BOJ Surprise Announcement, Or Is It?

CLUB/EDGE post this morning.

Quick market thoughts after closing my trading room.

BOJ ARRANGING TO END NEGATIVE INTEREST RATE POLICY AT MARCH MEETING - Reuters

After this news:

JAPAN'S LARGEST INDUSTRIAL UNION UA ZENSEN REPORTS BIGGEST AVERAGE PAY RAISE OFFERS BY 231 FIRMS SINCE 2013, YEAR ON YEAR.

But then to soften the tone, a few minutes ago they released this article:

BOJ to discuss negative rate exit next week as Japan pay raises grow - Asia Nikkei

If I was a betting woman I would say this potentially massive news is setting up to be a 'buy the rumor, sell the news" I suspect next week.

What's The Trade?

Anyway, for trading purposes, I warned this morning that this news would likely cause a knee-jerk reaction to some selling, or de-risking in part until Big Money can quantify the hit.

There aren't a lot of details, and we already know the unions in Japan likely pass a wide-reaching wage increase tomorrow, so with BOJ meeting next week, they are just getting in front of the wage increase announcement it seems without really committing. Likely they don't move this forward until June/July for real.

But some will wonder: Is this the beginning of the "Carry Trade Unwind"? Too early to say. We have time.

Strong USDJPY is the MACRO REASON for the yields spike and market weakness - on top of strong retail sales and PPI this morning, which together, have contributed to the EXPECTED bounce in the USD + 10Y yield. As such, here are my thoughts on how to play it:

I do believe the JPY 10Y yield will move higher now - currently .77 - in the short-term.

That will cause my US30Y-JPY30Y spread to push lower, pulling indices with it.

GOLD coming back in as warned as USDJPY moves higher. (see chart below)

TLT falling back into 92.83 PT as warned, after getting rejected at 96.33 last week.

See the lower levels for the T-note futures for both 2Y + 10Y bonds (chart below). All is working even before this news hit.

This combo punch of higher yields, dollar & oil, as I said premarket, should cause puts to pay... IWM especially vulnerable with Solar plays given spiking yields.

NVDA short highest conviction below 888... AMD short working from Monday... TSLA 167.50 short PT isn't slowing it down.

MSFT GOOGL AAPL AMZN green holding up the market, for now. AAPL I do not trust but the other 3 look good.

Whether you are chasing or need to protect swings, take care...

Time to lighten up on longs into OPEX Friday, FOMC Wednesday and EOQ choppiness...

Best Tells

VIX - really love how this works - Said past few days in my live trading room that it would tag 13.54 before reversing. It hit 13.55 - close enough - then move back up to 14.49 before likely 15.21 by Friday.

Not worried about market UNLESS/UNTIL VIX can get/stay above 15.69!

Bitcoin losing momentum (see chart below), so if BTC rolls over with NVDA, careful...

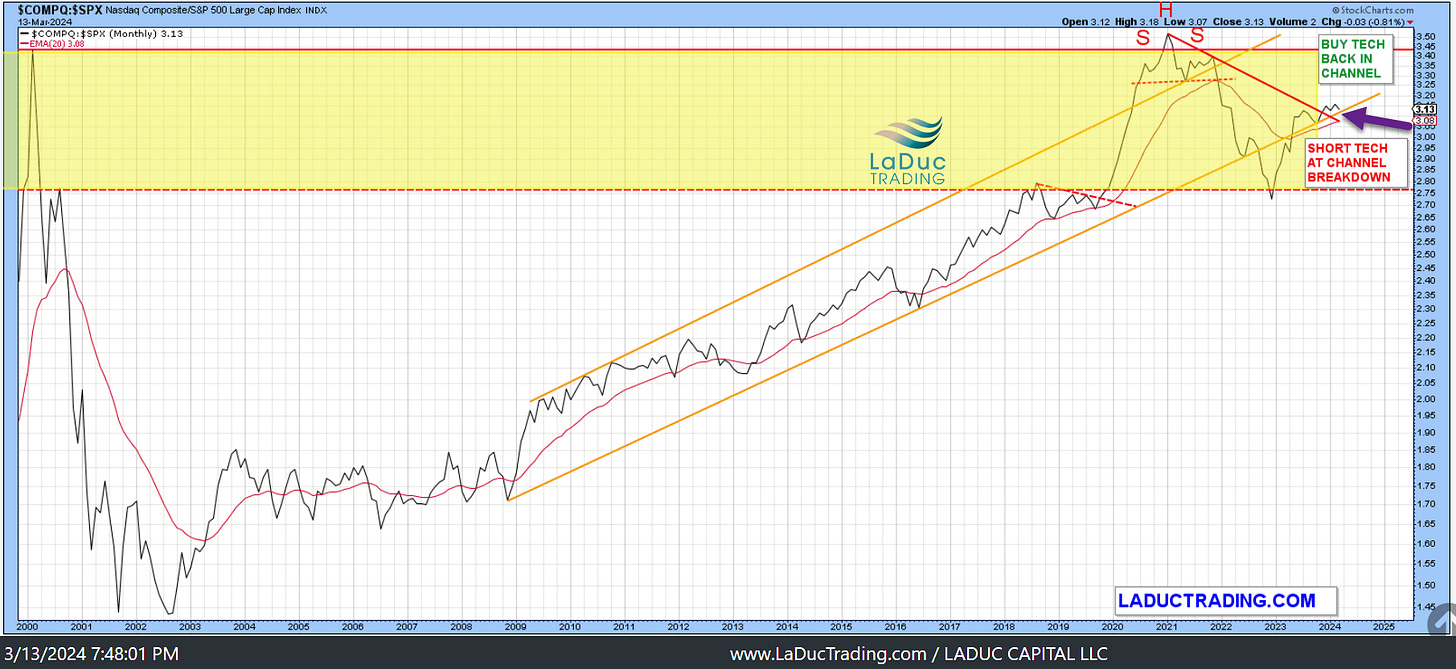

Nasdaq composite has been in a bullish channel on my COMPQ:SPX intermarket analysis (see chart).

If/When the ratio breaks below, the market will be a Big Short.

Housekeeping

My live trading room is closed both Friday and Monday as I will be out of town!

I will be back Tuesday 9:00 am March 19th so we will have time to assess before Fed Day on the 20th!

Also note, Craig will be back Monday and Archna Thursday!

Swing & Trend Portfolios - Open/Closed/Fave Watchlists continue to be available to you to highlight my highest conviction trade positions & ideas.

Please note: CLUB/EDGE client channels have - #swing-trade-notifications and #trend-trade-notifications - to alert you to New trades, as well as when we issue Updated Stops & PTs, when the position has taken Partial Profits, when to Protect, and when it is Closed.

We are still working on the option streaming and more timely underlying price data and automations, but for now, you can get notified via slack if you choose to add yourself to those channels!

That's it for now.

I wish you all a great rest of your trading week and weekend!!

OH - Before you leave, remember I am posting the recording of my live trading room on Substack so you can follow along to see if this type of custom engagement and live commentary is something that might help you in your trading and investing.

I cover Chase, Swing & Trend timeframes - from Macro-To-Micro - and my VIX calls don’t suck. Would love to work with you live.

In summary, what did I say this morning in my #LiveTradingRoom?

SPX $5130

AMD $183.83

VIX 15.21

TLT $92.83

X $39 to 36 - but this really is from yday

All HIT! As the Growth-to-Energy/Value rotation I called is still working. ;-)

Good luck tomorrow!!!