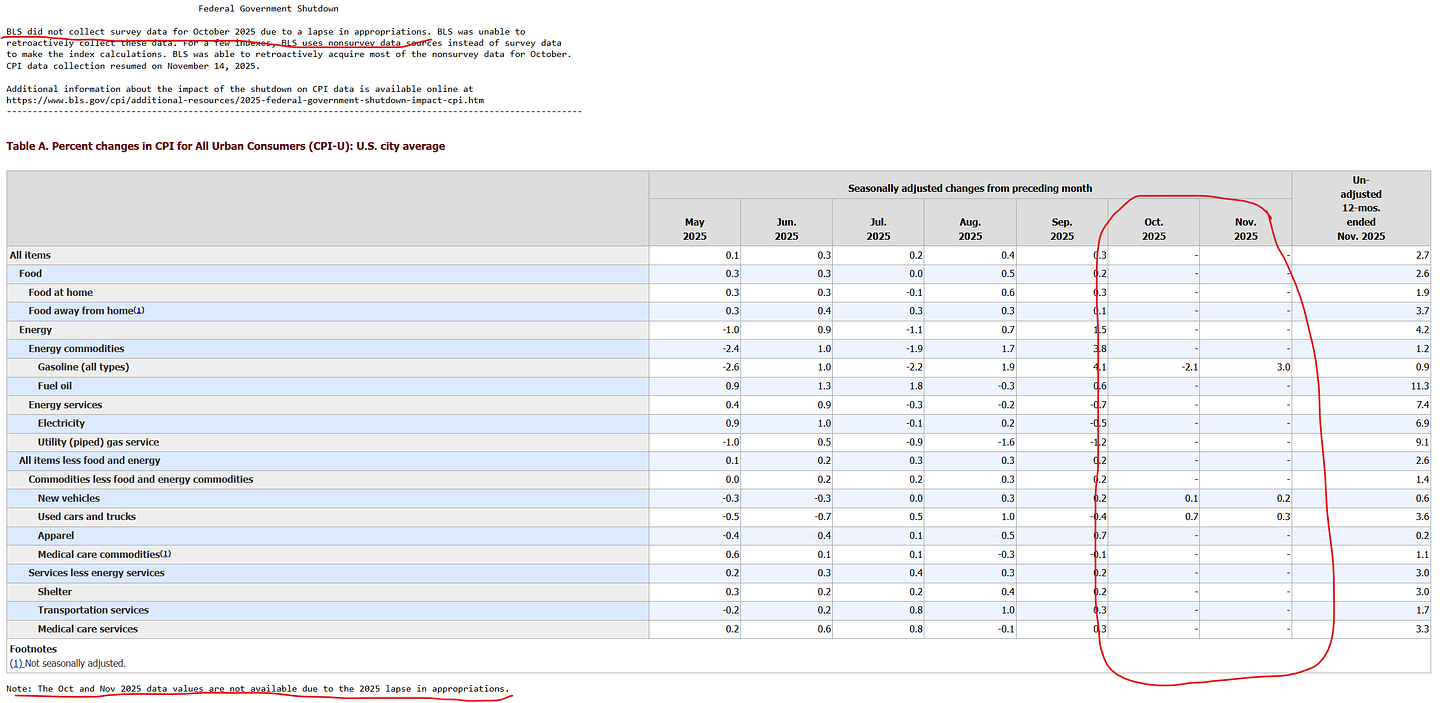

Inflation-Deflation FinTwit was enfuego today with hot takes on how deflation impulse was good for stocks (and Fed cutting) - all from a MUCH lower than expected 2.7% reading that helped markets gap higher pre-market after the MU massive beat last night. But the truth is, today’s CPI report should be taken with a grain of salt given lack of data during shutdown. (As in a LOT of missing data.)

Anyway, the Dec report, due in early Jan, will carry more weight for Fed - many of whom are on record with stagflation concerns.

Stagflation Is Really The Risk -

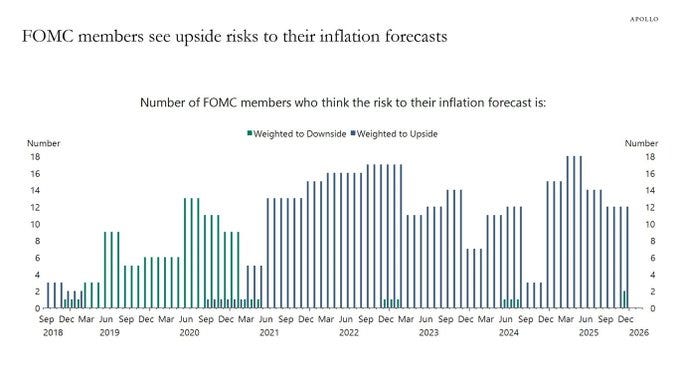

Fed Sees Stagflation as Biggest Risk in 2026. Yup, that was the heading to accompany charts from Apollo’s Slok.

FOMC members foresee rising inflation and rising unemployment at the same time.We will get another chance at inflation data premarket Friday with PCE.

Quant Take -

Nomura’s Charlie McElligott says that the AI investment theme has shifted from CAPEX euphoria to a rigorous “adult” phase demanding quick ROIC and monetization amid valid concerns over debt/financing pressures. However he says, much of the recent sharp selloff stems from year-end profit-taking and P&L protection after strong 2025 gains, exacerbated by leverage (options and leveraged ETFs) acting as negative gamma to accelerate downside velocity.

“I also believe that some of this has become pin the tail on the narrative to justify the reversal of the initial euphoric price-overshoots, as investors struggle to rationalize the magnitude of the up up up, then way way down swing… which again in my eyes was at least a partial function of many investors having enjoyed a really good year in no small part thanks to this AI trade, and wanting to lock-in / protect P&L into the calendar turn… which then saw profit-taking snowball into something sloppier, especially with the amount of leverage in the trade which acts like Negative Gamma feeding the velocity of the price moves up & down, both real (Options) and synthetic (Leveraged ETFs).”

Taking a step back into macro outlook, the just mentioned repricing of cross-asset markets for better than anticipated economic growth and inflation outlook for 2026

...seems like an overshoot to me as well (we have seen vol sellers stepping-in / paying high strikes to fade some of this shorter expiry hawkish reflation stuff), and an opportunity to pick-up deeper ’26 cutting cycle than anticipated type trades due to lower inflation and ongoing weakening in labor markets, despite goldilocks type growth… which in turn should also benefit buyers of (now well-discounted) secular growers equities again too, which don’t need hot cycles to grow earnings & profits

....the above speaks to a continued range trade compression where this tug-of-war has just bled the vol out of the market… but at the same time, showing that the range compression is so historically low that we may have nowhere to go but up (wider rates range, wider distribution of outcomes, higher vol / vVol).”