Dealer Gamma Flows Matter to Market Returns!

First, a refresher:

Option dealers are “liquidity takers”, and as such, they 'make the market' move! This is why I track this money flow in options and why @Tiff uses gamma extensively in her trading which she posts under #tiffs-gamma-flow.

GammaLab on dealer flows:

it currently takes only 10MM to move the market by 20 bps and will adjust their delta hedges cyclically (if the market goes up they buy more, if the market goes down they sell more).

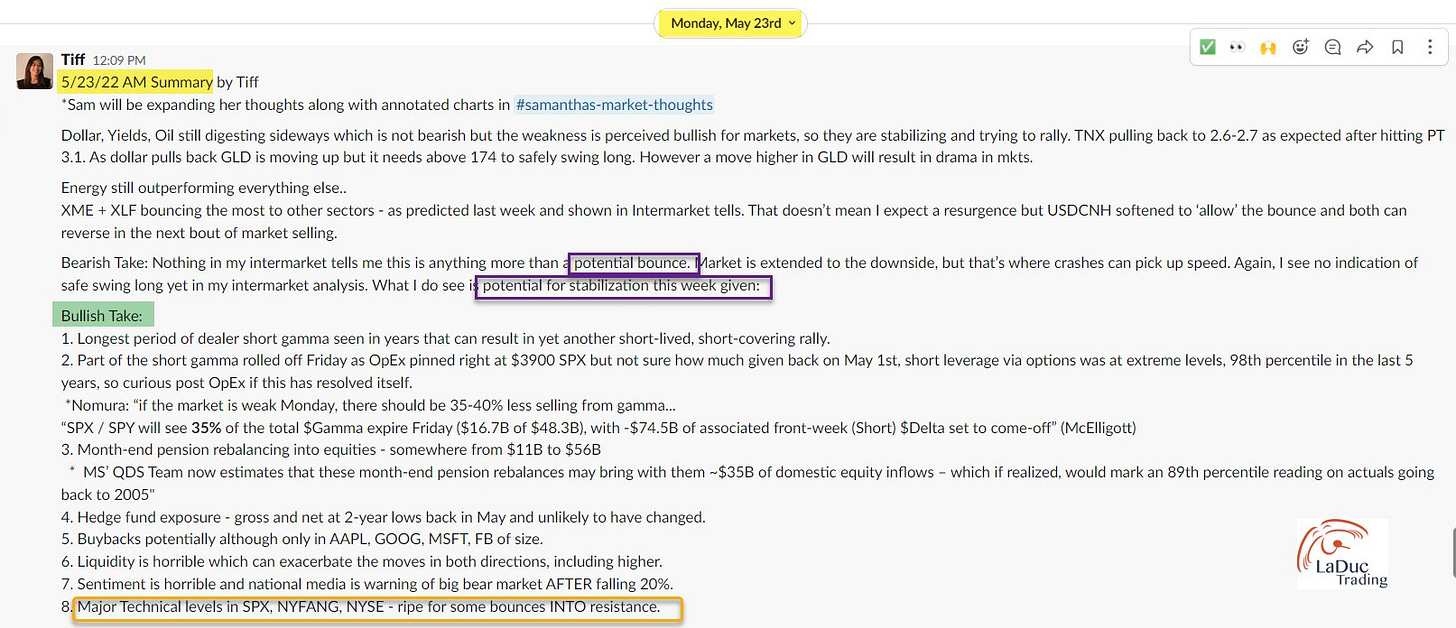

Post FOMC minutes Wednesday, the prospects of lower rates/fewer hikes (market narrative not mine) translated into a sharp short/gamma squeeze. This was what I was watching for since Monday (see screenshot from May 23 - "Bullish Take":

Longest period of dealer short gamma seen in years that can result in yet another short-lived, short-covering rally."

Then, McElligott on Wednesday suggested

those hoping for a “Bostic pause” (as the media took to calling it) may be disappointed. But now that the Fed has successfully engineered i) a sizable correction in stock prices, ii) a material widening in credit spreads, iii) sharply higher mortgage rates, which are spilling over into the housing data, and iv) a slowdown in activity as measured by PMIs, the incentive for incremental hawkish escalations may have diminished.

Nomura' team even modified their rate hiking predictions: wherein they had previously called for consecutive 75bps hikes, they now see only three 50bps hikes instead.

That's a Big Shift in Fed expectations that helped drive the quants. Here's another: the systematic buying by dealers leads to re-leveraging/re-risking/re-allocating from the CTA crowd, which McElligott tracks closely.

Daily changes in SPX of “just” 1.5% would drive +$12.1B of buying over the next 1w; +$23.3B of buying over the next 2w; and +$26.4B over the next month

Even spicier, daily changes in SPX of “just” 1.0% would drive +$15.3B of buying over the next week; +$26.7B of buying over the next 2w; and +$32.6B of buying over the next month

So basically, the "Fed Pause" market narrative overcame universally disappointing economic data (GDP, housing, etc) this week to meet month-end pension and quant rebalancing flows - post Friday's OpEx.

