BEAUTIFUL DERISKING Into a Rate Cut

CLUB/EDGE client post July 24th. Focus on CONCENTRATION RISK DERISKING & Fed Rate Cuts.

» CLUB/EDGE client post JULY 24th, 6:22 PM.

Magnificent 7 lost nearly $2 TRILLION in market capitalization in just 10 days.

And as my clients, you hopefully were positioned (and/or protected) for most if not all of it as I warned early and often!!

Mama said there would be days like this!

Amazon, Apple, Google, Meta, Microsoft, Nvidia and Tesla combined saw the largest daily loss since October 2022.

S&P 500 dropped by 2.3%, ending the longest streak since the Great Financial Crisis of 356 days without at least a 2% decline.

The S&P 500 erased over $1 TRILLION of market capitalization just today.

Via GlobalMarketsInvestor

As a CLUB/EDGE client in my live trading room - or as CHASE member watching live - you know I had high conviction this was a trending short day for SPX & QQQ - not to mention TSLA, AMD, NVDA, AAPL, MSFT, etc.

I called it early + re-enforced throughout the session we had FORCED SELLING IN TECH that was orderly so to keep pressing short.

I even had $SPX $5447.25 TODAY with overshoot to $5443 with -2% drawdown?!!

Stocks Dropped Enough For A Rate Cut

You already know where I stand on this - even if I got the Yield Curve inversion wrong:

JUNE 19th: Rethinking My Yield Call

FOMC 7/31 seriously considers rate cut. (Don’t me; it is a growing potential as YC inverts.) They may even pop in for one in August before UE hits 4.2%.

Equities see some volatility once 10Y breaks below 4.2%, but not outsized volatility until UE breaks above 4.2%. And we know Fed/Treasury will accommodate before that happens. It is an election year after all!

Bonus Prediction:

I am doubling down on my 2024 prediction that Biden will not make it to the ballot.

2024 Predictions - given to clients in December '23:“Outlier: Biden drops out, and H2 prices that change of policy regime in with higher Volatility and Oil.”

I have also discussed often how the narrative would flip from inflation to deflation into year-end.

And how the narrative of #HFL (higher for longer) would start to reverse.

Then this morning, in Fed's pre-FOMC blackout period, Bill Dudley (former NY Fed President) wrote an OpEd in Bloomberg pushing hard for a rate cut - NEXT WEEK - in order to avoid recession. Yes, it feels political, but it is also intervention as the market undergoes this BEATIFUL DERISKING into a rate cut.

Earnings Bar Is Also Just Too High

It was more than just TSLA and GOOGL afterhours Tuesday that triggered more FORCED SELLING, although that helped.

In terms of Big Tech vs. median S&P 500 stock:

"AMZN, GOOGL, META, MSFT, and NVDA are collectively expected to grow 2024 profits by 37% compared with 5% for the median S&P 500 stock.

But we have previously noted that consensus estimates of sales growth for the five stocks is forecast to slow from 22% year/year in 1Q 2024 to 17% in 2Q, and further decelerate to 16% in 3Q and 14% in 4Q.

NVDA sales growth is expected to slow from 262% year/year in 1Q to 111% in 2Q, 73% in 3Q, and 56% in 4Q.

In contrast, sales growth for the median S&P 500 stock will be accelerating, albeit from a slower pace (year/year growth of 2%, 3%, 4% and 5%)."

David Kostin with chart of Annual Earnings Growth for MAG5 vs SPY median

Bigger picture, as of Monday per DataTrek via FactSet on earnings reported to date:

1. Companies have beaten earnings estimates by 5.5%. This is worse than the 5-year average 8.6%

2. 62% of companies have beaten analysts’ revenue estimates. That is noticeably worse than the 5-year average 69%

3. In the aggregate, companies have beaten revenue estimates by 1.7%. This is worse than the 5-year average of 2.0%

4. "At this early date, Q2 earnings season is shading towards the mediocre. Revenue growth is fine, but that is not translating into significant upside to the bottom line. Recall that analysts cut their Q2 numbers by less than usual during the quarter. This set the bar higher than historically normal, and thus far earnings beat amounts are lower than the longer run averages."

