Dancing Closer To Global Bond Volatility

With Trade Updates on Gold, Silver & Miners

In this interview recorded on Jun 10, 2025, Jason Burack of wallstformainst and I discuss the growing risks to the U.S. economy and financial markets as fiscal policy takes center stage. Obviously, this talk was before Israel attacked Iran, but it does not change what I have seen forming for a year now.

I argue that the US is in a “fiscal dominance” regime where runaway government spending, sticky inflation, and rising interest payments are keeping bond yields elevated, and how rising prices against rising jobless claims will pull recession risk forward.

I continue to see end of year as particularly vulnerable, especially as tariffs are deployed into a budget reconciliation bill that could very well result in government shutdown, which would be very negative risk assets.

While stocks have rallied on liquidity and policy interventions since the GFC, and particular Covid stimulus, I warn it is but a "monetary illusion" and is at risk of turning into an inflationary trigger that will hurt more than help US.

Amidst all this, I remain long-term bullish on gold and select commodities—particularly miners, silver, and uranium— due to strong macro fundamentals and continued falling demand for US dollars.

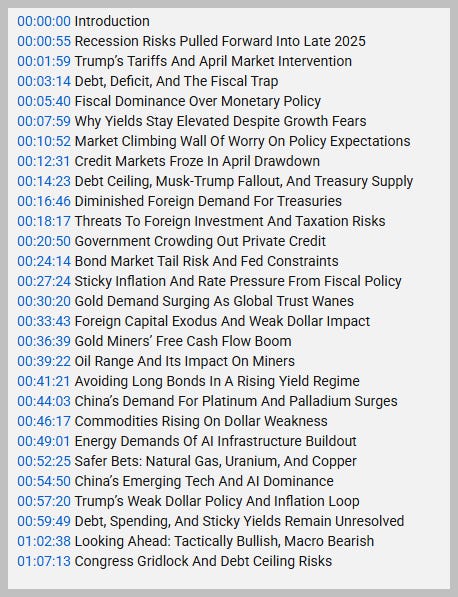

Access the table of contents in the recording for detailed thoughts:

GOLD AS RESERVE CURRENCY & UPDATED TRADES

Before I post my updated charts on gold, silver & miners - with my warnings - let this sink in…

Gold overtook euro as global reserve asset in 2024 is a big deal and why this macro trade is not done - big picture. In fact, I wrote about this monster sector rotation back in APRIL 2024 - highlighting its role as FX neutral reserve currency.

Fast forward: huge gains have been made. The trick now is not to lose them.

You don’t want to miss this review…