The Fed pause narrative may be early (leading indicator) and economic data late (lagging indicator), but market gamma option flow is very much front-and-center, so it matters to market returns.

Tier1 Research out this morning - which I read off to live trading room members:

several large call expiries between 4075-4200 that may now function to pull markets higher in the next few sessions.

Leading into this morning, we rose 7.7% gain from lows - when I posted:

For Nasdaq last price: $4058; Zero gamma: $4265. For SPY last price $299; Zero gamma $310.

I had SPX $4129 as PT. We closed on the highs as $4158. I had QQQ $303.50. We closed at $309!

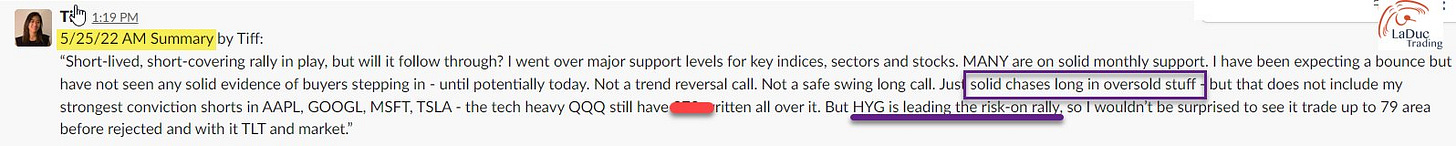

Dow had led this advance as called out Monday followed by Russell outperformance Tuesday.In each of my Thursday and Friday morning live trading room sessions, I emphasized to clients that we had 'trend days', which is the opposite of chop days. This was easily identified by strong breadth, systematic buying as demonstrated in my cumulative volume indicator (and made available to FishingClub members on the Indicators Page), along with falling VIX and soft dollar and yields but strong HY and Junk bonds, specifically HYG to $79/80 which I called out Wednesday. All called out in my live trading room this week.

Once again, this rally served as a great example of market structure from option flow, illiquidity and reflexivity.

But let's keep all in perspective: I'm still a bear! I'm not ready to jump in short until I see a clear reversal, but I have continued to believe strongly - and gave my biggest pitch for concern in my afternoon trading room session, that my Nasdaq multi-year top call is still in play, that flash crashes happen from oversold not overbought, that we will make a new low in June/July, and that big picture: Being Bullish Markets is Fighting the Fed

Being Bullish Markets is Fighting the Fed

For me, the question is simple: Is this reduced ‘sense of urgency’ to hike in light of “peeking inflation“ mantra sustainable?

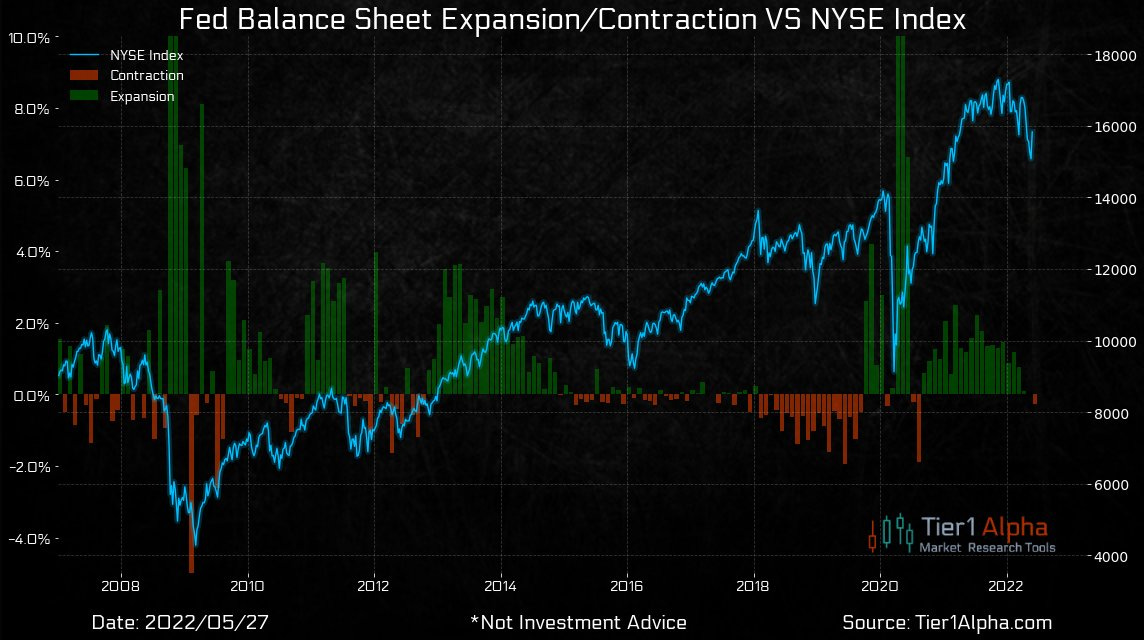

Earlier this month, Fed announced their plan to allow $30 billion of runoff for 3 months before eventually raising it to $60 billion (see chart of Fed balance sheet expansion).