So we really have been priced to perfection and stocks are now reflecting what we already knew.

Let's Review My Market Thoughts To Date

JULY 10th Client Post: Option Flow is Stalking A Market Top

(that timing didn't suck)

JULY 11th Client Post: TIMING DEFLATION & QQQ TOP & ROTATION

(that timing really didn't suck)

"the narrative shift can absolutely contribute to a sizeable unwind in the Concentration Risk that has suppressed volatility.

Know what you own."

JULY 17th Client Post: Is the FORCED SELLING done in tech?

The answer was "NO; SAFETY PAYS”.

So now review my summaries as posted in #trading-room-notes and you will find a theme ;-)

Here's today's:

My write-up last week and rant yday morning was clear:

1. FORCED SELLING IS NOT DONE IN TECH

2. SAFETY PAYS: IWM, XLP, XLV, XLU, GDX, XHB

3. FED RATE CUTS ARE COMING - see Bullard OpEd in Bloomberg this am.HIGHLIGHTED INTERMARKET TELLS:

I will do an update with all my intermarket analysis/charts for tomorrow, but for today I showed three that were critical to allowing me to help you navigate short tech with conviction this morning:1. STOCK-BOND-VOLATILITY - PREMARKET SAID NOT DONE. That is clearly correct.

2. YEN OVERSOLD JULY 10TH - YDAY SAID NOT DONE. That is clearly correct.

3. GROWTH-TO-VALUE RATION - ALL WEEK SAID NOT DONE. That is clearly correct.And all 3 will be used to gauge a relief bounce, and as such, Pls note:

1. VIX has not made it to all my PTs given near open: 16.30, 17.36, 18.21, 18.70, 20.

2. Yen bounce via FXY made it to my 60.40 PT but it can still overshoot to 61.30 after wee digestion. With that USDJPY to 151.86 is strong support for a solid bounce.

3. We are back to NOV 2021 HIGH in my growth/value ratio. We could bounce here but I see 1.95 ratio as higher conviction.STOCKS OF INTEREST

