December 12, 2025 Live Trading Room Market Recap & Trades - (Samantha and AI Briefing notes)

FREE POST TODAY TO SEE WHAT YOU ARE MISSING!!

Macro-to-Micro In A Nutshell

10Y yield is still pressing 4.2% - That’s exactly where we were Fed day/post Fed cut.

That’s because Fed controls the Overnight Rate, but the Bond Market (capital B.M.) controls longer duration rates. And clearly the bond market is pricing in rising term premia (as warned) and the inflation Fed will cause (which is why dollar is falling & Industrial/Precious Metals are rising).

In short, we don’t own enough gold:

“American barely own gold. Gold ETF’s are just 0.17% of U.S. portfolios and physical gold buying is low. That means even small inflows into the metal could push prices sharply higher”. Goldman Sachs

My RECESSION INTO ALL TIME HIGHS theme continues...

U.S. LAYOFFS ARE ON TRACK TO EXCEED GREAT FINANCIAL CRISIS LEVELS: U.S. EMPLOYERS ANNOUNCED 1,170,821 JOB CUTS IN 2025, THE SECOND-HIGHEST TOTAL IN 16 YEARS

It wouldn’t be surprising to see layoffs accelerate after the new year. Many companies delay cuts until budgets reset in January, and so folks aren’t hit into the holiday, because that is just cruel. But, point is: the real adjustments to budgets often start after the holidays end. They will soon end.

At the same time, U.S. home prices go negative for the first time in over 2 years.

Translation: the biggest engine for collateral values, upon which the US private sector credit is based, is weakening enough that we should start to see if affect equity buybacks / corporate refinancing in the future.

NVIDIA in trouble?

“Nvidia was the most prominent name cut from several quality-focused portfolios...

During its semi-annual rebalancing, MSCI made the decision last week to purge some Big Tech names. The decision to drop these stocks was driven by specific “quality” metrics:

The removal was primarily due to a technical metric called “accruals,” which measures the difference between reported earnings and actual cash flow. For companies like Nvidia, massive capital investments in AI infrastructure led to higher accruals, causing them to lose their “high-quality” status. via MSCI

More Rebalancing on the way:

Invesco QQQ Trust (QQQ): As of mid-December 2025, the Invesco QQQ Trust is undergoing a major structural change as Invesco attempts to convert it from a unit investment trust into an open-ended ETF.

Roundhill Magnificent Seven ETF (MAGS): This specialized ETF, which focuses exclusively on the “Magnificent Seven” (Apple, Microsoft, Alphabet, Nvidia, Amazon, Tesla, and Meta), saw a significant slump in early December 2025 as investors rotated capital away from growth and toward value stocks.”

TRADE UPDATES

VALUE names long & GROWTH plays short as a theme continues to work. (see prior day’s posts for targets for which AVGO & MRVL hit)

Short Chases/Swings of late: NVDA, AAPL, META, MRVL, NFLX, CRDO, HOOD, AVGO, ORCL

Consumer Cyclical Longs (from late Nov): LULU, JBHT, ANF, EL, DG, DLTR, ADBE, CRM, TGT

RIVN - Swing long from 14 working GREAT & said I was bullish into AI & Autonomous day before Friday it spiked low to high 24% - hitting wkly resistance at the 30W near 18.77. Still in good shape for higher into 22 in Q1.

TLT - working nicely lower, hitting 87.24 on target with 85.48 potentially by EOY

“Debasement” Trades continue to work.

AA, MT, FCX, RIO, GLD, SLV, GDX, GDXJ

10Y2Y yield curve steepener

New:

APP - round 2!! Yup, rejected at 726 on cue before dropping -6% intraday. Lol. Now needs to get < 667 to move back into 525 area.

RBLX - swing short: when 87 wkly support breaks, I have 80 then 73.71 before potential 67.05 then 60.50 IPO support.

F -swing long Ford actually shocks the heck at me, but it looks great now that it’s > 12 monthly pushing into 13.95 resistance with 14.85 critical resistance to get above then 16.68 before this travels higher into ~24. The March 15C stand out or a financed call spread (12P sold to finance 14x17CS for $.30).