The levels of inflation are still at 40 year highs, with continued war and supply chain shocks keeping inflation more than sticky.

Oh yeah, and we have an energy crisis, globally, and oil and gas continue to close very strong - with crude oil very close to launching much higher (wkly close > $116).

So despite this fabulous 3-day rally, keep it in perspective. Also note how the rates market hasn't moved much from Wednesday on the Fed Pause narrative, as it had already topped at 3.1 on the 10yr and is pulling back as I predicted to the 2.7% area (10W) (with overshoot to 2.55% possible).

Obviously, the decline in volatility triggered buying of calls (as we tracked live in my trading room as one of the key tells to stay long and press the chases). And yes, above $4K SPX can imply a strongly bullish bent both psychologically and to dealer gamma flow, but the still-hot inflation data, weakening economic data not to mention spiking energy costs underscore the scale of the problem central bankers have around the world.

Basically, this short-lived, short-covering rally I have called since Monday has run hot on a market narrative of reduced ‘sense of urgency’ to hike in light of 'peeking inflation' mantra.

And this is seemingly exactly what the Fed wants. First, a gradual deflation of the asset bubble, higher inflation, slowing economic growth and rising unemployment. On that latter point, Powell went so far as to say last week that unemployment is too low He said the natural rate of unemployment is closer to 5% than current 3.6% and likely rises back to its mean.

Curiously, I warned about this higher unemployment rate coming as projected in my #intermarket-tells on unemployment claims which I have posted past few weeks. Companies announcing hiring slowdown just this week included AMZN MSFT WMT NVDA FB SNAP and many others.

For market bulls, despite all of this strong inflation and slowing growth, they still think the Fed Put exists. That the Fed will narrowly avoid 1970s stagflation pain - higher inflation, slowing growth + rising unemployment - without bursting the equity bubble.

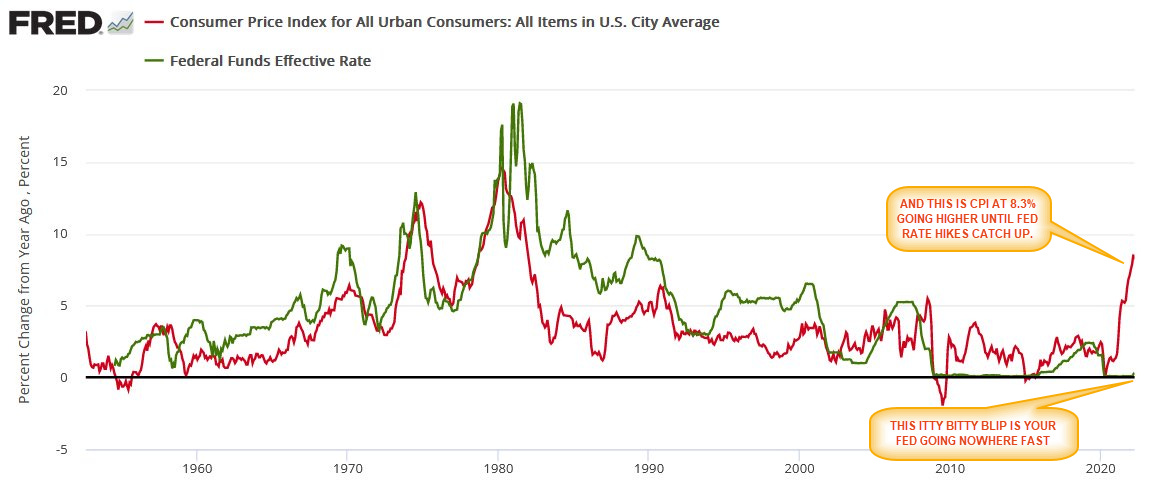

But as you can see from the chart of CPI overlaid with Federal Funds Rates over the prior decades, the Fed has no history of 'soft landings' or even inflation containment without massive rate hikes to play catch up. Being bullish risk equities big picture is fighting the Fed.

Steve Sosnick, Chief Strategist at Interactive Brokers, posted a piece today that takes us down memory lane on how the Fed Put has worked in the past and where it might be moving forward:

"Wherever the Fed Put may be struck, it is clearly at a deep discount to the market."

Steve and I discussed this very topic in his interview of me in which I gently argued, "tops are processes, bottoms are events" of Fed intervention. And we have none, just the hope of a Fed pivot - that I suspect will get unwound just as quickly as the shorts covered this week.

But first, the long weekend!

I wish everyone a nice break on Monday as the market (and trading room) are closed!

/Samantha

Don't miss:

Samantha's interview on the recent IBKR podcast with Steve Sosnick - Chief Market Strategist at Interactive Brokers - is up!

Traders’ Insight Radio Ep. 21: Things Over Paper