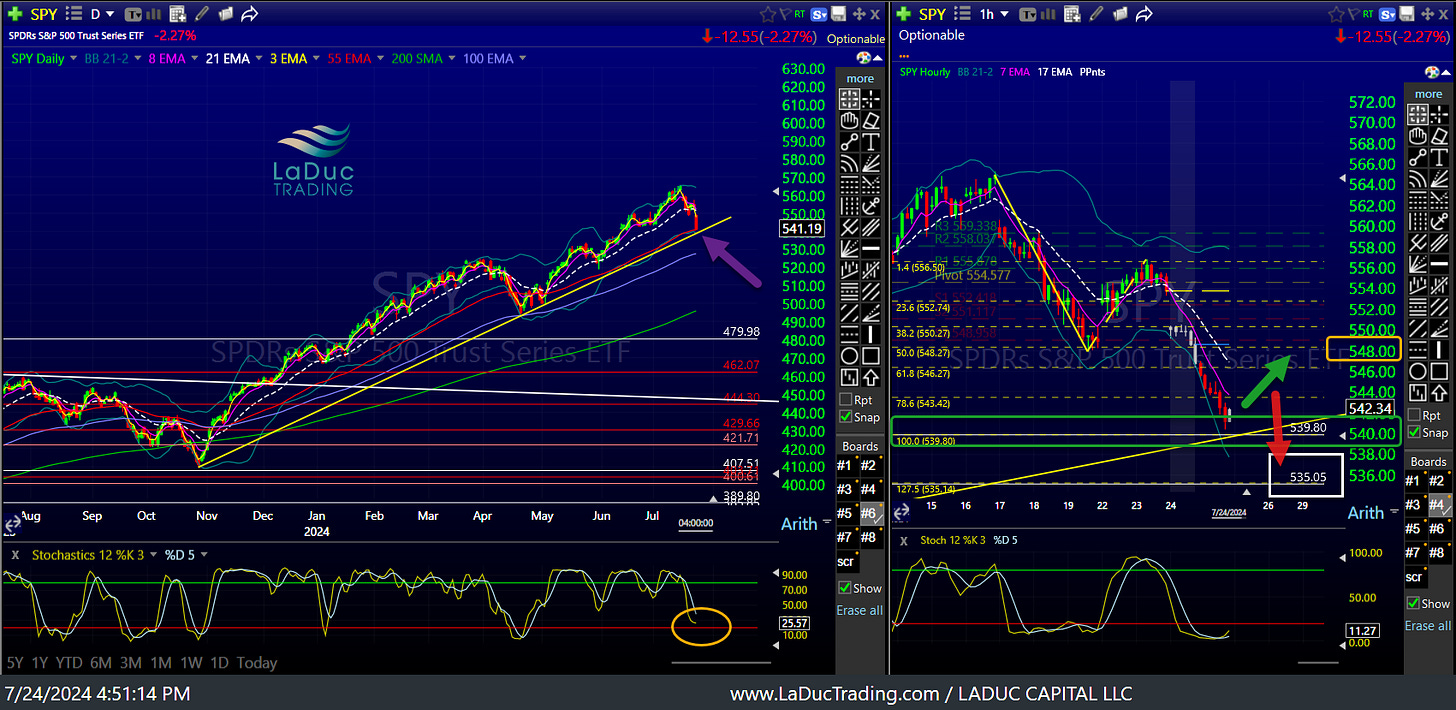

I was VERY specific that today was HIGH CONVICTION CHASE SHORT DAY given SPX opened BELOW its R3 (resistance level 3) on Hrly.

After ALREADY tagging my SPX 5505.53 PT last week, we opened at 5505.84 wherein I said this is what we will hit: 5571, 5560, 5447.25

If we take out 5447.25 we can get that -2% drawdown day.After ALREADY tagging my QQQ 476.50 PT last week, we opened at 473.82 wherein I said this is what we will hit: 468, 465.74

TSLA was also high conviction short from open at 225 to 217PT.

NVDA from 119 to 115 area/55D with SMCI + DELL into their 30W.

Also said, if SMCI + DELL break below their 30W, NVDA will fall further.

ASML, NXPI fab shorts/

AMD gave swing short already from 184 to 174 to 164 then send below = 153.49, well today we opened right below so gave 147.62 as short PT.

NFLX spike higher into 650 I said was FAKE + would reverse.

AAPL, MSFT, META - gave levels of breakdown + PTsALL OF THESE WORKED/ARE WORKING - ALLLLLLL

So the easy money has been made shorting tech, so we could bounce a few days, but the bigger issue is this...

Macro Worry:

Fed/Treasure are WAY behind the curve and I contend COMPRESSING the credit spreads and SUPPRESSING the yield curve, which is an OUTLIER THAT WILL REVERT WITH VELOCITY in time.

Yes, we have a trendline tag coming up for SPX wherein we could/should bounce - see my annotated chart.

Yes, we have gap fills higher in both QQQ & NDX that we will fill eventually.

But we need my growth:value ratio to stop falling - and then bounce.

That and CTAs to stop selling...

To Sell or Not To Sell

CTA positioning is clear. De-risking is not done.

"We model US systematic sellers in all scenarios over the next week in a flat, up, or down tape (prior to todays market move). US CTA positioning starts the day at the longest level in 3 years."

There could be $219bn to sell over the next month in a down tape, according to Scott Rubner of GS

Then, despite potential bullish earnings, Fed intervention, Yellen liquidity and the like... BIG PICTURE, my RSP:SPY ratio shows we are clearly in a BEAUTIFUL DERISKING of concentration risk bets of tech into oversold value that still has room to run.

And I contend, likely into a RATE CUT, or two or three, sooner rather than later!