Biggest Ape Fight Of Them All

Rate of Inflation Use to Matter to Fed Rate Hikes. Now it's Job Openings!?! Yes, I know that sounds odd, but it is the New- Not-Normal for Fed monetary policy. Let me explain.

The monthly Consumer Price Index prints (CPI for both MoM + YoY) premarket on Friday June 10th. I expect it to be hot given sticky home prices and YoY rent increases that have accelerated to a 20% year-over-year rate, not to mention globally rising energy prices and rising food prices. With that alone, I believe the September Fed hike pause narrative - as was floated by Bostic on May 25th (same day as FOMC minutes were released that triggered our most-recent short-covering gamma squeeze) - has always been off the table. To cement that view, Vice Chair Brainard made it very clear a September pause was not the base case, as none of the key metrics Fed has referenced have changed, namely, unemployment needs to rise!

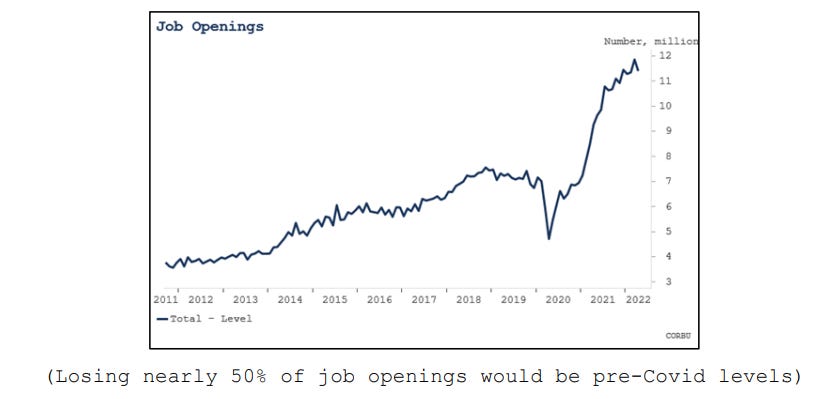

Powell had already indicated that pain in the labor market would be tolerated to cool down rising wages, meaning that higher unemployment from 3.8% to the 5% historical mean would be acceptable. In this regard, the labor market needs a "better balance", according to Brainard, as measured by job openings.

“There are too many job openings, and the economy is running too hot. We are willing to take some pain in the labor markets to see consistent downward pressure on the inflation dynamics our policy can directly affect.”

So not only would inflation need to show a string of decelerating core PCE readings, but Fed needs to see a deceleration in average hourly earnings to lessen the fear of a “wage price spiral” AND a solid deceleration in job openings to consider a viable pause in their rate hike policy. We have none of those data points so we have no Fed Pause to talk about until we do!

(* H/T charts courtesy Samuel Rines | Managing Director CORBŪ).

Isn't it ironic that the Fed is raising rates to influence FEWER job openings/choices, LOWER average hourly earnings against falling real wages, in order to slow inflation? I mean versus take steps to tamp down blatant abuse of rampant stock speculation and excessive borrowing by corporations to artificially buy back stock (and single family homes) and write blank checks and other schemes to bid up equities? It's not scarcity of raw materials due to the inflationary buildup from war and supply chain disruption that motivates the Fed. It's not like the house price appreciation past two years from all-time low housing inventories amidst the migration during covid and the demographic demand by millennials looking to "nest" has Fed reversing its MBS bond buying program. No, the Fed is targeting wage inflation, pure and simple, as their main strongarm attempt to rebalance the economy, once again on the backs of the working class.

Back to the data: Slower hiring is what the Fed wants to see.

So how much farther do job openings really need to fall before Fed pauses?

Let this sink in:It's a good 50% to make it back to pre-covid levels!Now, have a look at the last chart of Unemployment (white) to CPI (blue).With unemployment record low, and Fed wanting hiring to slow, job openings to fall and unemployment to rise, the Fed has A LOT of miles to go in tightening - or until the blue line comes down and white line goes up!So let's keep the macro narrative on monetary policy simple:

As long as labor market stays strong (as indicated this past week in ADP and NFP data), Fed will stay the course of tightening.

As long as inflation stays sticky (as indicated by rising energy, food and housing prices), Fed will stay the course of tightening.

And as long as inflation stays sticky and with it the labor market wages, equities won't. There has to be a release valve somewhere and my bet was and is that we see it in lower stock market returns.

Deflation of Wages Ended with Covid

This is, ironically, the biggest Ape Fight of them all. Much more important and impactful then HOLDing GME, AMC and even BTC.

If the Fed orchestrates their "soft-ish" economic landing, it will be by punishing wage earners so that the rich equity holders win more than they lose - as many insiders (and Fed heads) have already cashed out their out-sized profits - so that the systemic income inequality continues. But if the wage earners succeed in holding and gaining ground in their fight for higher wages, and housing doesn't collapse (range-bound is my contention believe it or not), then it would be an equity reset that pulls down still-high tech valuations amidst an economic slowdown that compresses corporate margins that then results in falling job openings and higher unemployment without decelerating core PCE readings and average hourly earnings! Girl can dream!

But either way, in my book: rate hikes to lower WAGE inflation will cause higher unemployment which means deflation of equities.

And here's the tough part for new, bold retail traders who just jumped on this train a mere two years ago: those higher rates (the macro) will keep your beloved tech plays under pressure (the micro) in the same way that lower rates kept them bid the prior 13 years! Yes, we have fallen 'a lot' in indices, and some expect capitulation to new all time highs. I don't and have made my views known since Nov/Dec/Jan. I expect we will see a series of bear market rallies that can last longer and shoot higher than many expect. And I hope to be able to time these waves for tactical out-performance in your trading results.

But one thing I really hope to prepare you for is a change in mindset. It's more than my call in November for a durable Growth-To-Value rotation. We are very close to a tipping point - where “momentum“ crashes down and “anti-momentum“ takes over for the LONG run.

There's a time for growth of capital and time for capital preservation.

If you're not focused on capital preservation by now, you are forcing trades.

And forced trades will lose in this new market regime.

What you learned was that it was easy to make money.

Now, you must learn the tricks not to lose it.