Crypto Craze Drives China Chase

But can it last? THIS was the question I posed in #chase at noon after Tiff warned:

Blackrock cusip has been removed from dtcc list.

https://blockworks.co/news/blackrock-ibtc-bitcoin-etf

Since the market was 'bullish' last night/this morning due to bitcoin spiking higher on expectations of approval of the Blackrock ETF, it bears watching to see if the run in crypto - and China plays since market open - could last.

China plays were also helped by this headline supporting the potential for more Chinese stimulus, in one form or another:

Xi Jinping made his first known visit to the nation’s central bank.

Some see gold and bitcoin as 'safe assets' and given how hard gold ran up on Israeli War headlines, some were expected Bitcoin to follow.

With the rumored news of Blackrock ETF approval coming soon, "Digital-Gold" bulls argue the ETFs would widen adoption of the cryptocurrency.

Crypto skeptics wonder if this is just exit liquidity, as thinly traded assets in after hours are easy to manipulate.

Love this quote by @RJRCapital:

Bitcoiners, you don't understand what you wished for and what BlackRock is going to do to Bitcoin. Ask a gold investor how having futures contracts and GLD has worked out for them.

They don’t understand futures contracts are a tool to control a market that they previously couldn’t control.

There is also the backstory on both crypto and gold as largely manipulated by China.

But that's for another day.

My point is simply that a lot of these moves are made using Monopoly money.

And just because Bitcoin is rising on potential BlackRock ETF, it is absolutely not a thesis to go Long US Stocks.

Bitcoin is not a risk barometer to me.

It is an offramp for equity liquidity in lieu of volatility.

It’s one way they suppress VIX and why it correlates with QQQ - but with diminishing returns.

A break below $BTCUSD $33K could be eventful.

Already seeing profit taking/shorting in MSTR MARA COIN BITO GBTC

Earnings Disappoint Thus Far

So far, not so good!

Q3 US earnings season has started poorly, with fewer than average companies beating estimates. Analysts are taking Q3/Q4 numbers down as a result. This week, when 32% of the S&P 500 reports, needs to be better. DataTrek

From an options standpoint, it is surprising that vol is not more elevated for this week given Mag4 or the 7 are reporting: MSFT, GOOGL, AMZN, META.

Bunch of names reporting this week as we head deeper into earnings season. What remains shocking to me is there is absolutely no event vol baked into $SPX right now (from an earnings standpoint). Few big names this week and the Friday straddle is slightly under 1.5% ? Kris Sidial

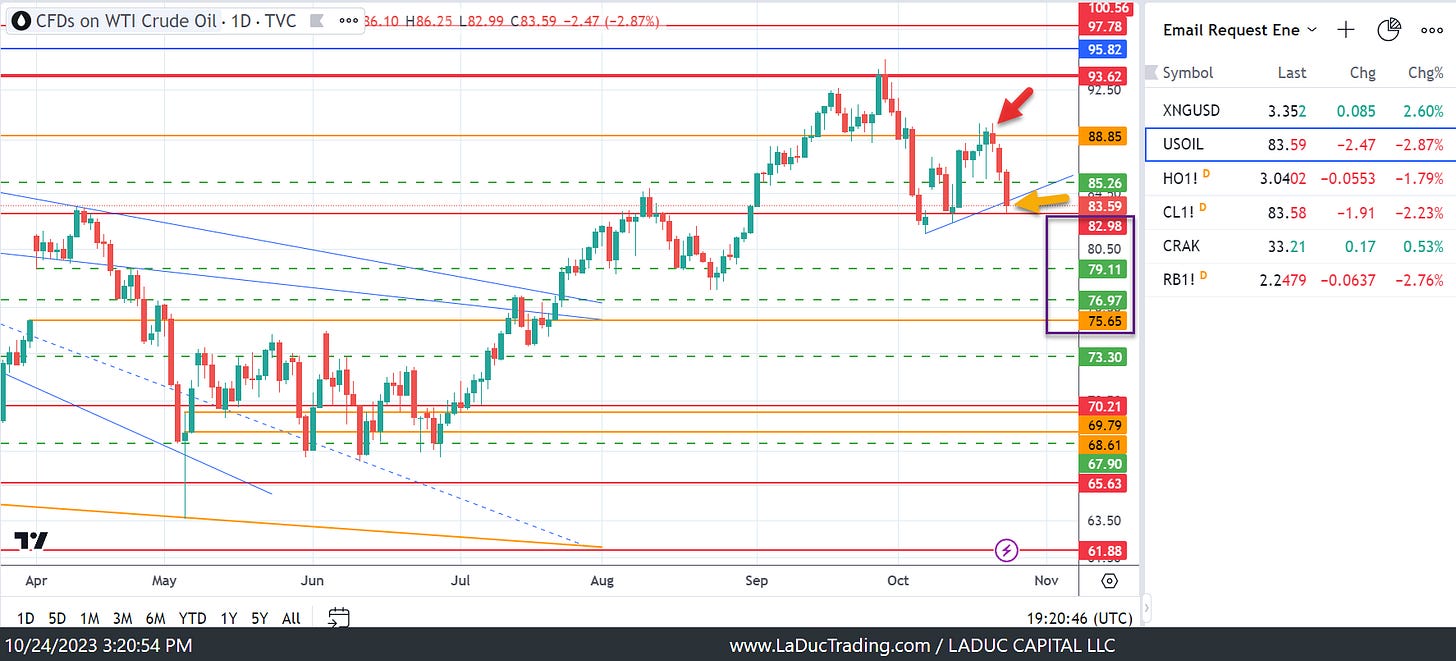

Oil Short Thus Far

I recommended an XLE short last week that is working well.

Energy is the only sector not in a bear market.

And as posted in #bobs-oil-and-gas, speculators have largely left.

It doesn't mean I suggest shorting Oil or Gold outright during a conflict!

But oil is a casualty of war in that demand destruction often trumps supply disruption.

SiriusXM Interview

Each month I am interviewed by @janetonthemoney from @SXMBusiness.

This month the focus was on why yields are rising, markets are weak and oil as a casualty of war.

Did you enjoy #samanthas-market-thoughts posted above? Then you would love full access to her and her live trading room, detailed macro and intermarket analysis, not to mention full portfolio of trades across Chase, Swing and Trend timeframes!

Upgrade to CLUB or EDGE today!