Bear Market Rallies

CONCENTRATION RISK or “BROADENING OUT”

Monday, bulls got ripped off as markets didn’t gap down (10W EMA would have been ideal as proposed Friday). Instead, Trump was already intervening in futures Sunday night, which set up a 50% retracement of the Friday retreat, setting up my “short the rip” call into Tuesday morning.

Then this Tuesday morning near the open, Client Anne asked in my live trading room about her near-expiry QQQ puts which I feared would be be compromised on a bounce at 6560 as the 6600 wall of puts monetized since they were nicely ITM. I gave 6640 as PT for the day and we closed at 6644.

Strong gamma support at 6650 area means: bullish above and bearish below.

Jason from Vol.land in our slack member workspace commented Monday that he would not be surprised to see SPX back up to 2735 area soon:

Friday qualifies as a vol event, meaning we are supposed to now see Thursday’s close at around 6735 by Halloween, a signal that has a 93% hit rate since 2013.

He goes on to say:

Options have been overpriced for some time. As I pointed out on Friday, VIX at 17 with RV around 9 made no sense, something was up in the background. It was causing near term vol to be elevated and caused outsized vanna moves up near every vanna positive expiration. Now we are at Oct. opex, and we have volatile goalposts set up into the end of the week.

6525 is the start of downside support down to 6400 and 6700 is the start of upside resistance. In between there we are looking at untethered volatility.

My call this morning was simple:

big puts at 6600 means they likely monetize and dealers cover so SPX fills the intraday gap into 6640 with overshoot to 6666.

that and VIX likely softens from 22.87 to 21.33 on way back to 19.29.

And that happened. Otherwise, the day was uneventful if you were not trading small caps that are squarely focused on critical metals & rare earth miners long or select semis short. I mean, NVDA is down 8% since Friday’s high and yet my Growth:Value ratio has still not decisively rolled over!

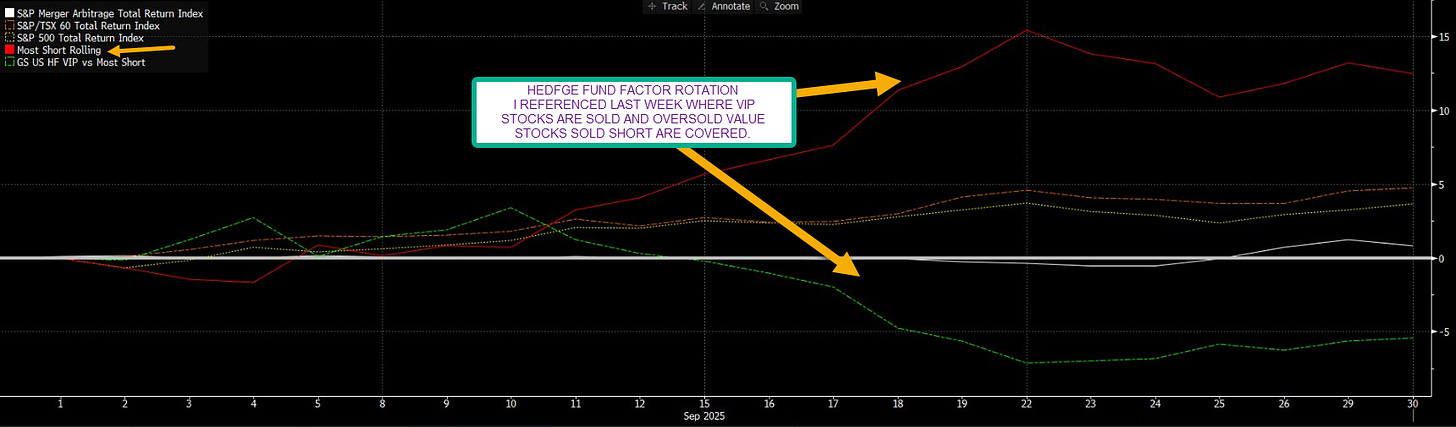

But the Goldman most-shorted basket was up +830 bps Mon - - after a few weeks of it outperforming. And one of the reasons I gave last week for why the market wasn’t really ‘broadening’ but getting more unstable.

This squeeze comes as both high beta, most short index and non-profitable index are all at multi year highs.

Current 1-month return of the most concentrated short stocks vs. history. The 21% return ranks in the 98th percentile since 1995. Goldman, Oct 4th 2025

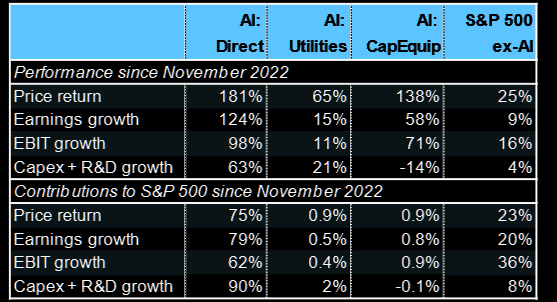

Now Remember to give thanks to Nvidia for dragging markets higher for the past 3 years.

“AI related stocks have accounted for 75% of S&P 500 returns, 80% of earnings growth and 90% of capital spending growth since ChatGPT launched in November 2022.” (JPM’s Cembalest)

But as for ‘broadening out’, here’s the case for September…

“The $1+ trillion stocks in the Russell 1,000 gained an average of 8.1% in September, while the 991 other stocks in the index gained just 0.1%.

The overall index was up 3.4%.” Bespoke Intel

You can have CONCENTRATION RISK or “BROADENING OUT” Not gonna get both.

And then there is the other side:

IN LIEU OF SECTOR ROTATION, THERE WILL BE VOLATILITY

With that, I reviewed some of the continued warnings for risk off live: