Catching This Falling Knife Of Metal Madness

A well-timed $8 trillion capitalization wipe out from a gold & silver crash in a 7-sigma move. So when is it safe to go long again?

‘Rare’ Is An Understatement

Let’s Roll The Tape

Crypto Followed Metals

About That Dollar Bounce & Warsh Nod

Metal Volatility Triggers Equity Volatility

‘Rare’ Is An Understatement

So… I truly hope everyone is okay - after a violent sell-off in metals Thursday and Friday, that has no doubt shaken investors from their bullish complacency.

The volatility continues into the weekend for crypto assets. We wait with bated breath to see how Asia opens Sunday night. But with CME triggering even higher margin requirements AFTER precious metals experienced a 7-sigma move - while Asian markets were closed/many sleeping - it’s likely equities are next.

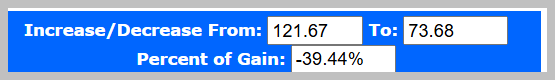

So I asked Grok: “what standard deviation move did silver futures price make from Jan 29th peak to Jan 30th trough (-39%)?” Answer: 7

A 7-sigma event in price movement is an extremely rare, high-volatility occurrence where price moves seven standard deviations away from the mean, effectively representing a 1-in-several-billion probability event in a normal distribution. In financial markets, this signifies a massive, near-impossible market crash or surge, often resulting from black swan events.

Many are debating the reasons for this out-sized move that also saw gold futures fall -16% during the same period (while pulling down Palladium -20%, Platinum -25% and copper -7% with it):

I gave my detailed analysis to clients premarket on Thursday with warning to “PROTECT NOW. WE CAN’T WAIT UNTIL FEBRUARY”

I followed up with a detailed write up in the afternoon including this section highlight: Extreme Metal Volatility Incoming: Top Ten Charts.

My focus was on critical option data, sold-to-you fund flows, supply-demand dynamics with physical inventory eroding on future delivery confidence imploding, SLV restrictions, China silver fund halting, and potential risks on forced LIQUIDATIONS.

I specifically warned that

“a metals squeeze can trigger funding stress and rotation to USD. The same thing I warned about in September before gold & silver had a similar dramatic sell-off and markets sold off aggressively Oct 10th, 2025.”

Let’s Roll The Tape

Okidokey. A 7-standard deviation move in silver qualifies as warned volatility from my January 22nd client post:

Clients KNOW I was warning of METALS VOLATILITY starting next week. I listed macro event risks for most all of February! But it was my TRADING INSTINCTS that pulled it forward January 28th, with the ‘PROTECT NOW’ call live & in my teacher’s voice.

I decided to roll the live trading room tape for Thursday, January 28th. Lots of nervous laughs, and a clear warning metals were about to crash. Have a listen for yourself.

Taken word-for-word from the Zoom live trading room transcript from January 28th:

(starting at min 28 on silver)

“so we’re 100% from my geometric mean.

I’ve never, ever seen that before...

(long pause)

on any chart

(long pause)

All right, well, what that means is 65.

So if we get violent volatility, you have 65 potential flash crash level if you’re looking for ITM puts.

You think I’m joking.”

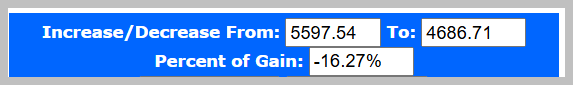

Well, just so happens silver fell -39% AFTER my comment and SLV crashed into a low of $69.12 from $109.83.

Those OTM puts on SLV for Friday screamed upwards to 63,000% on the day.

(min 32.39 )

I talk about the METALS FUNDING SQUEEZE that would trigger a USD BOUNCE and METAL VOLATILITY would trigger EQUITY VOLATILITY

(min 39.15)

“I think this is getting pulled forward, like, I have it for February, between the 8th and the 28th. It might just come a little bit early. It could start

Today, I think it starts today.”

(min 41.23)

“Metals stress is causing market stress right here, right now. I don’t think we’re gonna wait until February.”

“Silver just went red. Silver just does not look healthy to me. It just does not look healthy to me. Dollar’s getting bid. My, reverse psychology is working. I think a metal squeeze is gonna be profit-taking into the dollar.”

(min 1:03)

“Protect Now”

“Not gonna wait. It’s here.”

$SLV was 108.61 at that moment.

Top was 109.83

Bottom was 69.12 a mere 29 hrs later.

a -36.36% drawdown

#Silver futures dumped -39%.

