Crisis - In Confidence

Credit disruptive behaviors hurting stocks AND bonds.

My Secret Sauce

What if I told you the selling isn’t done? Would you believe me?

INTERMARKET ANALYSIS - WEEK ENDING APRIL 5, 2025: BOTTOMS ARE AN EVENT

1st sentence: VOLATILITY IS NOT DONE BIG PICTURE

…lots of charts & annotations & levels from global markets, FX, fixed income, volatility…

Last sentence: TRANSLATION: DON'T FORGET TO HEDGE - ESPECIALLY IF WAR WITH IRAN STARTS TO ESCALATE - AS THIS MARKET SELL-OFF IS NOT DONE BIG PICTURE UNTIL WE GET A MACRO EVENT TO STOP IT.

This focus on Intermarket Analysis is my weekend deep-dive for CLUB/EDGE clients where I showcase all of my funky cross-asset analysis to identify inflection points, trends, divergences etc to better time market direction, sector rotation & volatility. It really is my secret-sauce that allows me to apply macro event risk as backdrop with my technical analysis on any asset and across any timeframe.

All weekly intermarket reviews this year have been bearish. Actually, I turned bearish Nov 12th in preparation of what was to come:

NOV 12, 2024: INTERMARKET REVIEW - Peak Oil & Semis & Tech As Gold Digests & Value Resets for 2025

NOV 25, 2025: INTERMARKET REVIEW - NOTHING TO FEAR ... YET

DEC 13, 2024: INTERMARKET REVIEW - MELT UP INTO INSTABILITY

DEC 27, 2024: INTERMARKET REVIEW - UNDERCURRENT OF WEAKNESS PERSISTS

JAN 8, 2025: INTERMARKET REVIEW - WHY I DON'T TRUST THIS MARKET

December 2nd I warned that I saw the start of selling under the market.

We topped December 6th in SPX at my $6010 2024 price target.

I warned the air pocket of risk was growing despite the market's advance...

Then Feb 19th I warned again while recommending (LRE = low risk entry) short in QQQ at $539 & SPX $6110. The rest as they say is history. And in every weekly review since I have demonstrated how these mantras are still in play:

MONEY GOES HOME

BUYERS HAVE YET TO RETURN

WE ARE THE EXIT LIQUIDITY

Long story short, this is how I have been able to guide clients to $4878 SPX - a level I gave weeks ago. Now that we are here I can foresee a good amount of chopping this week inside today’s 400+ point SPX range: 4835- 5246. The problem is stuff is so broken it WILL take time to repair.

The other problem is that I still don’t see VIX topping just yet and I still don’t see net selling done. Much closer, and yet as warned, oversold is bearish. It is not a reason to buy. Basing and turning higher on fundamental & macro reasons will be the reason, but we have none of those yet although we already got a teaser on how quickly the market can recover on even the rumor of good tariff news.

Liquidity Sucks

For option traders, we know when market makers don’t want us in, AND, don’t let us out! Bid-Ask spreads blow out. Volatility has exploded in equities, commodities, bonds - you name it. That’s what happens in a GLOBAL MARGIN CALL and we just had 3 days of it!

A professional rates trader I know sent me this:

I've traded for 30 yrs and never seen such lack of liquidity. This is a broken market for now and the best trade is to not trade. My SOFR carry structures are engineered to be resilient to these moves, and have been, but there is zero liquidity in that space as well. Hand sitting is sometimes a good trade.

Retail is not the only one suffering. “Pod shops”, heavily leveraged hedge funds and the like, are also closing. We have had outsized moves in a very short period of time. At one point last night, the Fed Funds Rate was pricing in a 30% chance of an EMERGENCY MEETING. That dissipated today, but the point is, THIS is why I warned:

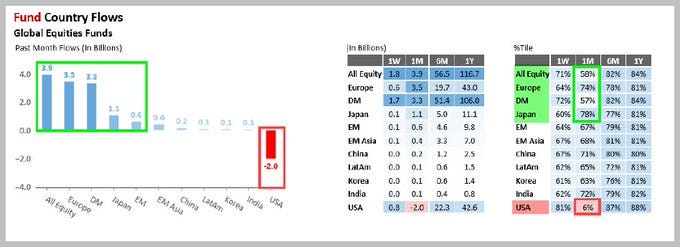

The past week’s notional net selling was the largest in 15 months and second largest in the past decade (-4.3 SDs 1-year). GS

And MONEY WENT HOME