Macro-To-Micro In A Nutshell

UE Above Powell’s Line-In-Sand -

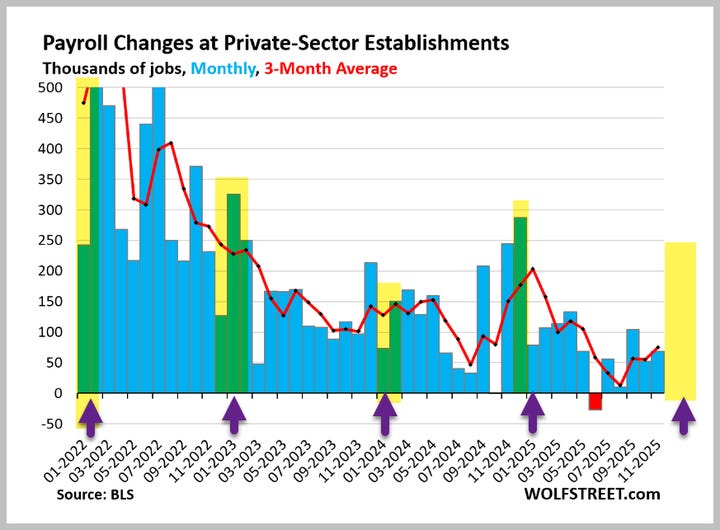

Unemployment rate moved higher today to 4.6% - above Fed Powell’s level of 4.5% where he intonated in the past that normative cuts could turn accommodative. (Read: front-running recession risk). I thought that’s what they already did with the 75bp cuts since September?

Of note: Govt lost -5K jobs in Nov, but Fed govt job losses in Oct were -162K (remember the early retirement folks?).

The U.S. federal government has lost 271,000 workers since President Trump took office.

AND for every 1 govt employee who lost their job, it is estimated that 3 more federal contractors are let go ...

My bet: we haven’t seen those numbers hit private employment. Especially as January will likely show more layoffs (highlighted area/annotations mine) given seasonality in waiting until after the company’s calendar year, & the holidays, to notify employees they have lost their job.

Since bad news is good news to market bulls, it makes sense that January FOMC rate cut odds stay bid.

End of Week Drama -

I think MU could be a bigger reason for a sell-off post earnings Wed night into EOW - ahead of CPI data Thursday morning - than is priced in.

Add to that, Thursday we have BOJ rate decision and whether or not they give forward guidance.

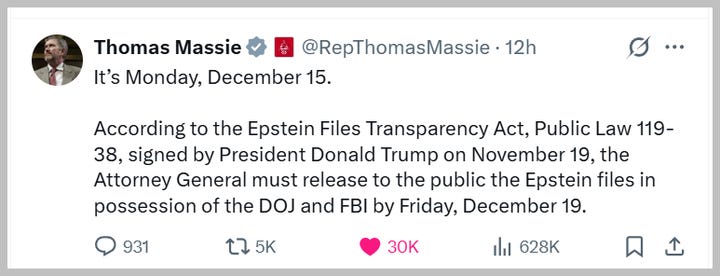

PCE Friday along with Dec monthly Options Expiration will be made more eventful given it is EPSTEIN FILES TRANSPARENCY ACT day.

Assuming there is copy to read after the many months & millions of redactions.

Oh, and add to that a recently unplanned & JUST ANNOUNCED Trump impromptu “Major Announcement” Thursday evening!

Is it in defense of Susie Wiles or announced attack on Venezuela...

A forced armistice agreement between Russia & Ukraine...

Or Cabinet changes?

Or just front-running to set expectations before the Epstein file release??

With VIX expiry Wed, we will have an opportunity to hopefully see if this market can move out of its tight range-bound, low-volume, year-end holiday trading!

Year-End Target -

Consensus sees S&P ending the year with a strong return of ~16%.

The Street’s current implied S&P price target is +16.7 percent higher than Friday’s close, the third highest expected 1-year return over the last decade.

via Datatrek

Translation: 2026 IS PRICED FOR PERFECTION.

US equities cannot afford a sustained macro shock as both current valuations and expected returns reflect a very fault-intolerant market.

My bet for October was we had reached TOO MUCH OF A GOOD THING, and that market would not break into new highs but grind sideways into year end to effectively destroy the crowded call-wall. Now that we have experienced solid distribution sideways in indices and rotation out of AI story stocks into more boring, low-beta value and oversold consumer cyclical plays, it would not surprise me if we still snake sideways around 6666 - give or take 250 points in both direction - UNTIL the distribution runs its course before we get a confirmed direction. This could easily be another month.

With that, I have a 20% chance we could break out to new highs in Q1, but right now.. I still see STALL ZONE with more risks to the downside than up.

But for now: the focus into year-end is CAPITAL PRESERVATION and patience - both personally and professionally