$XAGUSD was 120 (silver/dollar)

“This would not surprise me to just hit the 85 level, right? So before I said this is the monthly breakout, the next is 98, but because the mean here is about 80, we could slice right through that.”

“So you’ve got to protect big picture, because this could get violent.”

XAGUSD (silver/usd) fell -39% into 73.68

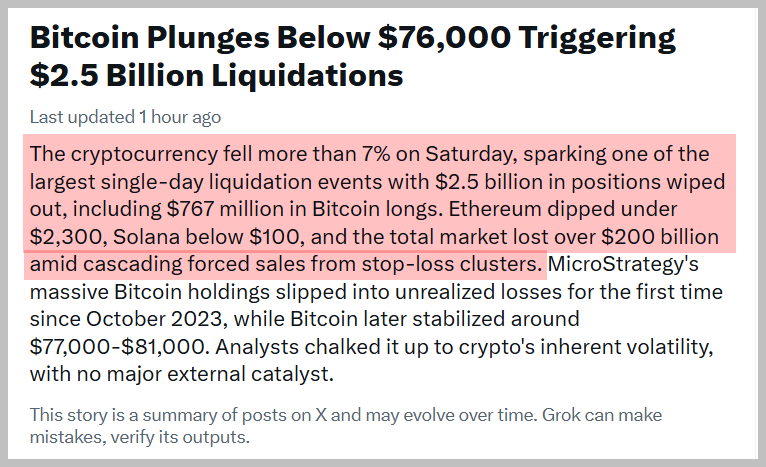

Crypto Followed Metals

Welcome to the weekend…

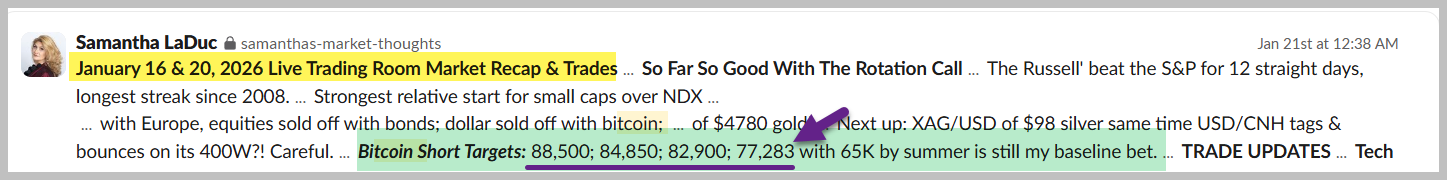

Luckily I warned clients January 20th I expected this:

Bitcoin Short Targets: 88,500; 84,850; 82,900; 77,283 with 65K by summer is still my baseline bet.

Not only did I start my gold & silver warning on Jan 20th, with a BIGGER piece on Jan 22nd, and then straight out warned to “PROTECT NOW” Jan 28th & 29th…

But I also warned of the bitcoin sell-off with 77,283 target ;-). We are there & likely not done.

About That Dollar Bounce & Warsh Nod

Clients already know that last Friday, January 24th, I fully expected the USDJPY to fall into 152 then bounce, pulling USD higher with it.

