Critical Levels For Quant Quakes

A conversation for those who like to geek-out on market structure.

Historic Dispersion

CTAs are Vulnerable

Negative Gamma

The Week Ahead

Gamma Mechanics

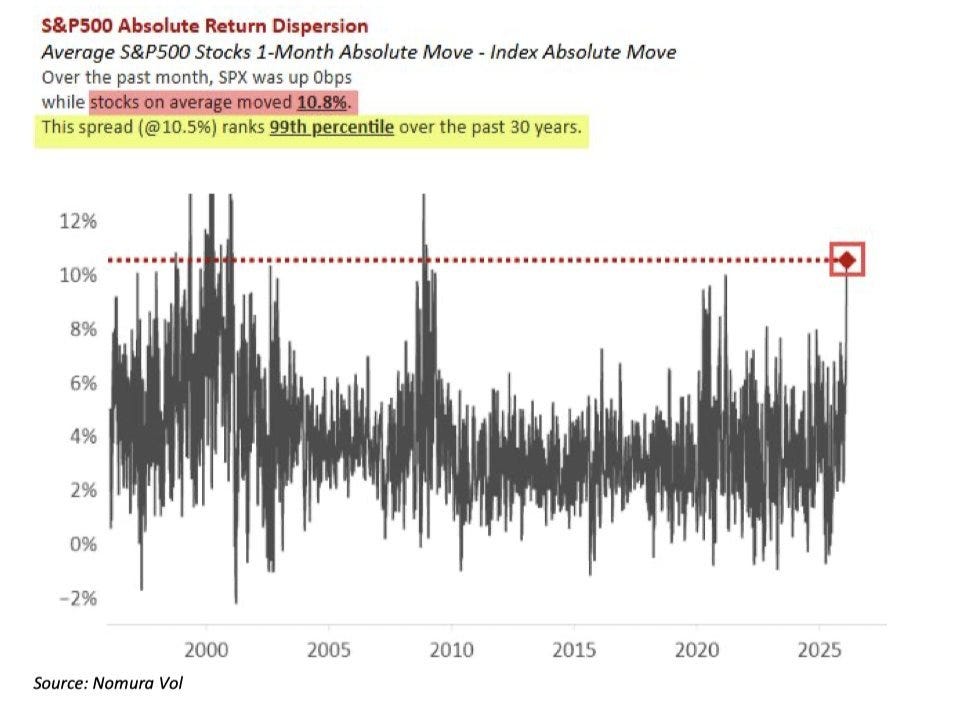

Historic Dispersion

This has been “THE theme” for quants in 2026: rotation under the surface caused by tech weakness and value strength that manifests in hedge fund factor rebalancing of size.

Yes, THAT growth-to-value sector rotation I called in November to last through Feb before volatility Mar into May. THAT was my call and it’s still in play before a massive de-risking in MAG7 and SaaS unwind showed up along with a very-well timed warning for metals and crypto volatility - as money rotates into:

Value over Growth

Cyclicals over Seculars

Defensives & Low Beta (even bonds) as proxies over Volatility

The result:

“the S&P index Spot return is 0.0% since Jan 15, but the “Average S&P 500 Stock” absolute move is a blistering +/- 10.8%, i.e. Spread 99%ile over the past 30 years…

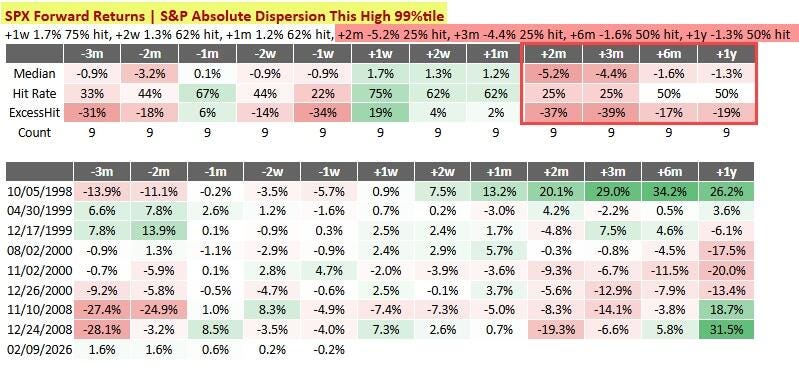

The latest “99%ile Absolute Dispersion Spread” event has occurred 8 prior times, so this is the 9th. And with that, forward returns can be challenging... h/t Nomura

And why I remind often:

IN LIEU OF SECTOR ROTATION THERE WILL BE VOLATILITY