COLOR ME SKEPTICAL

Bull Trap, Anyone?

Bitcoin and Nasdaq are liquidity pigs. They suck in the levered money and don’t ever want it to leave because when it does, the rate of change in the bull run would end.

There are early signs this is changing... under the surface and in the AI story stocks (read: Nvidia) and Crypto Cabal (see Bitcoin) getting banged up of late.

I know the market’s faith in Santa (read: Seasonality) is strong, but don’t forget to hedge..

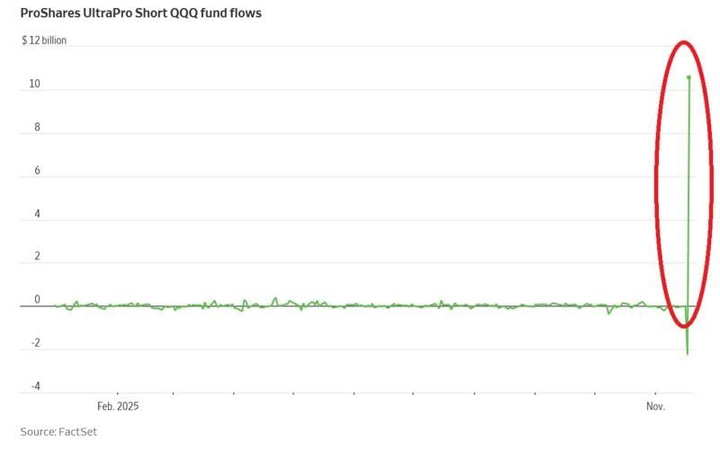

Just last week we saw THE biggest inflows to SQQQ evah (the short QQQ triple-levered ETF used mostly by retail). Maybe it’s nothing.

In general, liquidity is tightening until Fed cuts (Dec 10th?) and stops its QT (Dec 1st), but the market is front-running this as usual and pricing that in NOW.

So now the risk is they don’t cut and/or the labor data the following week confirms “recession risk pulled forward”. Then, it’s a bull trap, but the market doesn’t see that yet.

For now, since Williams talked up a Dec rate cut last Friday (triggering the short covering), odds have increased to 85% chance. ADP data helped:

The latest ADP numbers are out and show that over the four weeks ending November 8, 2025, US private employers shed an average of 13,500 jobs per week.

Given the market has also priced in the 10Y back down to my LINE-IN-SAND level of 3.99% (wkly close), I’m not sure another Fed rate cut will even help that much as the trend of sticky inflation, weak labor market, and rising credit distress broadens.

Bears reminding: On the other side of falling 10Y yields with oil, is the carry trade unwind. Yes, that yen carry trade unwind. It is not rising oil & yields that spikes the yen but falling-fast oil & yields. Curiously, while the market is looking for any reason to FOMO into year-end, the mid-Dec TAIL risks I’ve written about past few weeks ... remain.