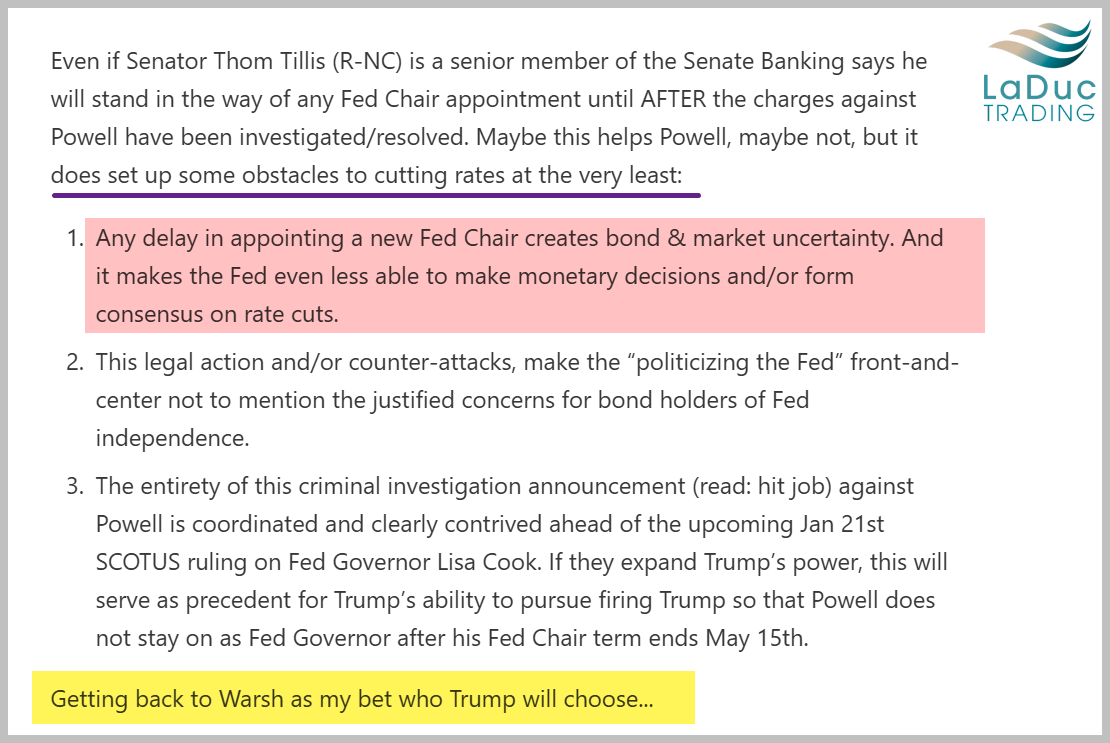

Yen started falling with Yuan / dollar bouncing on Wednesday the 28th - just in time for Thursday evening the 29th when President Trump said he would be announcing his pick for a nominee to chair the Federal Reserve Friday morning.

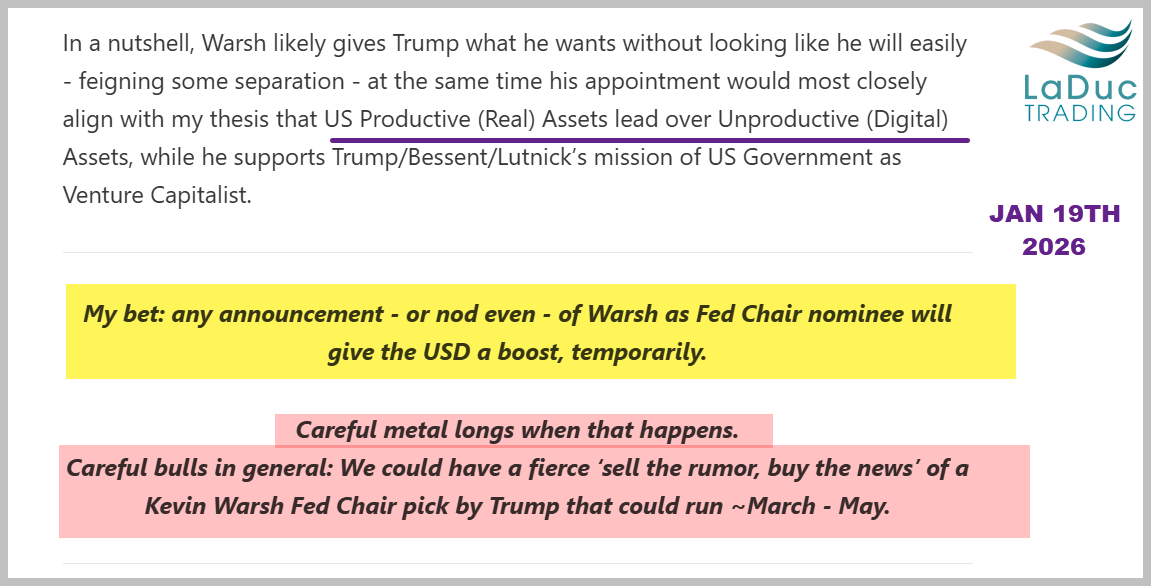

Polymarket odds shot to near 80% for Kevin Warsh. I had already pitched my high-conviction bet on January 16th that it would be Warsh. I doubled down on the 19th in my 2026 Intermarket Analysis Roadmap:

“will give the USD a boost, temporarily…

Careful metal longs… Careful bulls in general”

Most of Wall Street media is blaming the metals sell-off on Warsh and the dollar bounce. Yes, I warned dollar would bounce on Warsh and endanger metal bulls, but I was very detailed in explaining the real reasons: a deep review of the extended options market fire that was about to flame out, on top of the structural supply-demand dynamics that would force liquidation & margin requirements destined to break the bullish flow.

OUTLIERS REVERT WITH VELOCITY, as I often say.

What I got wrong was the timing of Warsh's announcement.