UNH - swing long > 324 with 342 breakout on way to: 355, 366, 376

MSOS - gapped up on Trump announced cannabis reclassification to trigger long at 4.94 with 5.32 - 5.55 as targets. Now it must stay above to get/stay above 6.02 but could take many weeks of digesting sideways to do so and option IV is jacked as MANY of the components are penny stocks/near penny stocks so of very little interest to me honestly.

CMG, SHAK, CAVA - all are trying to base & move higher. I already rec’d CMG. A few more for you to chase as part of my oversold Consumer Cyclical plays to have in mind next few weeks.

Market Direction

Irony: I gave 14.88 as VIX level for a bounce (check the AI briefing doc)

and that is EXACTLY where we bounced intraday Friday. And yet, VIX closed at 15.88 as SPX closed -1% lower with QQQ -2%.

I also gave QQQ 613 & SPX 6807 as targets short & to look for bounces there.

Otherwise, we head to 602.87 QQQ & 6700 SPX pretty quickly.

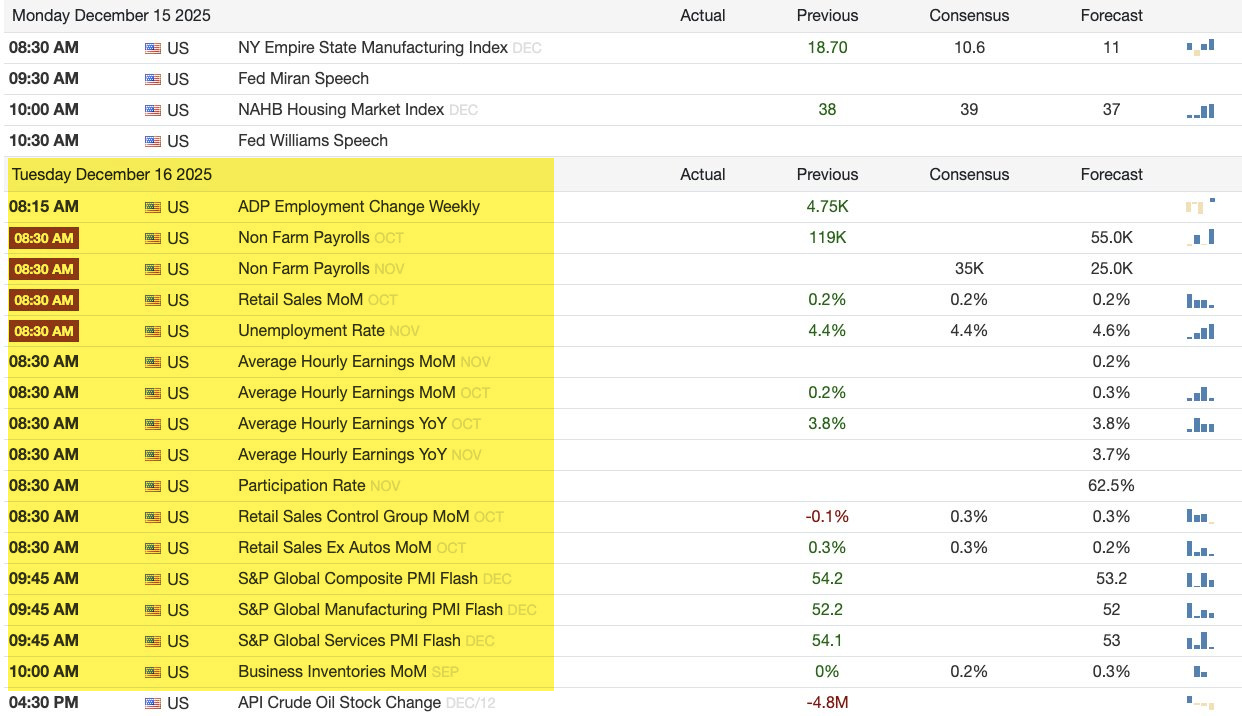

Market is nervous ahead of payroll reports Tuesday not to mention Options Expiration AND Bank of Japan Friday!!

Hope you had a great weekend!

See you in the trading room tomorrow.

Here’s the AI Briefing for Friday: (unedited)

Your insight into the bond market pricing rising term premia, which aligns perfectly with your earlier inflation warnings, offers such a precize market explanation.